The one interest rate differential that is driving the US dollar

As global investors turn their attention to the prospective end-point of the US tightening cycle, the Fed's neutral interest rate has become a hot topic. Here's why it matters for the dollar

The US dollar’s de-coupling with a spectrum of interest rate differentials of late has gained quite a bit of attention – and has in fact led ourselves to hypothesise that the currency may be in the early stages of a regime change (see Dollar Regime Change: The Prequel).

However, there may still be one interest rate differential that matters for the broader trajectory of the US dollar – and that’s the relative neutral interest rate differential. We suspect the neutral interest rate (‘r-star’) – defined as the policy rate expected to prevail when an economy is operating at full potential and when the stance of monetary policy is judged to be neutral – could be a hot topic over the next few months, not least as global investors turn their attention to the prospective end-point of the Fed’s tightening cycle.

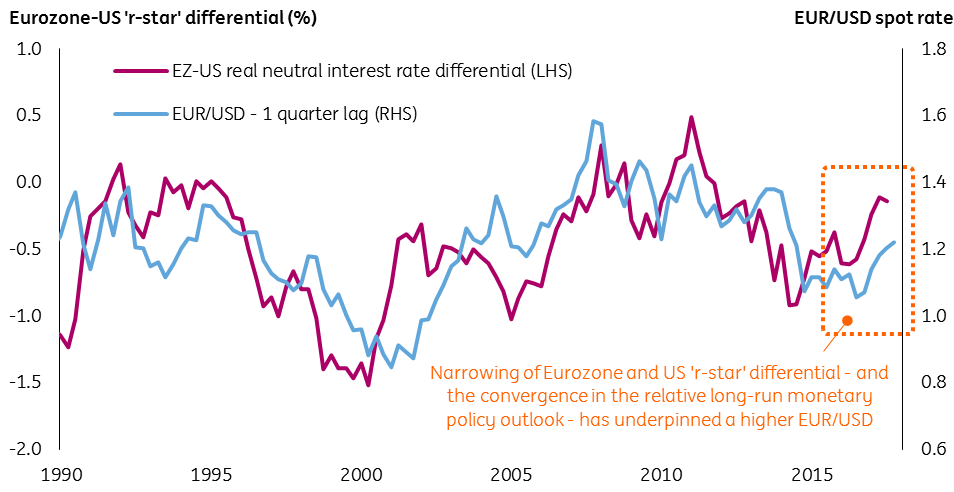

The chart below shows that over time, EUR/USD has broadly tracked – albeit with a lag – the difference between estimates for the Eurozone and US neutral interest rates (we label this as the EZ-US ‘r-star’ differential)*.

The one interest rate differential that may in fact be driving the US dollar...

The observed relationship suggests that the outlook for the EZ-US ‘r-star’ differential is a crucial factor for the medium-term trajectory of EUR/USD. Over 2H17, we did see a narrowing of the EZ-US ‘r-star’ differential – driven primarily by estimates of the Eurozone r-star being revised higher (as well as a small moderation in the US r-star estimate) – that supported a latent appreciation in EUR/USD**. With some of the structural – as well as cyclical – headwinds fading for Europe, not least as long-run domestic political risks subside, it’s quite easy to rationalise a higher EUR/USD through the prism of a narrowing of the EZ-US ‘r-star’ differential.

Does a higher US neutral interest rate mean stronger USD? Not necessarily...

With Fed Chair Powell testifying to Congress tomorrow, there's growing noise this week over the Fed’s neutral interest rate – and a potential upgrade in light of greater optimism over the US and global economy. In reality, we probably won't know of any change to the Fed's neutral interest rate assumptions until the March FOMC meeting. But even if we assume that there is a consensus revision higher, there are two caveats to consider before concluding whether this will lead to USD strength:

- Is the move higher in the US neutral interest rate estimate specific to the US economy?

- Have markets already priced this in?

Rise in global neutral interest rate a more convincing argument for a higher US r-star

- Neutral interest rates are typically driven by long-run factors specific to a particular economy such as productivity and population growth – as well as common global factors (typically captured by the global neutral interest rate).

- While the Trump tax package is arguably a reason to revise one’s estimates for the US neutral interest rate higher, the ambiguous long-run effects of tax cuts on productivity and demographics – as cited by both private-sector economists and Fed officials – suggests this would be an unlikely reason for any Fed neutral interest rate upgrade.

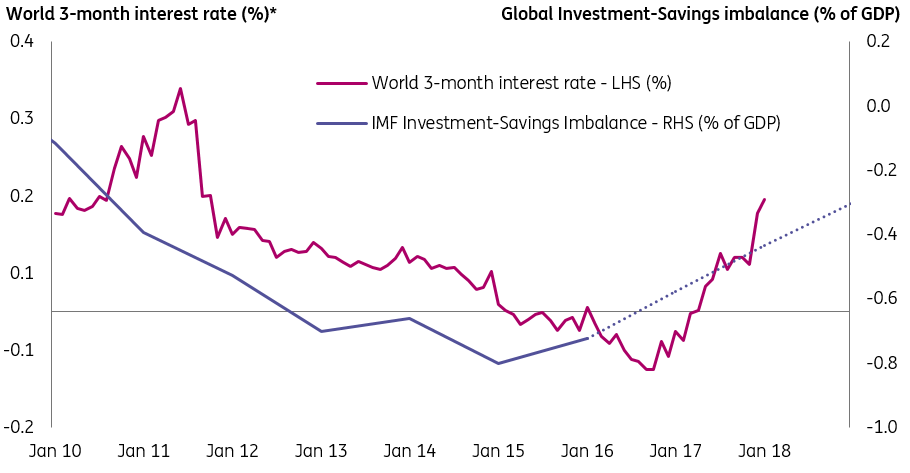

- Instead, we suspect that it is an upward revision in the global neutral interest rate – underpinned by higher global growth expectations – that may be the bigger driving force for any optimism over a higher US neutral interest rate.

- By definition, any rise in the global neutral interest rate will also be reflected in the EZ equivalent – and given that it is the relative EZ-US ‘r-star’ differential that matters for EUR/USD, we would argue that any near-term optimism over a higher US neutral interest rate estimate would not, in fact, lead to isolated US dollar strength.

Synchronised global growth and activity gives rise to a higher global interest rate

Markets have priced in the rise in US (and global) neutral interest rate story

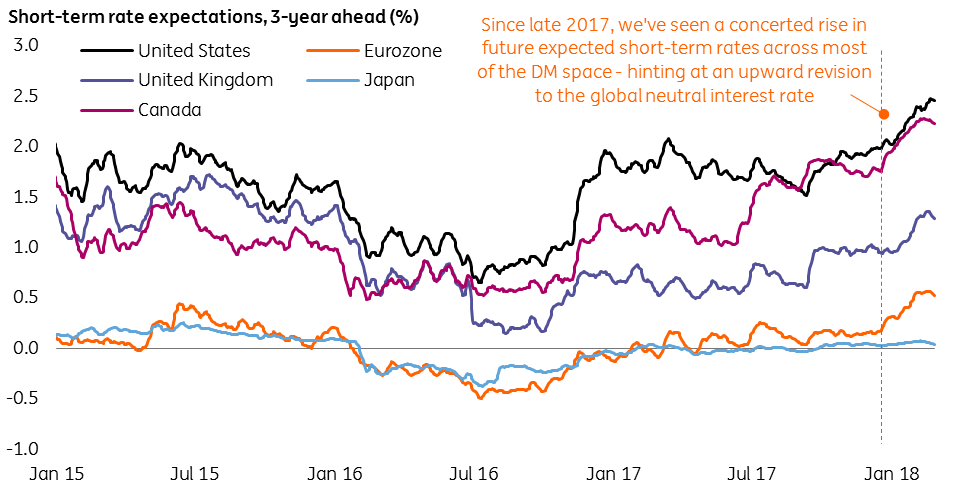

- None of this should be 'new news' for global investors given that we’ve had three-six months of the strong global growth narrative dominating markets. Indeed, when we look at a range of future expected short-term interest rates across the developed market space, there has been a concerted uptick in estimates for expected long-run policy rates – corroborating the idea of an upward revision in the global neutral interest rate of around 25bps (see chart below).

- In the FX world, where it’s all relative, any synchronised movement higher in interest rates should, in theory, have limited impact on any one currency. Moreover, we would argue that it is the relative mispricing of the terminal policy rates that is the key for currency markets over the coming quarters.

- With the Fed tightening cycle all but priced in, the focus is on the rest of the world – namely Europe and Japan – where there is greater scope for positive monetary policy adjustments to lead to further isolated EUR (and to some extent JPY) strength. In contrast, a boring and predictable Fed – as we are expecting under the leadership of Jerome Powell – is unlikely to do much for the US dollar in the grand scheme of things.

Coordinated repricing of terminal policy rates across developed markets

Bottom Line: Greater monetary policy mispricings in the RoW to weigh on the USD

Exchange rates thrive on unpredictability and mispricings – and therefore monetary policy as a driver for currencies packs more punch in economies where the gap between actual policy rates and neutral interest rates is the biggest. With the Fed tightening cycle all but priced in, the focus is on the rest of the world – namely Europe and Japan – where there is greater scope for positive monetary policy adjustments to lead to further isolated EUR (and to some extent JPY) strength.

As such, we still feel that markets remain relatively underprepared for the ECB’s next policy normalisation steps. Any ‘Sintra Part II’ moment will come when EZ policymakers are comfortable to bear the consequences of another broad move higher in the EUR. For us, this is a summer 2018 story; our expectation for German bund yields to breakout – as markets position for the end of ECB QE and the start of a 2019 hiking cycle – should set EUR/USD on a path to 1.30 by year-end.

Footnotes

*Note we use estimates of the neutral interest rate provided by Holston-Laubach-Williams https://www.frbsf.org/economic-research/files/wp2016-11.pdf

** Note the lagged relationship makes sense as investors are, on aggregate, likely to make judgments over the neutral interest rate – or the factors that underpin it – ex-post (rather than ex-ante), while they will also want to see structural trends emerge (rather than buying into one-off anomalies)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article