The Netherlands: Domestic momentum stays

The Dutch economy continues to grow above potential thanks to strong domestic demand, and as long as hard Brexit and trade war fears don't materialise, we forecast GDP growth of 2.8% this year and 2.5% for 2019, which is still above the Eurozone average

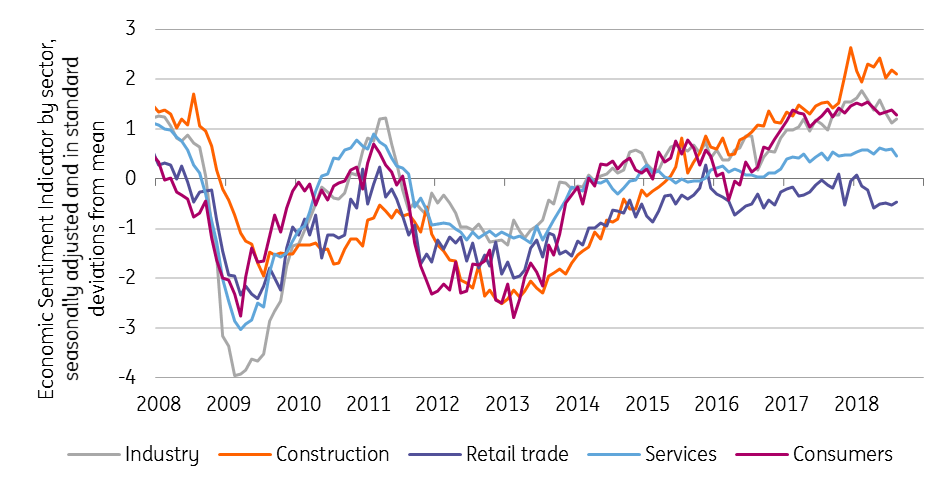

Soft indicators fell, but still point to strong growth ahead

The outlook for the Dutch economy is still rosy, even though a number of survey indicators are currently lower than when they were at the peak, around the turn of the year.

We forecast GDP growth of 2.8% for this year and 2.5% for 2019, which in both years is above the potential growth rate and the Eurozone average.

Strong domestic demand makes Dutch GDP growth less vulnerable to risks abroad than in recent years

While geopolitical tensions seem to have affected the mood, the sentiment is still more positive than the historical average in services and industry and especially in construction. Purchasing managers' index shows the industry is more optimistic about domestic order positions than new export orders, however continuing export growth may be combined with downward risks for foreign demand. Fortunately, strong domestic demand makes Dutch GDP growth less vulnerable to risks abroad than in recent years.

Survey indicators lower but still above historical average

Consumption acceleration keeps economy pacing forward

The mood in retail is still subdued and consumers haven't been going on spending sprees, despite 17 quarters of positive GDP growth in a row and domestic demand recently providing the most forceful push.

While a value-added tax hike in 2019 might somewhat limit the acceleration of household consumption, we expect consumers to start being less thrifty by the end of this year and in 2019. The continuous tightening in the labour market and wage growth that has finally begun to accelerate supports our view.

Domestic demand driving high growth

Import growth outpaces moderate exports growth

Due to an unusual and unexpectedly weak first quarter, Dutch exports are expected to grow at a subdued pace of 2.5% this year. Accordingly, we project weak import growth of 2.9%. Together, this drives the annual net contribution of foreign trade to nearly zero.

Current account surplus is expected to remain around 10% of GDP

During 2018 and 2019, export growth is projected to maintain its pace, although slightly below historical averages. On the back of further improvements of households’ disposable income, businesses continuing to buy (foreign) equipment and the government restricting gas production (and hence net gas exports) in the earthquake-stricken province of Groningen, percentage-wise imports may grow faster than exports in the quarters ahead.

Nevertheless, the current account surplus is expected to remain around 10% of GDP.

Tighter labour market to limit further unemployment falls

The labour market continues to reflect strong growth, but employment growth might have reached its peak in the second quarter of 2018, recording 2.5% YoY.

We forecast unemployment to fall a little further, reaching 3.5% in 2019, after 3.9% in 2018

While unemployment fell to 3.8% mid-2018, the falls are slowing, also because more people are (re)entering the labour force. Growing businesses will continue to hire more people, but find it increasingly difficult to do so. More than one in four businesses is reporting shortages of workers as a factor limiting production.

We forecast unemployment to fall a little further, reaching 3.5% in 2019, after 3.9% in 2018. Persisting labour demand is starting to show up in wages. Wage growth remained very modest in recent years but agreed collective wage agreements showed an upward jump from 1.9% to 2.3% in half a year.

Policy boosts consumer price inflation in 2019

Increasing wage pressures are hardly visible in inflation figures yet.

Food, clothing and communication are currently keeping headline consumer price inflation at moderate levels, just above 1%. Fuel and energy price have caused headline inflation to rise from 1.4% in 2017 to a projected 1.8% in 2018.

We expect inflation to rise further to 2.6% in 2019, primarily due to an increase in the reduced VAT rate (from 6% to 9%). Food items and some services (e.g. theatre and hairdresser) will see the largest increases in prices. Also, wage pressure will start to feed into output prices during 2019.

All industries growing, except gas

All industries are growing in 2018 except gas production, which is likely to shave off 0.1 to 0.2%-points off GDP growth both in 2018 and 2019.

Once the political goal to entirely shut off the gas tap in the Northern Province of Groningen has been achieved, this may cost between 0.5% to 1% of GDP beyond our forecast horizon.

Commercial services, including IT and job agencies, construction and health care are the sectors that grow at the highest rates. The solid growth in commercial services, which is responsible for more than half of capital formation, contributes heavily to the steady investment outlook of around 6% in both 2018 and 2019.

Public finances in line with European norms despite fiscal expansion

Fiscal policy is largely in check, with a fiscal balance close to 1% of GDP in 2017 and years to come. For the long-term, only a minor consolidation challenge remains.

The Rutte-III government uses cyclical tax revenues to offset falling gas revenues as well as to spend more and cut taxes. There is procyclical additional spending on defence, education, R&D, civil service and infrastructure in 2018, which will increase in 2019. In 2019, labour taxes will be lowered, while energy taxes will rise. Government debt was 56.4% of GDP at the end of 2017, below the European norm of 60% GDP. We expect the drop to continue and fall below 50% of GDP in 2020.

Above potential growth in 2019 again?

Compared to previous business cycles, the positive output gap is small. From a domestic point of view, the economy has ample space to grow above the estimated potential rate of 1.7%. We expect GDP growth in 2019 to come in around 2.5%, conditional on foreign downwards risks such as a hard Brexit, or major escalation of the trade war not materialising.

For 2020 we expect a normalisation towards potential.

The Dutch economy in a nutshell (%YoY)

Download

Download article17 September 2018

ING’s Eurozone Quarterly: A late-cycle economy? This bundle contains {bundle_entries}{/bundle_entries} articlesAuthor

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more