The Netherlands: Maintaining strong growth momentum

The Dutch economy should maintain a high growth rate in 2018; it's broad-based, consumer spending is high but labour market pressures are appearing

| 2.9% |

Netherlands GDP growth rate2018 (YoY%) |

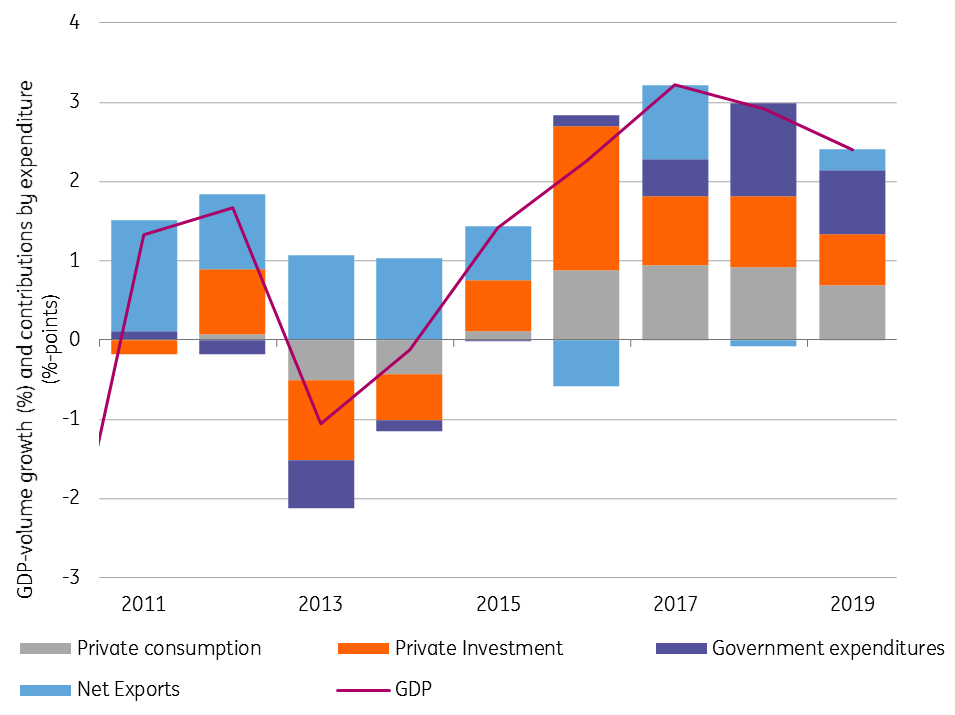

Domestic demand is driving economic growth

We forecast GDP growth of 2.9% for the Netherlands in 2018. Increasingly, growth is driven by domestic demand; consumers keep spending more and business investment continues to grow. On top of that, the coalition agreement of the new Rutte III government involves additional public spending. This will provide an additional boost to domestic demand and prevent growth from slowing down considerably after the impressive GDP figure projected for 2017. New policies also explain the upward revision of our 2018 forecast. The additional spending comes at the expense of public finances. Nevertheless, a budget surplus is projected for 2018 (+0.5% GDP).

Import growth outpaces export growth

Exports are expected to grow at considerable pace, projected at 5.6% for 2018. Yet, the net contribution of foreign trade will be close to zero. Imports are forecast to grow fast. In fact, import growth in percentage terms will be faster than export growth because of the strength of domestic demand as well as due to the government’s decision to further lower the maximum permitted gas production in the northern province of Groningen. Level-wise, exports will remain much higher than imports, maintaining a large current account surplus.

Sector-wise, growth has become broad-based

All sectors in the real economy are seeing growth in volumes. The exception is gas production, which locally faces a legal production limitation aimed at mitigating earthquakes in the province of Groningen. Industry is benefiting from growing investment in the Eurozone, while wholesale and transportation will also deliver above-average growth thanks to solid export growth. Commercial services, including IT and job agencies, construction and health care are growing at the highest rates.

Strong domestic demand driving high growth

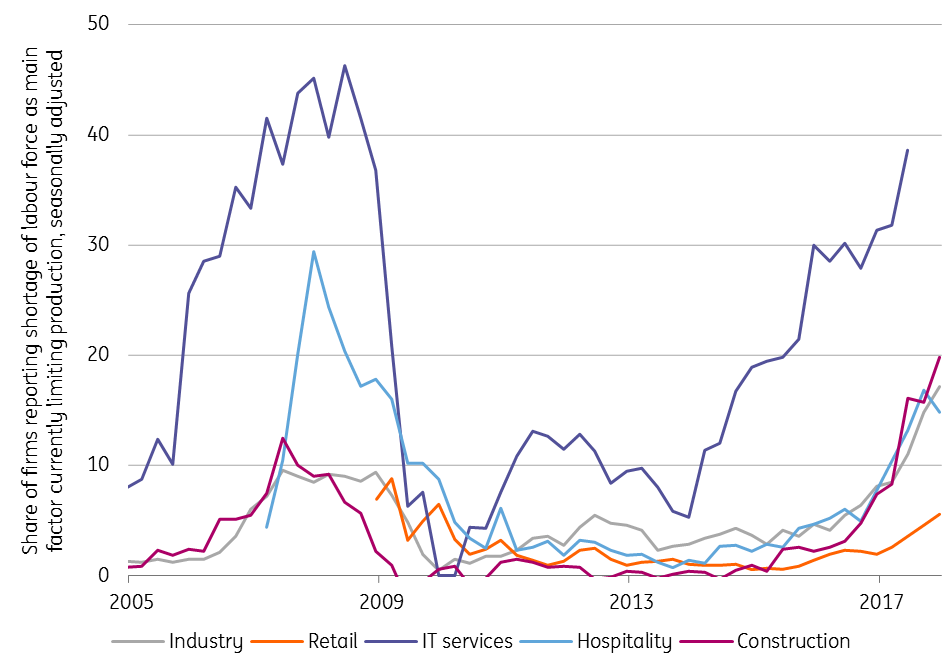

First signs of labour shortages

While unemployment has already passed the estimated natural rate, we forecast it to fall further, to 3.9% in 2018. Due to the persistent demand growth, the first signs of shortages in the labour market are appearing. One in six businesses is reporting a shortage of workers as the main factor limiting production. In the IT-sector this was already an increasing problem for quite a while, with currently 39% of businesses reporting shortages. Now, concerns are also becoming increasingly prevalent in construction, hospitality, industry and transportation.

While much of the initial rise in employment was achieved with flexible and temporary contracts, the most recent figures show that fixed contracts are finally also on the rise with considerable numbers. While the self-employed, who represent a large and increasing share of the labour force, took a large hit in their income as the result of the crisis, they appear to have achieved higher income growth rates than employees in recent years. This trend is expected to continue in the short run.

Signs of increasing labour shortages

Consumer price inflation remains subdued

Although shortages are rising, labour market pressure is not yet back at the levels prior to the crisis. It will therefore only gradually translate into higher wages. As a result, price pressure will increase, but with a lag. Being forecast at 1.5%, consumer price inflation will remain subdued in 2018 and very much in line with Eurozone inflation rates.

Public finances in line with European norms

The new government has decided to spend more money on defence, education, Research & Development, civil service and infrastructure. The output gap appears to be closed, meaning that the expansionary fiscal policy will be pro-cyclical. Government finances continue to benefit from the fast-growing economy. Budget surpluses will, therefore, remain during the entire term of the third government with Mark Rutte at the helm, despite the additional spending and tax cuts. Public finances are and will remain in line with European norms. Government debt has already dropped below the 60% GDP norm and will continue decreasing as a result of cumulating surpluses and the continuation of the sale of the ABN AMRO bank and insurer ASR.

The Dutch economy in a nutshell (%YoY)

A strong growth figure for 2019 along with higher inflation

Looking at past upturns, there still seems to be plenty of room for the Dutch economy to grow after 2018. The next 'bust' is not expected to materialise any time soon. Our current forecast for GDP growth in 2019 stands at 2.4%. Growth is expected to normalise steadily towards the potential annual rate of 1.7%, but we forecast quarter-on-quarter rates for 2019 which are still slightly above that rate. Due to rising wage pressures as a well as the increase of the special VAT-rate, which will notably affect food items and some services, CPI inflation will be much higher in 2019. The inflation rate is currently projected at 2.5%.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

18 January 2018

ING’s Eurozone Quarterly: All systems go This bundle contains 13 Articles