Thailand: Why the central bank should ease policy this week

We don’t mind being an outlier in the consensus view which solidly backs no policy change from the Bank of Thailand this week. We are convinced that the time is up for the central bank to cut rates now before the weak economic trend gets out of hand

| 1.50% |

ING forecast of BoT policy rate25 basis point cut |

ING, a consensus outlier

The Bank of Thailand’s (BoT) Monetary Policy Committee meets this week to review the current policy setting. It will announce its policy decision on Wednesday, 26 June, around 2pm Bangkok time.

We don’t mind being an outlier in the consensus view; 20 out of 21 participants in a Bloomberg survey are looking for no change from the Bank of Thailand this week. We, the only one in this survey, are convinced that now is the time for the central bank to cut rates before the current economic weakness gets out of hand. Hence our forecast of a 25 basis point BoT policy rate cut to 1.50% this week.

Weak domestic economic dynamics

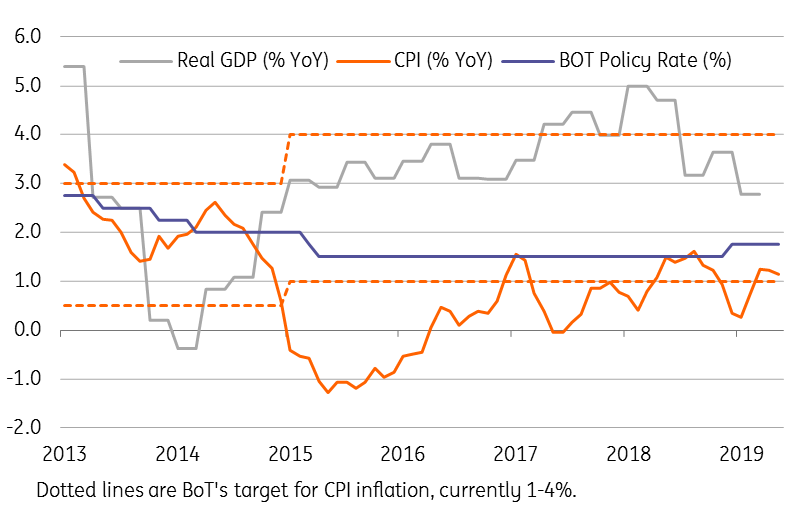

The BoT’s last policy change was a 25 basis point increase in the 1-day repurchase rate, the policy rate, to 1.75% in December 2018. We thought that policy tightening wasn’t required in the first place when the external economic headwinds were already getting stronger, GDP growth was petering out, and inflation was running under the BoT’s 1-4% target for the policy.

Indeed, Thailand’s economic environment hasn’t got any better since the last policy move. Rather, it has deteriorated - an embarrassing outcome for policymakers. The export weakness, which has gathered steam, took a toll on GDP growth, driving it to a four-year low of 2.8% in the first quarter of 2019. Exports weren't the only thing to blame. Increased political risks surrounding general elections, which were finally held on 24 March after nearly five years of military rule, also weighed on domestic demand. Such a dismal report card for 1Q19 prompted a sharp cut to the official growth forecast for 2019 to 3.3% from 3.8%.

The negative fallout of the US-China trade war has also hit the tourism sector, the backbone of the Thai economy, evident from the slowdown in Chinese visitors underway since last year.

Meanwhile, inflation has remained subdued, rendering the last rate hike even more unnecessary. Average consumer price inflation of 0.9% year-on-year in the first five months of 2019 was unchanged from the same period last year. A spike in food inflation offset lower housing and transport costs. Core inflation, which strips out food and fuel prices from total CPI, has eased to 0.6% year-to-date from 0.7%.

Growth-inflation dynamic calls for a rate cut

Strengthening external headwinds

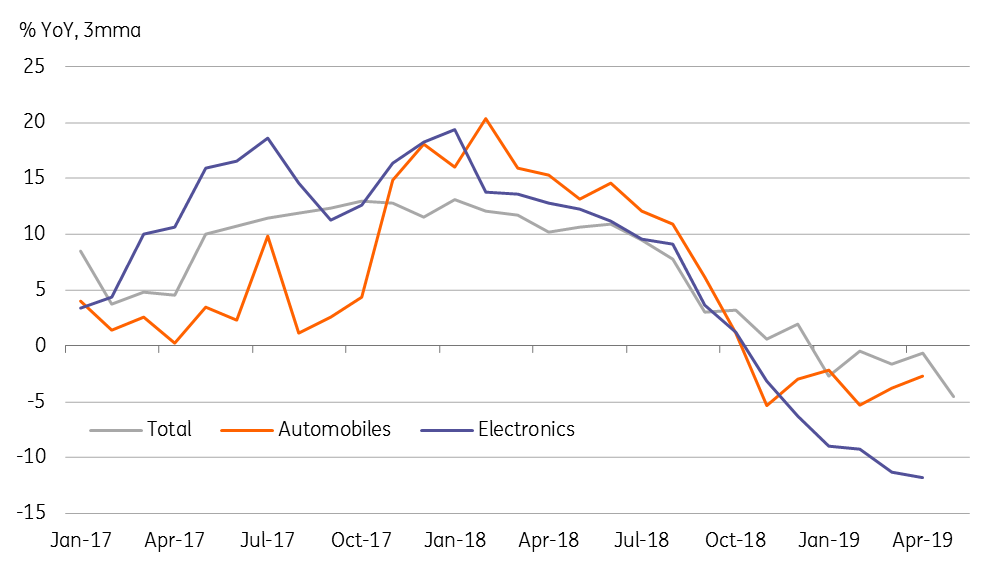

While domestic economic risks remain tilted towards growth, external risks are on the rise. Exports of electronics and automobiles, together accounting for 30% of Thailand’s total exports, have been on a downward grind. The slump in the global tech sector is compounding the higher US tariffs on the auto sector.

A 2.7% YoY export fall in the year through May is a significant negative swing from 12% growth a year ago. The swing is much worst for imports, - 1.0% YTD from +16%, which underscores domestic economic weakness. This is associated with a (just slightly) narrower trade and current account surplus than a year ago. The potential negative impact on the tourism dollar could mean that the surplus narrows even further, though we think the current surplus should continue to be a significant support to the currency compared with other Asian economies.

Slumping autos and electronics exports

Runaway currency appreciation

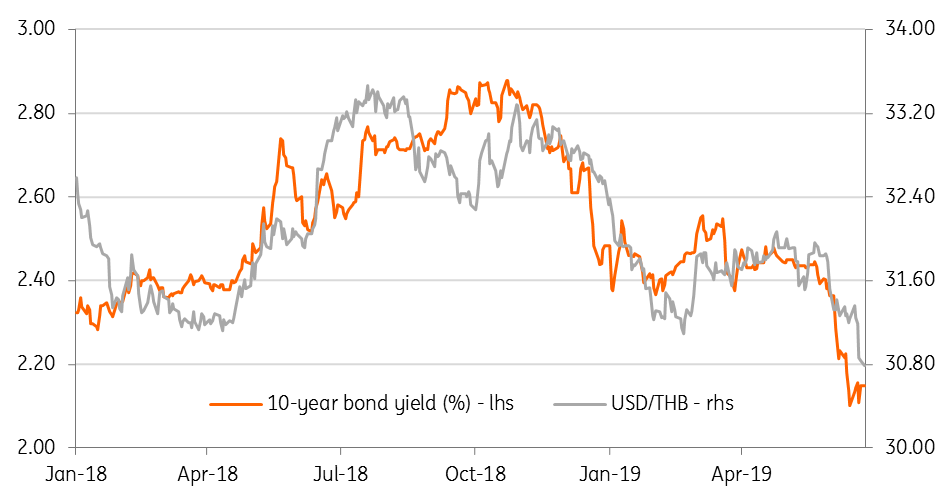

Further depressing export demand is runaway currency appreciation. The baht (THB) continues to be among the best performing emerging market currencies this year. Nearly half of the 5.8% THB appreciation against the USD so far this year occurred in the current month, taking the exchange rate to a six-year high of 30.78, as of this writing. This was despite heightened global economic and geopolitical uncertainty.

The authorities are worried about excessive currency strength aggravating the export weakness. It also makes visits to Thailand increasingly expensive, removing its lustre as a cheap tourist destination in Asia and perhaps the world. All this has prompted the BoT to closely monitor the foreign exchange market for speculative interests. A rate cut might help in the process.

Surging portfolio inflows boosting bonds and currency

A reversal of December hike, not much

Just last week, BoT policymaker Somchai Jitsuchon signalled that monetary policy would be data-dependent, with the fallout from the US-China trade war on the local economy leaving the bank “open to all possibilities”. This being the case, it’s hard to imagine the BoT ignoring the latest activity data, which offers no hope of recovery in economic growth in the period ahead.

We believe the case is strong for a BoT rate cut this week, even if it merely reverses the December 2018 rate hike and there is no accommodation in a real sense just yet. The economy will need more policy support for a recovery in GDP growth towards the 4% average rate of the last two years. Given persistently low inflation, there is enough policy space for more rate cuts, in line with the global easing cycle.

What this means for markets?

We think that a rate cut this week will pass without hurting local financial markets too much. In keeping with the recent global pattern, both equities and government bonds stand to benefit from lower interest rates, without causing too much impact for the currency, which is benefiting from a strong external payments position.

The question is, whether local government bond yields offer enough of a risk premium over their US counterparts for investment in an economy with weaker fundamentals. Currently, at just 10 basis points on a 10-year local yield (2.15% vs. 2.05% on UST), we don’t think it’s worth the risk.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

24 June 2019

Good MornING Asia - 25 June 2019 This bundle contains 4 Articles