Czech Republic’s housing structure

The homeownership rate is high in the Czech economy but is gradually decreasing mainly in towns. Housing costs have grown significantly in the last decade but were compensated by higher net incomes on average, however, low-income households were affected more significantly

Last year there were 4.395 million households in the Czech Republic with the average household having 2.36 members with 1.1 working persons and 0.5 dependent children. The remainder are unemployed people and non-working pensioners, while almost 29% of households are single people, according to the Statistics of Income and Living Conditions survey published by the Czech Statistical Office for 2018.

Homeownership is still the most popular option

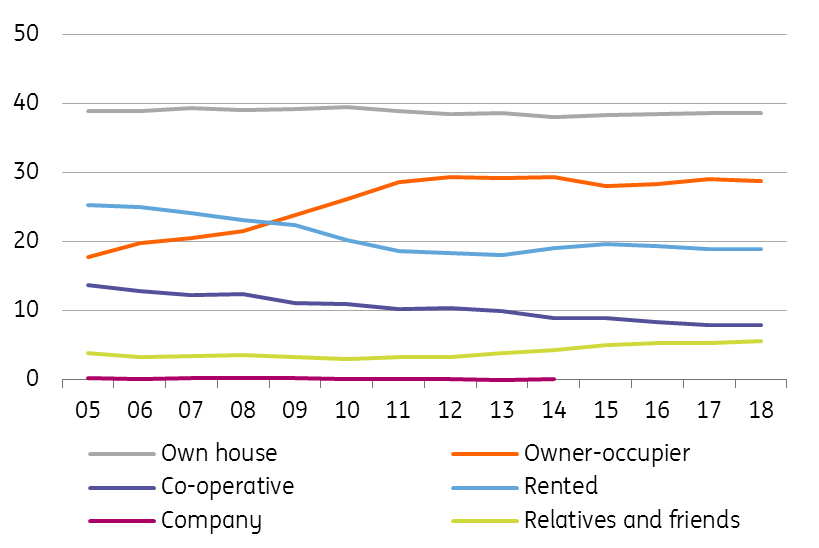

Homeownership rate in the Czech Republic is about 67.5% where 38.7% of households own a house, and 28.8% are flat owners, while renters make up 19% of households and 7.9% live in co-operative housing. The remaining 5.6% of households live with their relatives and friends.

In comparison to 2009, the ownership rate has increased from 63%, while the number of rented housing decreased from 22.4%, and co-operative housing fell from 11.1%.

Housing structure in regions and municipalities

The structure of the legal form of flat use differs depending on the region and the size of the municipality. While 81.3% of households in smaller municipalities with less than 10 thousand inhabitants own a house or a flat and only 11.5% rent, cities with population exceeding 100 000 people, the homeownership rate is 55.7%, while rented housing represents almost 31% of the housing stock.

In Prague, 11.2% of people own a house, and 44.7% own a flat. There is also the third highest percentage of co-operative housing (9.3%) in the Czech Republic, and the percentage of rented housing is the highest in the country with 31.3%.

Structure of households (%)

House prices have increased significantly in the past 10 years

The Czech Republic has experienced increasing house prices since the post-crisis low in 2013. House price growth was the highest among EU countries in 2017 when it accelerated by 12% on average, but also 2018 also saw an average growth of 8.6%. As such, since 2015, the prices increased by 30% where several elements contributed to this increase such as historically low-interest rates, strong economic growth, increasing real wages, and a generally good economic outlook.

Also, some natural demand was most likely postponed during the years of the global financial crisis, leading to higher demand when economic conditions improved. Moreover, there is an increasing share of single-person households in the Czech economy, from 24.5% ten years ago to 28.7 in 2018 - a trend which is likely to continue, generating new demand for housing.

An additional factor contributing to the price increases is the housing supply which was severely affected by the global financial crisis. The number of 'started dwellings' fell by 27% in total between 2008 and 2018. The supply started recovering since 2014 but is still lagging, particularly in large cities where demand is highest, and the process for obtaining a construction permit takes a long time due to legal obstacles, especially in Prague, followed by Brno.

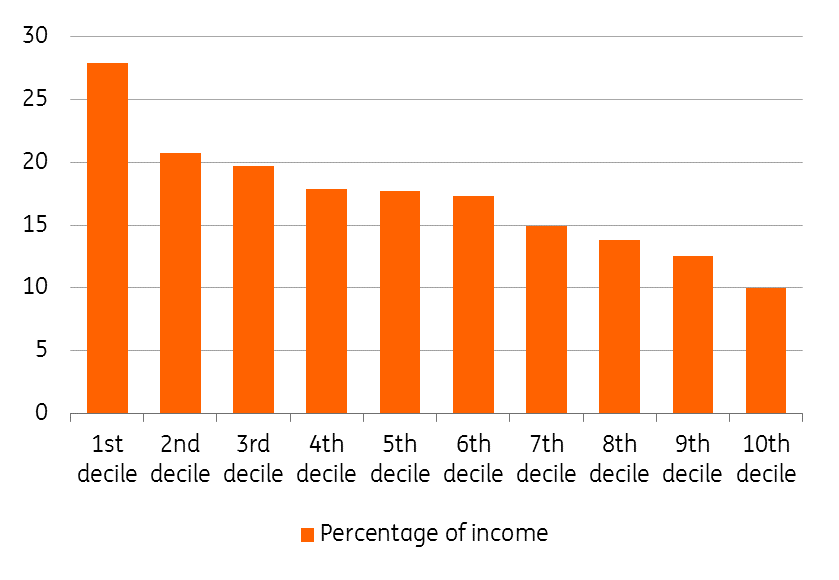

Housing costs based on income distribution (% of net income)

Housing costs are following the growing real estate prices

The survey shows growth of real estate prices is reflected by increasing housing costs which grew by 31.7% between 2008 and 2018. On the other hand, net disposable income increased by around 43% (consistent with average nominal wage growth by 41%), meaning total housing costs to total net household income slightly decreased to 15.9% in 2018. This means that on average 16% of the households’ net income is spent on housing out of which the highest portion is electricity.

The most affected by the increasing housing costs are households with the lowest net income (up to 107 118 CZK per capita) as they spend on average 27.9% of their net income on housing expenditures. Whereas, in the highest decile ( net income above 305 594 CZK), households spend only 10% of their net income on housing.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article