The iron ore surplus disappears

Following the tragic tailings dam accident in Brazil, we revise our iron ore price forecasts higher, with a significant reduction in the expected seaborne surplus. However we must stress, that given there is still a large amount of uncertainty over the exact impact on supply, these forecasts may need to be revised again when there is further clarity

ING iron ore price forecast

Seaborne surplus disappears

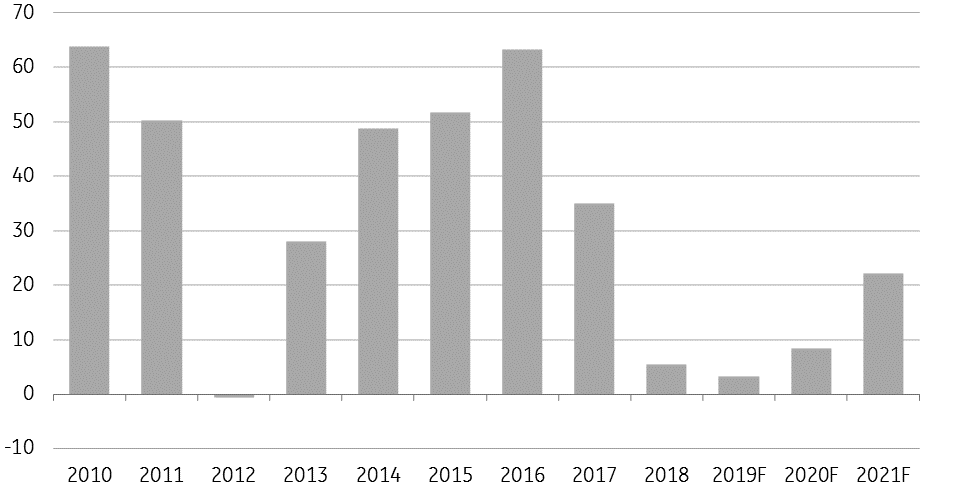

2019 was set to be a year of weakness for the iron ore market. Seaborne supply was expected to grow with the continued ramp-up of supply from a number of mines, whilst weaker steel margins, and broader concerns over the global economy suggested limited growth in iron ore demand for the year.

However, following the tragic tailings dam accident at the Corrego do Feijao mine in Minas Gerais, Brazil there is plenty of uncertainty over the global seaborne balance for the next couple of years. While the mine is relatively small, producing around 7.8mtpa, the implications from the accident have been significant. In the aftermath of the disaster, Vale has announced that it will decommission all upstream tailings dams, resulting in a loss of around 40mtpa production. Although the miner will at least partly offset these losses with increases elsewhere.

However, Vale have had to make further cuts in order to comply with a Brazilian court order. Operations at the Brucutu mine have also been suspended, affecting an additional 30mtpa of production. Vale has in fact declared force majeure on some contracts as due to this court order. As a result of these cuts, there is the potential to see up to 70mtpa of production lost, although we think losses this extreme are unlikely. The continued ramping up of their 90mtpa S11D mine is likely to contribute significantly to offsetting losses - production at the mine over 2018 is estimated to have totalled around 55mt. Additionally, other miners will be keen to fill the gap, especially in the higher price environment.

There is still significant uncertainty over supply - potential losses range anywhere from 30mpta to 70mtpa. In our base case scenario, we are assuming that Vale output falls by 40mt from their previous 400mt target, which leaves the global seaborne market in balance over the year. Although this does assume that we see around a 36mpta increase in supply from other miners this year. These increases are driven by Rio Tinto, along with a recovery in Anglo’s Minas Rio output this year. Any larger losses will only push the seaborne market into deficit for the remainder of the year, and prolonged shutdowns would obviously tighten the balance moving into 2020 as well. We certainly wouldn’t rule out extended outages - if we use the Samarco mine as an example, a similar tailings dam accident happened in November 2015, and the mine is still waiting on approvals to restart operations. Obviously recent developments mean that this mine restart is likely to be further delayed.

Global iron ore seaborne surplus shrinks (m tonnes)

Downside demand risks

One of the clear themes for markets this year is concerns over a global slowdown, driven by China and the impact of the ongoing trade war between the US and China. Therefore how trade talks evolve will be key for sentiment. The current ceasefire between China and the US expires at the end of February, and assuming that there is no deal or extension to negotiations, tariffs on US$200bn worth of Chinese goods is set to increase from 10% to 25%. The other key date is 17 February, which is the deadline for the Department of Commerce to conclude whether auto imports into the US are a national security risk. Following this President Trump has 90 days to decide what action needs to be taken if any. He has threatened in the past to impose tariffs as high as 25% on vehicles and parts. How both of these events play out will certainly have an impact on broader market sentiment, including metal markets.

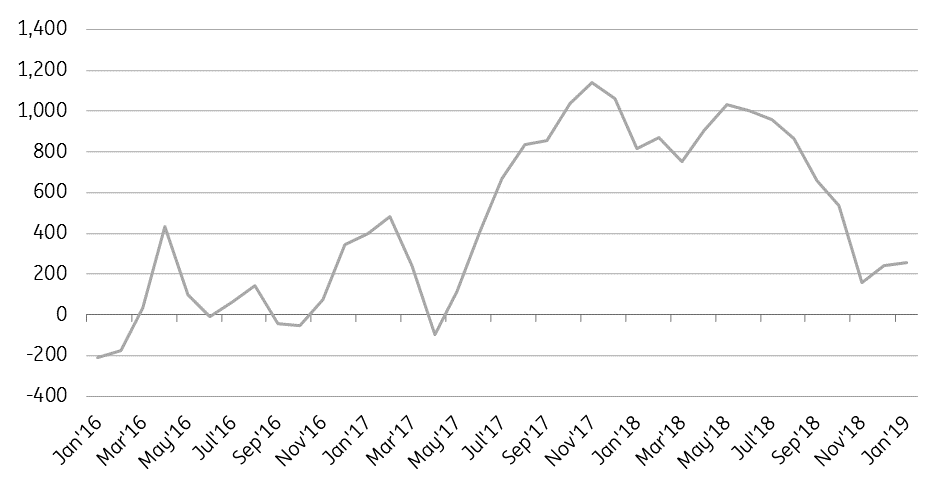

Looking specifically at iron ore, imports into China did slow over 2018, with inflows totalling 1.06b tonnes, down 1% YoY. Despite this slight reduction, Chinese steel output over the year hit a record 928mt, up 6.6% YoY according to the World Steel Association. This divergence appears to reflect a combination of both increased usage of higher grades of iron ore, along with the drawdown of domestic inventories.

Moving forward, we do believe that Chinese steel output has peaked, and as a result, in our base case scenario, we are assuming that iron ore import demand over 2019 will be largely flat. Although a sustained period of weak steel mill margins may weigh further on imports, with mills turning increasingly to domestic inventories, which are largely thought to be lower quality ore.

The World Steel Association in their last forecast assumed that global steel demand will grow by 1.4% over 2019, down from an estimated 3.9% in 2018. Although growth is expected to come largely from ex-China, with Chinese demand growth forecast to be flat over 2019. However, this is where the key risk is - both to the upside and downside. On the one hand, you have trade developments weighing on demand prospects, yet it is still unclear how effective stimulus programmes will be in boosting infrastructure investment. Growth rates in infrastructure appear to have bottomed out, but we are not seeing a significant rebound in these growth rates just yet.

Chinese BOF steel margins remain weak (CNY/t)

Limited growth in Chinese Fixed Asset Investment (YoY%)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

13 February 2019

In case you missed it: More battles lie ahead This bundle contains 9 Articles