Thailand’s central bank leaves policy on hold

We maintain our view of no change to the Bank of Thailand policy anytime soon

We recently revised our USD/THB forecast for end-2018 to 32.3 from 31.0. However, just as for most other emerging market currencies, the new forecast could become stale sooner rather than later. We maintain our view of no change to the BoT policy anytime soon.

| 1.5% |

BoT policy rateNo change |

| As expected | |

On-hold monetary policy

As widely expected, The Bank of Thailand’s (BoT) monetary policy committee unanimously decided to leave policy unchanged at the meeting held today. The decision comes as the Thai baht (THB) weakened 3% against the US dollar over one month, while there were no other economic motives for change from an on-hold policy stance that’s been in place for over three years now. The last policy move was a 25bp cut to the policy rate to 1.50% in April 2015, marking the end of that easing cycle.

Weakening currency

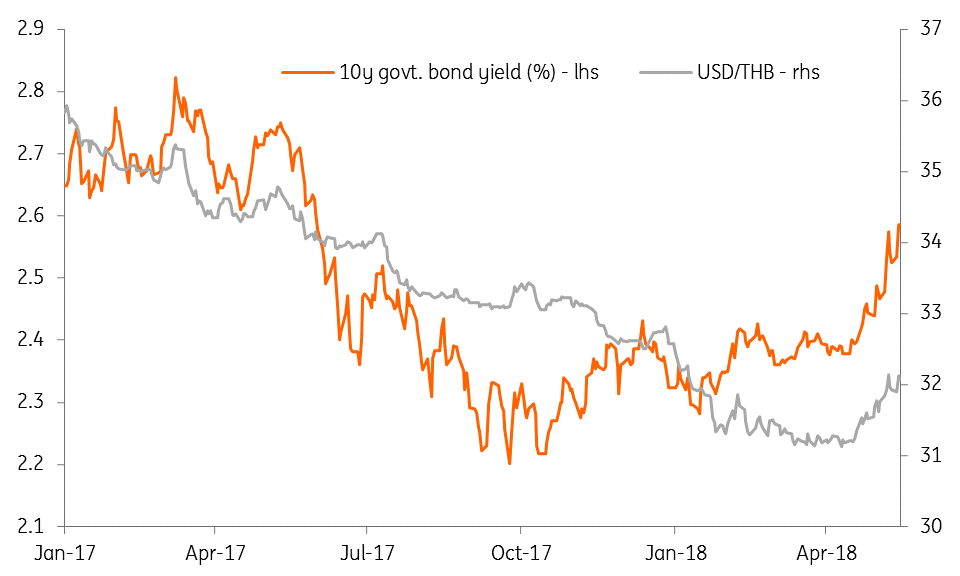

The 16% THB appreciation against USD from end-2016 through April this year allows the central bank to accommodate some depreciation pressure. The broad USD strength and outflows from the local bond market since April are associated with a 3% depreciation of the THB above the 32 level against USD. The hit to local currency bonds is evident in a 20bp spike in the 10-year yield, the steepest selloff since late 2016.

Today’s policy statement noted that, “In the period ahead, the baht would likely remain volatile mainly due to uncertainties pertaining to monetary, fiscal and foreign trade policies among major advanced economies.”

The only support for the currency is the prevalence of large current account surpluses, which amounted to $48bn or about 11% of GDP in each of the last two years, and at $17bn in the first quarter of 2018 was $2bn wider on the year.

Slow growth, low inflation

Thailand’s GDP growth is poised to moderate as the data for the first quarter of 2018 is expected to show next week (May 21), while inflation remains negligible at 1.1% in April or close to the low end of the BoT’s 1-4% medium-term target. As elsewhere, high household debt further constrains any monetary tightening along the way.

With expectations of these trends continuing, we aren’t forecasting any change to the BoT policy for the rest of the year.

Weakening government bonds and THB

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

16 May 2018

Good MornING Asia - 17 May 2018 This bundle contains 3 Articles