Thailand: What to expect from the central bank

We continue to forecast no change to Thailand's central bank policy for the rest of this year. While recent market stability undermines our view of the Thai baht trading towards 35.0 against the US dollar by the end of the year, we don’t see the currency returning to its status as an Asian outperformer

| 1.5% |

The BoT policy rateNo change |

A unanimous consensus on BoT policy

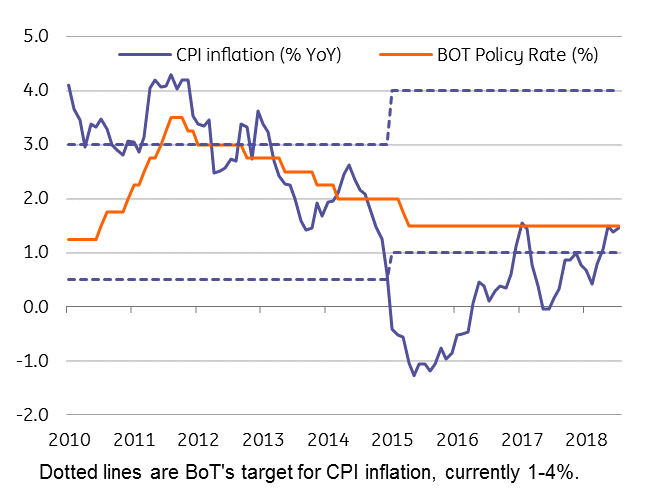

Thailand’s central bank (Bank of Thailand) monetary policy committee meets on Wednesday (8 August). We share the consensus view, which unanimously supports an on-hold policy decision, i.e. no change to the 1.50% policy interest rate. The policy rate has been held at the current level since early 2015.

Although the solid consensus forecast favouring a stable policy rate makes this meeting a rather dull event, market participants will focus on the policy statement for hints about the potential policy direction, particularly as one of the seven policy committee members voted for a rate hike at the last two meetings.

What to look for in the policy statement

Here is what to look for in the BoT policy statement:

- Growth: Recent policy statements have been generally upbeat on growth and we don’t think the next one will differ in this respect. The recent upgrade by the finance ministry of its growth forecast for 2018 from 4.2% to 4.5%, topping the BoT’s 4.4% forecast (which the central bank revised in June from 4.1%), is further reason for a continued positive central bank assessment of the growth outlook. However, slower industrial production growth in the April-June period suggests the best of the GDP growth may be over. We forecast growth likely eased to 4.5% in the second quarter (data due on 20 August) from a five-year high of 4.8% in the first quarter. And global trade wars could depress it in the remainder of the year.

- Inflation: The June policy statement flagged the possibility of slightly faster inflation ahead due to higher oil prices. While we aren’t expecting any toned-down language on inflation in the upcoming statement, we believe that inflation has already reached its peak level of about 1.5% in the current cycle. Barring any severe shocks to food or fuel prices, we see the high-base effect nudging inflation below 1% by September and keeping it there for the remainder of the year. The BoT’s policy target for inflation is 1-4%.

- Financial markets: Consistent with global emerging markets, Thai financial markets are seeing some stability after a sell-off in the first half of the year. The Thai baht (THB) rate against the US dollar has stabilised in a 33-33.50 range since July, after being the worst performer in the second quarter of the year. This is likely to have the BoT rehashing the language from its previous statement on the soundness of local financial markets, although with a caveat of continued future vulnerability from evolving trade protectionism and central bank policies in developed markets.

- Policy stance: With the above backdrop, the statement should maintain the view that “monetary policy should remain accommodative”. Emphasising this stance, BoT Governor Veerathai Santiprabhob has said recently that they are in no hurry to follow rate hikes by other central banks.

ING's policy and currency forecasts

We expect no change to the BoT policy this year, which is a view we have held for over a year now. While recent USD/THB stability undermines our view of the pair trading towards 35.0 by the end of the year, we don’t expect the Thai baht to return to its status as an outperformer again this year. The currency's outperformance since 2017 carried through to the first quarter of this year. But a 5.8% depreciation against the USD in the second quarter was the most among Asian currencies. It's been in the middle of the Asian pack since July - neither an underperformer nor an outperformer.

The BoT policy isn't going anywhere anytime soon

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

7 August 2018

Good MornING Asia - 8 August 2018 This bundle contains 4 Articles