Thailand: Weak activity leads GDP forecast downgrade

Following weak September manufacturing activity, we have cut our 3Q18 GDP growth forecast to 3.7% from 4.1%, and full-year 2018 growth forecast to 4.2% from 4.3%. Recent data weakness not only undermines the government’s optimism on the economy's growth this year but also dampens the prospects of the central bank tightening policy anytime soon

| -2.6% |

September manufacturing growth |

| Worse than expected | |

Exports dent manufacturing

Consistent with the consensus view, manufacturing output contracted on a year-on-year basis in September. However, the 2.6% fall was much steeper than the consensus median of only a 0.5% fall. Coming on the heels of unexpectedly weak exports (-5.2% YoY), the steeper manufacturing fall isn’t a complete surprise.

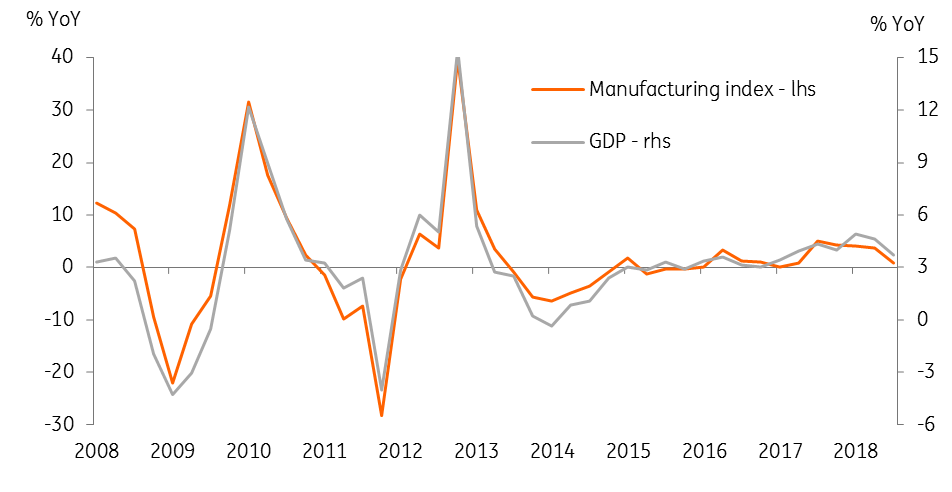

The decline in exports and manufacturing in recent months has been partly the result of high base effects; growth was accelerating during the same period of 2017. A sharp slowdown in manufacturing in 3Q18 to 0.9% YoY from 3.7% in 2Q18, will have undoubtedly pulled GDP growth lower (see figure). It’s not only manufacturing though. Service sector activity has also started to take a hit from falling tourist arrivals, especially visitors from China.

Manufacturing drives GDP

GDP forecast downgrade

We now estimate 3Q18 GDP growth of 3.7%, slower than our earlier 4.1% estimate and down from 4.6% in 2Q (Bloomberg consensus 4.2%, data due on 19th November). This pushes our full-year growth forecast down to 4.2% from 4.3%. The fourth quarter is typically a strong growth quarter, which will soften the impact on full-year growth.

Yesterday the finance ministry reaffirmed its 2018 GDP growth forecast of 4.5% but cut its export growth forecast to 8% from 9.7% projected three months ago, citing the US-China trade conflict as the reason for the cut. We consider the official projection optimistic. With 8.1% growth in the first nine months, exports will have to continue growing at this pace over the remainder of the year. The risk is squarely on the downside, with export growth likely remaining negative in the final three months. The ministry also revised its forecast of tourism revenue this year to 2.01tr Thai baht from 2.08tr.

However, we agree with the finance ministry’s view that there will be no change in Bank of Thailand policy in the rest of the year. The BoT policy rhetoric lately has been flitting between dovish and hawkish, driven by factors of potential downside growth risks and the need to create policy space for the future. The latest data empowers the doves.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

30 October 2018

Good MornING Asia - 31 October 2018 This bundle contains 4 Articles