Thailand’s growth slips to 4-year low in 1Q

A weak first quarter combined with intensified downside growth risk leads us to cut our 2019 growth forecast to 3.1% from 3.8%. We expect the Bank of Thailand to join its Asian counterparts in easing with a 25 basis point policy rate cut at the next meeting in June

| 2.8% |

1Q19 GDP growth |

| As expected | |

Weak domestic demand dents growth

Thailand’s GDP growth slowed sharply to 2.8% year-on-year in the first quarter of 2019 from 3.6% in the previous quarter. Spot on with the consensus median estimate, but below our 3.1% forecast, this was the slowest pace of quarterly GDP growth in four years.

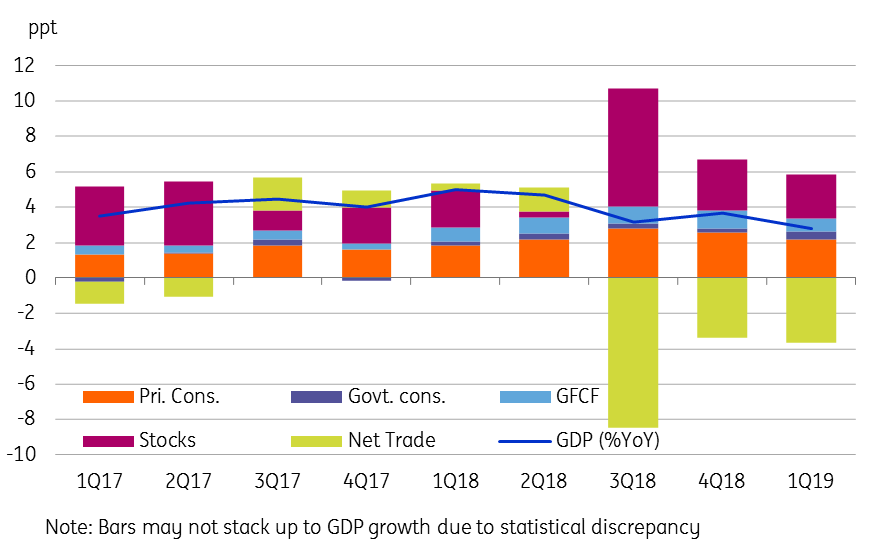

A spike in the political risks surrounding the general election weighed on the domestic economy with nearly half of the slowdown in headline growth coming from private consumption and the rest from investments. Albeit a slightly narrower contribution, inventory re-building remained a key driver of GDP growth. And net trade remained a big drag, which was a bit surprising given a persistently wide current account surplus.

What's driving GDP growth?

Increased downside risk for the rest of 2019

The National Economic and Social Development Council, the government agency keeping the national accounts data, downgraded its growth outlook for the current year to 3.3% from 3.8% on expectations of much weaker export growth, 2.2% versus 4.1% earlier forecast, as the headwinds from the US-China trade war and Brexit continue to rise.

Data also prompts a revision in our 2019 GDP growth view to 3.1% from 3.8%. While we expect the export slowdown to broaden out to domestic demand, underlying our more bearish forecast is the persistent inventory overhang on growth.

It’s time for the BoT to reverse the December rate hike

We expect the Bank of Thailand (the central bank) to follow suit with a downgrade of its growth forecast for the year, currently 3.8%.

And a downgrade will, in all likelihood, be accompanied by a shift in the BoT’s policy stance from stable to easing. The current low inflation provides sufficient room for easing to support growth with lower interest rates. We continue to believe that the 25 basis point BoT policy rate hike in December 2018 wasn’t necessary and it’s now time to reverse it.

On that note, we revise our BoT policy view from no policy change this year to a 25 basis point rate cut to 1.50% at the next meeting in mid-June.

The central bank has policy space

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

21 May 2019

Good MornING Asia - 22 May 2019 This bundle contains 4 Articles