The credit reaction to the Ukraine-Russia crisis

The Russian invasion of Ukraine is severely impacting many markets. Here, we look at the cross-credit reaction to the crisis, we identify the implications of the conflict and what sanctions on and by Russia really mean in practice

The implications so far

Russia's invasion of Ukraine has led to severe economic sanctions and a huge reaction from the corporates working in Russia. Assets of Russia's Central Bank Reserves were frozen by the G7, the largest state-owned banks were cut off from SWIFT, and numerous individuals including some oligarchs were sanctioned by the US/UK/EU and other countries. Around 200 commercial companies are going to suspend, divest or cut off any ties with Russia. The Russian response to the West’s sanctions was to impose capital controls that hit external debt payments.

Last Saturday, President Putin allowed Russian borrowers to repay external debt only in ruble and only to investors in jurisdictions that have not implemented sanctions on Russia. Payments to other investors will be accumulated in the special 'S-accounts' but will not be available. The market started talking about technical default, indicative pricing of bonds remained at 20-40 cents per dollar, while Russia's Credit Default Swaps (CDS) rocketed to near 3,000bp vs. 125bp at the beginning of 2022.

Rating agencies put Russia's sovereign rating at pre-default level. Moody's cut Russia's rating to 'Ca' from 'B3'. S&P assigned ''CCC-.

Performance before invasion to now

Basis points

Russian exclusion from indices

Among the 'great exodus' of commercial business from Russia, Russian issuers lost their presence in global indices as securities trading has been suspended since 25 February on the Moscow Exchange. Future payments on eurobonds are in question. Key index providers called the Russian segment 'currently uninvestable' and announced plans to exclude Russia from indices: S&P, MSCI and FTSE for stock indices, and JPM and Bloomberg will exclude Russia from bond indices.

According to the Bloomberg Barclays EM Corp Quasi-Sov index, there were 51 Russian corporates and quasi-sovereign bonds included in the index as of 18 February 2022 whose value totalled US$41bn (3.15% of the index). The total market value of Russian index members plunged to $12bn as of 7 March (0.90%) vs. $44.8bn and 3.2% of the market share at the end of 2021.

Liquidity is virtually non-existent in Russian bonds

Russia's sovereign eurobonds' weight in the Bloomberg Emerging Markets Sovereign USD bonds index is estimated at $38.5bn (or 3.6% of the index) as of the end of 2021. This figure eased to $33.5bn (3.33% ) as of 18 February and plunged to $6.3bn as of 7 March.

The consequences of this are not just regular exclusion and rebalancing of the index portfolios, but since liquidity is virtually non-existent in Russian bonds there is hardly any possibility to wind down positions in Russian risk assets. In the case of default, or series of defaults over time, investors will need to recognise a loss in the P&L. We would expect key markets in Central and Eastern Europe, the Middle East and Africa regions: MENA countries, South Africa and India, and the Philippines to potentially benefit from this trend.

Technical default on external debt

There is a high probability that investors in various locations will not receive debt payments/coupons which could be considered as a default.

Starting from Saturday 5 March, FX debt service will be made only in rubles and only to those investors who are located in jurisdictions which have not implemented sanctions, according to Putin’s decree (link) and new clarification made by the Central Bank of Russia (link). For some investors in countries that have yet to impose sanctions, notably in Asia and the Middle East, along with domestic investors, payments will be allocated in rubles. There will be special payment ‘allocation’ to particular 'S-accounts' for investors in locations that have imposed sanctions.

We expect there will be numerous cases of investors not receiving any payments on their Russian risk assets

The Russian government has made a list of unfriendly countries, which includes all EU members, the US, Canada, South Korea, Australia, the United Kingdom, Monaco, New Zealand, Norway, Switzerland, Japan, and others. We expect there will be numerous cases of investors not receiving any payments on their Russian risk assets. So, this will mean technical default which may turn to real default and legal actions after the grace period.

Russian issuers have around US$115bn of external debt outstanding. The total amount of redemptions reached around $20bn in 2022 including $2bn of sovereign, $5.5bn of banks debt and $11.8bn of non-financial debt. The total default amount could be potentially higher as default in one instrument could trigger cross-default in another. However, we assume that some Russian corporates may start negotiations with investors regarding recognition of these special 'S-accounts'. All in all, the situation is changing so quickly that the willingness and ability to pay will depend on political decisions.

What else could happen theoretically?

The G7 and its allies will continue to impose further sanctions on Russia. Among the most often articulated and significant actions by both sides are:

- The Russian energy sector could face potential embargo sanctions by the US/EU and other countries. The ban on imports could be imposed on selected companies in order to smooth market stress.

- Russia may end its oil and gas exports although a wholesale stoppage is unlikely. Russia may shut down Nord Stream I in retaliation for the shelving of Nord Stream II, Russia's Minister of Energy has commented.

- Russia may shut down the export of base metals (aluminium, nickel, and/or other rare metals like titanium) or impose restrictions on fertiliser exports.

- The nationalisation of aeroplanes could be revoked due to discontinued lease contracts.

- New Russian banks might be cut off from SWIFT (the EU's proposal), or all Russian banks might be cut off from SWIFT (the UK’s proposal).

- The list of sanctioned oligarchs will be extended, triggering sanctions against particular companies.

Direct impact is limited for high yield companies but watch for secondary effects

We believe the direct business impact from the Russian invasion of Ukraine appears fairly limited for the majority of the European high yield issuers, with the exception of Russian and Ukrainian corporates and other relatively few names with more material operations in the two countries, such as Renault and Oriflame. However, we feel that second-degree impact is more material, of which the main transmission mechanism is commodity price inflation, from energy to agricultural commodities to metals. Furthermore, there may be some additional, less obvious, supply chain impacts such as those highlighted by Moody’s with regards to the Automotive sector (in relation to wiring harnesses manufactured in Ukraine for the European car manufacturing facilities).

While cost inflation may impact some sectors and sub-sectors, such as Transportation, Basic Industries, Packaging, Food Manufacturing, more than others, there is also the varying extent to which businesses can pass those cost increases to the final consumers, which needs to be taken into account. However, on balance, we believe that the overall impact will be felt to a varying degree across the board.

Do not expect a large increase in European speculative grade default rates

In spite of the adverse implications we have highlighted here, we do not anticipate a near-term material increase in default rates in the European high yield market (at least, outside of the emerging market issuer perimeter). We believe that liquidity continues to be sufficient for the near-term but default risks will rise as a result, and default rates may increase in the medium term, notably from 2023 onwards.

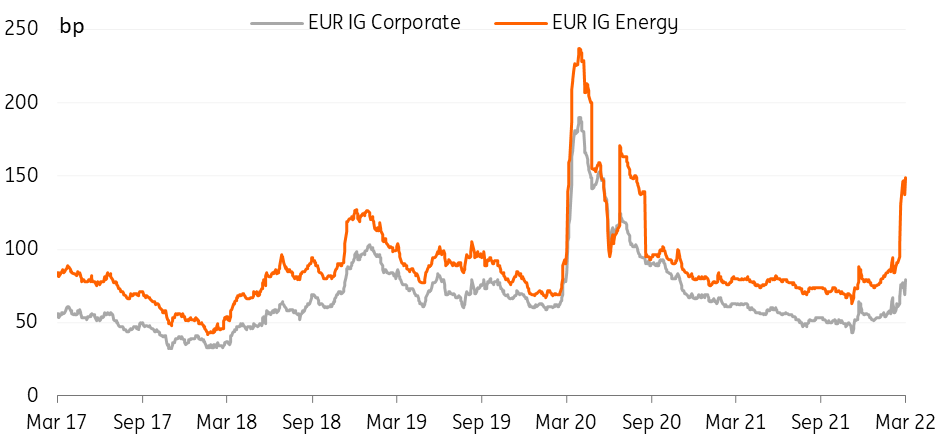

EUR investment grade credit widening, other factors will regain control

EUR investment-grade spreads are certainly seeing softness on the back of the Russia-Ukraine news. Spreads were already widening on the back of the likelihood of an earlier taper but then we saw yet more widening and volatility on the back of the invasion. Some sectors, such as oil & gas, utilities and industrials, are under more pressure. The telecom sector generally has little exposure to Russia and we have seen slightly firmer spread developments here.

Corporates with more exposure to Russia are naturally underperforming and will continue to do so as the market looks for true credit metrics. As many corporates announce a withdrawal from the Russian market, we are seeing the impact on earnings and potential write-downs, particularly on top of increased energy prices, associated inflation and supply chain issues. Environmental, Social, and Governance (ESG) scrutiny is another phenomenon to contend with as the social angle of ESG has become a reason to shy away from Russian business.

Credit curves have been flattening to crisis levels

Furthermore, shorter-dated bonds have been underperforming thus credit curves have been flattening. This has particularly been seen in the energy sector and can be considered a jump to default. Some names have even seen an inverted curve: Wintershall, Gazprom and EP.

Indeed there has been spread widening, but this has been rather underwhelming compared to the widening seen during the Covid-19 crisis. Technical factors will remain strong this year for EUR investment-grade credit, namely the drop in net supply and demand from the European Central Bank's bond-purchasing programme.

EUR investment grade corporate credit spreads widen

Energy underperforms

Excess overselling of ETFs is a risk, but demand remains

EUR corporate mutual fund outflows are persisting, with sizeable amounts of consecutive outflows in the past five weeks totalling 4.5% of assets under management (AuM) for the EUR investment-grade corporate market, according to EPFR Global. Exchange-traded funds (ETFs) have actually seen inflows over the past two weeks amounting to 1.4% of AuM. Although on a five-week basis, outflows still total a sum of 3.2% of AuM.

This is good news as massive outflows can create an imbalance between illiquid cash bonds and ETF prices. Excess overselling of ETFs is a risk for credit, such that a negative spiral occurs when the illiquid cash bond market cannot keep pace with the more liquid ETF market. However, ETFs are not currently seeing excess selling as flows between buyers and sellers are roughly matched.

ETF flows turn positive despite overall mutual funds still outflowing

Energy flows from Russia to Europe at stake

The response of European governments and corporates impact many sectors, not least the energy sector. Completed in September 2021, the German regulator has put Nordstream 2’s operating licence on hold. The natural gas pipeline, 1,200km long, aims to transport natural gas from the Russian coast near St Petersburg to Lubmin in Germany. With the same capacity as Nordstream 1, the project is estimated to have cost €9.5bn.

While Gazprom, the sole owner of the pipeline, brought 50% of the financing, the rest was provided in the form of loans by five European energy companies: Engie, OMV, Shell, Uniper and Wintershall. Not using the pipeline would mean substantial write-offs for its owners and for each of the five European companies, with an almost €1bn loss. The European Union has not agreed on completely stopping Russian natural gas from flowing into Europe but pressure exists from certain European countries to fully ban gas exchanges from the country. Europe consumers 40% of its natural gas from Russia and any decision to close Norstream 1 would financially impact Russia as well as a number of European utilities obliged to find gas from other parts of the world at markedly high market prices.

Oil and gas majors already announced measures

With direct operations in Russia, some European oil and gas majors also announced the intention to limit investments or fully withdraw from the country. BP Plc plans to sell its 19.75% in Rosneft. BP’s presence in Russia accounts for 35% of the company’s oil and gas reserves and Rosneft paid €600m in dividends to BP in 2021. The British energy company estimates that the write-downs of the assets could amount to up to €25bn.

Shell has also announced a full exit. The group has a more moderate exposure to Russia with about USD$3bn of assets in joint ventures which is small in regards to its massive asset base. Its Russian affiliates and activities brought around €600m of adjusted earnings to the group, representing 4% of total earnings.

As far as TotalEnergies is concerned, the French energy major will stop providing capital for new projects in Russia but thus far has decided not to withdraw from the country where it has a 19.4% interest in Novatek, including a 21.6% in the Arctic LNG 2 project and 29.7% in Yamal LNG. Russia accounts for 17% of the group’s production.

USD HY Energy outperforms slightly, with little effect on US Energy corps

Energy corporations in the US are less affected by the crisis and there has been little underperformance for US dollar energy credits in both investment grade and high yield. The ICE BofA USD HY Energy index (which accounts for 14% of the overall non-financial HY index) has actually outperformed slightly, mainly on the back of the higher energy prices as most US oil names are not exposed to Russia. Since Barack Obama's days in the White House, the US has been trying to reduce reliance on the Middle East and other regions, resulting in more production from a number of domestic oil producers, notably with shale oil and gas products. Therefore, these US corps are much less affected by supply issues from Russia and are just benefitting from the rise in oil prices.

Outperformance of US HY Energy

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

8 March 2022

A global power struggle This bundle contains 9 Articles