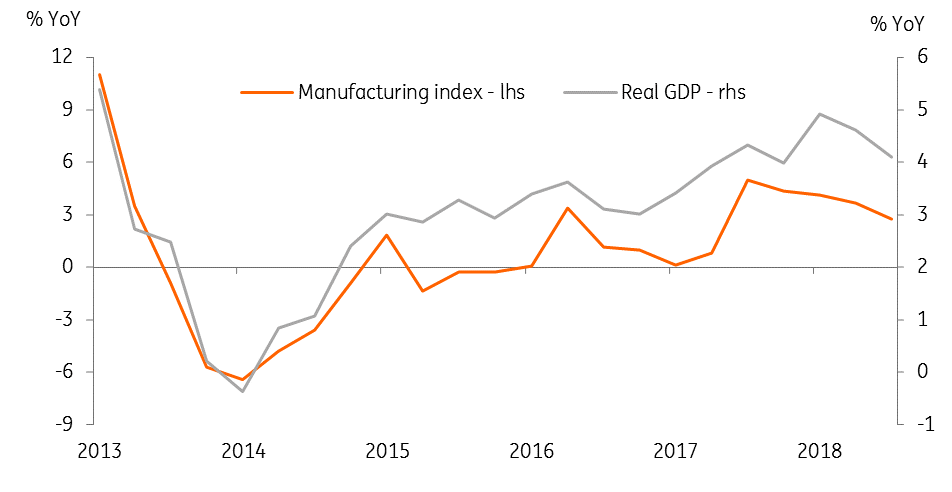

Thailand: Manufacturing points to GDP slowdown

We forecast a further slowdown in GDP growth to 4.1% in 3Q18 from 4.6% in 2Q. The Bank of Thailand has no more reason to tighten policy, while the strong current account is sustaining the Thai baht's outperformance

Thailand’s disappointing manufacturing data for August foreshadows a further slowdown in the country’s GDP growth in the current quarter. Slower growth dampens the case for a macroeconomic policy shift to tightening from the current accommodative stance. Indeed, the Bank of Thailand Governor Veerathai Santiprabhob has been alluding to continued policy accommodation in the medium-term. Still, we do not see this displacing the Thai baht (THB) from its status as Asia's best-performing currency anytime soon thanks to continued external payments support despite some weakening of the trade balance in recent months. Our end-year USD/THB forecast remains at 33.0.

| 0.7% |

August manufacturing growth |

| Worse than expected | |

Strong exports, yet weak manufacturing

The manufacturing index rose by only 0.7% year-on-year in August, undershooting the consensus estimate of 3.1% growth. This is the slowest rate of growth since April 2017. Meanwhile, July growth was revised up to 4.9% from the initial estimate of 4.6%. Manufacturing capacity utilisation also dipped to 65.9% in August from 66.9% in July (revised from 67.2% initial estimate), the lowest since last November.

Although the year-on-year manufacturing slowdown can be blamed on a technical factor due to a high base-year effect, the month-on-month growth performance was barely positive (0.2%) after two months of contraction in June and July. This contrasts with a strong double-digit export bounce in August, which more than recovered the monthly declines in the previous two months. This leads us to think that domestic demand was a weak spot for manufacturers in the last month.

Where manufacturing goes GDP follows - down in 3Q18

Assuming a monthly manufacturing change in September at the average rate over the last three years, the 3Q18 growth will see a slowdown to 2.8% from 3.7% in 2Q. Where manufacturing goes GDP follows (see figure). We estimate that the 3Q GDP slowdown to 4.1% from 4.6% in 2Q remains on track.

More reasons for the central bank to keep policy on hold

Aside from the GDP growth slowdown, we believe inflation also peaked in August. The Thai baht has continued to outperform due to the still large current account despite two consecutive months of merchandise trade deficit in the last month. These factors significantly weaken the argument for the Bank of Thailand moving to a tighter stance.

Moreover, the BoT policymakers are conceding to the need for continued policy accommodation. Just yesterday, a Bloomberg report quoted Governor Veerathai saying that monetary policy was data-dependent and was unlikely to shift to tightening from an accommodative stance.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

25 September 2018

Good MornING Asia - 26 September 2018 This bundle contains 2 Articles