Thailand: Inflation downturn starts

The Bank of Thailand's desire to begin interest rate policy normalisation in order to create some policy space for the future continues to be a desire rather than a looming reality

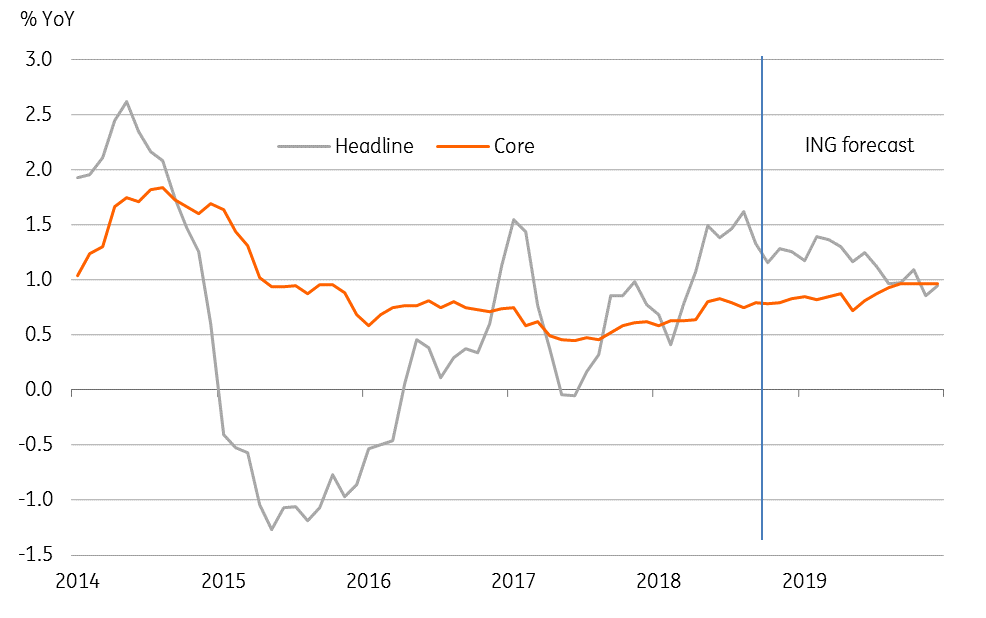

Thailand’s consumer price index (CPI) data for September today affirmed what we said a month ago, that ‘Inflation has peaked’. The start of what we see as yet another prolonged stretch of subdued inflation will be a blow for the central bank (Bank of Thailand) policy hawks. Not only do we maintain our view of no change in BoT policy this year, but we also are reconsidering our forecast of the BoT starting to normalise policy rates next year. Nonetheless, drawing support from the strong external surplus the THB should remain an Asian outperforming currency in the period ahead.

| 1.3% |

September CPI inflation |

| As expected | |

Food, housing and transport pulled CPI lower

The 1.3% year-on-year CPI increase in September was a bit above our 1.1% estimate but in line with the consensus estimate. High base-year effects in play in three key CPI components – food, housing and transport (with a combined 83% weight in the CPI basket) – weighed on the headline index. Inflation in the remaining components either slowed or was unchanged. Core CPI, stripping out food and fuel prices, remained close to the 0.8% level it has hovered around since May.

The 1.1% year-to-date rate of inflation is close to the low-end of the BoT’s policy target of 1-4%. While we leave our full-year 2018 average inflation forecast at 1.1%, we do not see inflation in the next year being far off from this level either. As such, the central bank’s desire to begin normalising interest rates in order to create some policy space for the future will continue to be a desire than becoming a reality. Meanwhile, GDP growth looks set to slip below the 4% mark in the coming quarters and remain on a tapering trend due to weak external demand.

Where CPI inflation is heading in 2019?

A prolonged period of stable central bank policy

We haven’t been among the BoT policy hawks with our long-held (for over a year now) view of no change to BoT policy through the end of this year. Now we are even re-considering a view of a gradual normalisation underlined by our current forecast of a 25bp rate hike in 2Q19 and another similar move in 1Q20. Even so, we don’t see this nudging the THB from its Asian outperformer status, which the currency continues to enjoy on the back of its persistently large current account surplus.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

1 October 2018

Good MornING Asia - 2 October 2018 This bundle contains 4 Articles