The digital euro project is making progress, European banks should pay attention

As the digital euro preparation phase nears its conclusion, it's crucial to consider the associated risks and benefits. Although many aspects are still under discussion, banks could incur huge costs if proper safeguards aren't implemented

Central bank digital currencies: the future of money?

One of the most notable changes brought by digital technologies in the financial sector is the rise of electronic payment methods. The fast-paced change was further accelerated by the global pandemic, making our current economy reliant on online payments as well as their providers. Coinciding with the take-up of new payment methods is a sharp decline in the use of cash.

Gathering data on global cash use still proves challenging. However, the IMF estimates that, globally, less than 20% of the value of point-of-sale (in-shop) transactions were made with cash in 2021. While this number varies between jurisdictions and the level of digitalisation of each economy, all regions share a common trend: the use of cash is expected to further drop in the coming years.

European Central Bank (ECB) data confirms this trend with a significant increase in card payments in shops since 2016, on top of the uptake of other digital methods such as mobile and contactless payments in the euro area. Additionally, the European payment landscape is marking a fast switch to online consumption and consequently also a decline in point-of-sale transactions.

The decline in cash use is noticeable in the European Union

Types of instruments used in Point-of-Sale transactions in the euro area

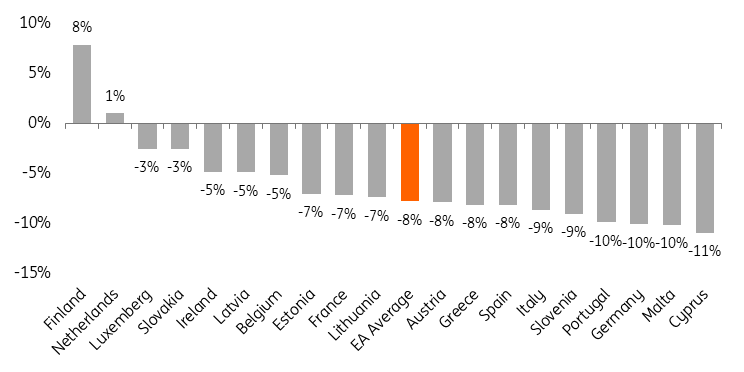

On average, the ECB notes a decline of 8% in the use of cash across the euro area in just two years. Only two countries, the Netherlands and Finland, show a positive change. This may be explained by the already wide use of online payment methods before 2022 and the end of Covid-related restrictions, leading to a regain in cash use.

Cash use varies per euro area country but the trend shows a general decline (2022-24)

In addition to the decline in cash use, we note a shift in digital payment methods. Interestingly, instant payments and e-payment solutions (wallets and mobile payment apps) have taken over part of card transactions over the last few years.

The structure of online payments is also rapidly changing

The declining use of cash in the economy is raising concerns for national regulators. Online or in-person digital payments are currently possible only through the use of “private money” created by commercial banks and other payment service providers (PSP). Since the current form of central bank money (banknotes and coins) can’t be used in digital payments, it automatically reduces the use of central bank currencies.

The simultaneous decline in cash use worldwide and the stark increase of digital payment systems raises questions on the function of central bank money as a ‘monetary anchor’. Currently, the eurozone’s citizens' confidence in private money stems from its one-to-one convertibility with central bank money, which is the only one whose face value is intrinsically guaranteed. Without convertibility at par, stress on the financial system could trigger a loss of confidence in digital currencies and ultimately also in central banks. Stepping away from the established two layers economy (with the first layer composed of central banks' money and the second one of private money) could also result in a decline in Central Banks’ transmission mechanism and ability to foster financial stability.

In this context, regulators across the world have been exploring new ways to safeguard the role of their Central Bank money, including through the creation of Central Bank Digital Currencies (CBDC).

The Bank for International Settlements (BIS) defines CBDCs as a digital form of money that allows users to pay each other using a direct claim on the central bank. In other words, it aims to reinvent central bank money – cash and coins – in a digital form. The main variation to the already available digital currencies and payment methods lies in the CBDC’s direct claim to central banks.

With a CBDC, users’ balances are not exposed to intermediaries’ credit and liquidity risks as they are today. Indeed, all forms of digital payments and currencies in use rely on either a commercial bank or a payment services provider (PSP). Users’ money is therefore subject to the credit risks those entities are exposed to and only have an indirect claim to the Central Bank.

CBDCs versus crypto-assets and stablecoins

A central bank digital currency differs from crypto-assets and stablecoins in many ways. Firstly, most digital currency projects aim to design technology-neutral money. This means it can, but not necessarily, make use of Distributed Ledge Technology (DLT) and/or blockchain technology. That contrasts with crypto assets that systematically make use of DLT to be transferred, stored and traded. Stablecoins also always make use of DLT but aim to anchor their value to a more reliable asset such as currencies, commodities, etc.

This contrasts with the CBDC’s anchor, which stems directly from its issuance as a central bank liability. The risks associated with central bank currencies are therefore much more contained than for stablecoins or crypto assets that have significant credit and liquidity risks.

Re-inventing the direct claim of cash digitally could allow Central Banks to ensure the preservation of their money anchor on the economy. Other motivations such as: increasing financial inclusion, improving cost efficiency and payment speed, safeguarding financial stability or even improving the safeness and robustness of payments are often mentioned.

Currently, most EU countries don’t have a national payment system and thus rely on international payment schemes. Designing a single European payment system/wallet for the digital euro would offer a fully European opportunity and unite the continent’s payment schemes which would complement existing payment solutions.

The interest for central bank digital currencies is global

To this day, only three countries have officially launched their own retail CBDC: the Bahamas (in 2020), Nigeria (in 2021) and Jamaica (in 2022). However, 103 jurisdictions are actively exploring the possibility of launching such a digital currency. The degree of advancement of these projects varies but the bulk of countries/regions (44) are in the pilot phase. Additionally, 20 are developing the currency and 39 are still in the research phase. The map below plots the progress made by each jurisdiction active on the topic. Despite the very small number of active CBDCs and their variable success, this highlights well the global interest in the creation of such currencies.

Distribution of Central Bank Digital Currencies projects

A digital euro; the European Union’s project

As discussed in the introduction, the European Union (EU) is not exempted from the rapid digitalisation of financial services nor the decline in cash use. It’s in that context that in 2020, the European Central Bank (ECB) launched an investigation phase for the development of a digital euro for citizens and business retail payments.

In 2023, the EU entered the second phase of the digital euro design: the preparation phase. Before the end of 2025, the ECB must finalise the design of the currency. This includes the digital euro rulebook, laying the legal boundaries in which the new currency will exist and selecting the providers for the platform and infrastructure. In addition to that, tests are conducted to ensure the alignment of the project to European regulations and users’ needs. By the end of this year, the Governing Council will position itself on the next step of the process.

Timeline of the digital euro project

The currency would come as a complement to cash and other existent digital payment solutions. Besides implementing a new and safe type of central bank currency, the ECB also clearly stated it as a way to reduce Europe’s dependence on international card schemes and a way to strengthen the international role of the euro as well as Europe’s “open strategic autonomy".

Additionally, it would reinforce the euro’s monetary anchor in the face of the increased digitalisation of the economy and decreasing use of cash, ensuring that the currency is available both physically and digitally in the future.

A digital euro is available online and offline

The European regulator outlined several working assumptions for its CBDC. The most important points are the design of a digital currency available both online and offline as well as its distribution through external payment system providers.

The question of privacy and safety is also crucial to the success of the digital currency. Therefore, to replicate the privacy cash represents for consumers, the EU also plans to limit the data shared. During online payments, personal information equivalent to those used with other digital means would be gathered. Whereas used offline, only the data equivalent to a cash withdrawal would be seen. The ECB promises to balance high privacy with fraud and terrorism financing prevention.

Potential impact for the banking sector

In short, the digital euro would offer European citizens a new and nearly risk-free payment system. It could also safeguard the role of Central Bank money through the strengthening of the euro’s anchor role. Nonetheless, it’s not without risk for the banking system and broader financial stability. In this section, we go through the three main contentious points the digital euro project has brought: the deposit outflow risk, the control of the related holding limit and the costs of the new currency.

Risks of deposit outflows

While this has not been observed with the three existent CBDCs, a Central Bank digital currency could attract depositors in masses. This is especially true during periods of uncertainty as it represents a nearly risk-free currency through its direct claim to the Central Bank. A large and sudden outflow of deposits from the banking sector to CBDC personal accounts would have a significant negative impact on the banking sector in the EU.

Firstly, it would imply a drop in credit institutions’ liquidity levels which consequently hardens banks’ task to reach their liquidity requirements. This would also imply a general increase of liquidity risks in the sector. Additionally, the impact of a large-scale deposit outflow could also spill over to the real economy as a result of banks’ limited lending capacity. Overall, a deposit outflow could lower banks' liquidity levels, profitability and ultimately also their resilience. Considering the potentially severe magnitude of these adverse outcomes, the European regulator stressed its willingness to implement adequate safeguards.

The ECB therefore proposes the implementation of digital euro-holding limits. These constraints would be set to limit individual holdings and prevent European citizens from using the digital euro as a store of value. The European regulator explored several levels of holding limits ranging from €1,000 to €5,000. Through a balance sheet optimisation model, they analysed the effect of a deposit outflow on banks under each of those individual holding limits. The model forecasted how credit institutions would manage the overnight deposit outflow while also minimising funding costs and managing their liquidity risks.

Estimates show that with the loosest limit, at €5,000, the household overnight deposit outflow could reach a maximum of 12%. With a €3,000 holding limit, European banks would see the outflow would not surpass 9%. At the current stage of the project, the regulator is considering enforcing the €3,000 personal holding limit.

Estimated maximum outflows of overnight household deposits in different holding limit scenarios

The ECB scenarios consider that when facing high household deposit outflow, banks would first compensate with their excess reserves before turning to other funding options such as interbank and central bank funding. Using data from the second quarter of 2023 and under the different holding limit scenarios, the central bank concludes that the impact on the sector’s liquidity risks and funding structures would be contained. Only an outflow of over 15% would make European banks reliant on central bank funding. In all other cases, banks own funds and the interbank market would suffice to cover the change.

That being said, the sector’s liquidity metrics would be expected to decline once citizens adopt the digital euro. However, results from the ECB model highlight that it would remain well above the regulatory minimum threshold. The following graph depicts the change in eurozone banks’ Net Stable Funding Ratio (NSFR) and Liquidity Coverage Ratio (LCR) and shows that even under the extreme case of a 40% outflow, banks would be able to respect the regulatory threshold.

Shift in banks funding relative to the overnight household deposit outflow

Despite variations in banks’ funding levels, the results also hold when looking at Significant Institutions and Less Significant Institutions separately. Additionally, the model shows that only under the unrealistic assumption of a 30% deposit outflow Central Bank funding would rise. For significant institutions, the increase would only occur even later, at 40% of deposit outflow.

Simulated impact of Significant Institutions key liquidity metrics

Simulated impact of Less Significant Institutions key liquidity metrics

While these results show reasons to believe individual holding limits can effectively constrain a negative impact of the digital euro on the European banking sector, the final threshold hasn’t been set yet and the establishment of such a ceiling remains a complex task. Indeed, setting a too-strict limit might dissuade citizens from making use of the new digital currency and would also be counterproductive for the ECB.

To limit the impact of the holding limit on the payment functionality, the Commission also proposes the implementation of different mechanisms such as ‘waterfall’ and ‘reverse waterfall’ functions. The waterfall mechanism would imply that when a payee receives a digital euro payment resulting in a total balance above the holding limit, the excess amount would automatically fall to the user’s linked private payment account. The reverse waterfall simply switches this mechanism by allowing an automatic transfer from a private payment account to settle a payment in digital euro that surpasses the holding limit.

Despite Europe’s commitment to establish and test those safeguards, concerns remain for the financial sector. Indeed, even if the ECB reports that deriving from several holding limit scenarios, the impact on banks deposit outflow would be contained as well as the liquidity risks and funding structure, individual banks could see varying impacts. These differences are still complex to estimate but could stem from the varying customer base, technological capabilities and change adaptation ability of each credit institution.

Who would control the holding limit?

Considering the crucial significance of setting a correct holding limit, a group of Member States including Germany, France as well as the Netherlands are currently arguing for national control. Without granting Member States this power, they believe their decision-making power would be limited. Additionally, some brought up concerns regarding the threat these limits could pose to citizens’ financial freedom.

The Association of German Banks even propose to leave the limit-setting power to banks themselves. The main argument is that banks are already setting limits for current accounts and are aware of their customers’ needs and risk profiles.

Despite those discussions, the current digital euro proposal sets the ECB as the sole manager of those limits and views them as inherently part of regulators’ supervisory responsibilities. Some came up with a potential compromise in which national legislators would set the parameters for the limits while leaving the ECB as the operator and decision-maker. However, it is yet unclear whether the ECB will concede some power on this crucial point of the project. At this point, no official modification to the draft policy has been introduced. Therefore, the control of the holding limit is to be expected to remain in the hands of the ECB solely.

Implementation costs

An inherent part of the digital euro project is to create a currency free of charge or for which customers could pay a small fee for additional services. While the Commission estimates the bulk of implementation costs to fall on the ECB, merchants and Payment Service Providers, and some bank associations expect a significant part of it to end on banks themselves.

Indeed, the policy draft plans to distribute the digital euro through the existing PSP. However, those will not be allowed to charge fees to customers for the basic digital euro services. Therefore, the proposal includes the possibility for PSP to charge inter-PSP fees, providing compensation for the distribution costs.

As European banks will be requested to offer the digital euro to their customer base, they could also face costs to deploy the necessary platforms or fees from utilising external services to do so. Bank associations view these costs as disproportionate. They also fear it could tie banks’ resources and lower their competitive advantage in the development of other payment services.

That being said, the ECB aims to restrict the fees depending on the implementation costs. This could limit the adverse impact those could have on both PSP and the European financial sector’s profitability.

Conclusion

The digital euro has been a topic of discussion for more than five years now. However, as the preparation phase is slowly coming to an end, both Member States and market participants seem to increasingly focus on the impact it could have on the economy.

The creation of a retail central bank digital currency in the euro area could ensure the money anchor function of the euro in the unavoidably digital future. With it would come the expansion of the transmission mechanisms. Upon a high adoption rate, it could also foster the EU’s “open strategic autonomy” through the broader use of the currency and lower reliance on non-European payment services.

Additionally, a digital euro accessible to all European citizens could foster financial inclusion by offering digital payment means for those excluded from the banking sector. It is also believed to foster innovation through the creation of digital wallets provided by European payment service providers.

That being said, several risks must be considered. First and foremost, a large deposit outflow from the banking sector towards the digital euro could significantly affect European credit institutions. This could spill over to the real economy through a reduction in banks’ lending capacity. Furthermore, the banking sector could see additional costs related to the implementation of the new digital currency that would add to the regular maintenance costs.

Nonetheless, looking at the three existent central bank digital currencies (in the Bahamas, Nigeria and Jamaica), we note that the adoption rate has been limited and certainly not sudden. In most cases, the government even decided to implement financial incentives to increase citizens’ interest in the digital currency.

Considering that most risks stated here would materialise only upon a sudden and significant adoption of the digital euro, one can wonder how serious those are. However, the Union’s financial system differs from the three real-life examples, hence, estimating the uptake of the currency remains challenging.

While the ECB is aiming to contain these risks through the inclusion of individual holding limits and cost constraints, these should still be considered. The coming months will be crucial in determining the future of the digital euro. Indeed, the most contentious points of the project, the holding limit level as well as its control, are still discussed. A miscalculation in setting the said limit could result in a shock for the European banking sector.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Digital currenciesDownload

Download article