Thailand: Inflation continues to drift away from target

With inflation further undershooting its target, the BoT should move to cut rates sooner rather than later. We maintain our view of a 25bp policy rate cut before the year-end

| 0.3% |

September inflation |

| Lower than expected | |

Another downside surprise

Thailand’s consumer price index (CPI) rose by 0.3% year-on-year in September, slower than consensus of 0.4% rise and the slowest gain in eight months. Our forecast of unchanged inflation rate at August’s 0.5% rested on expectations of supply shocks to food prices from heavy rains and floods in the northeast parts of the country being countered by persistently weak transport component. In the event both these CPI components posted slower gains with the added drag from deeper decline in clothing component.

The slowdown in core inflation to 0.4% in September from 0.5% in August was in line with our forecast, however.

ING forecast downgrade

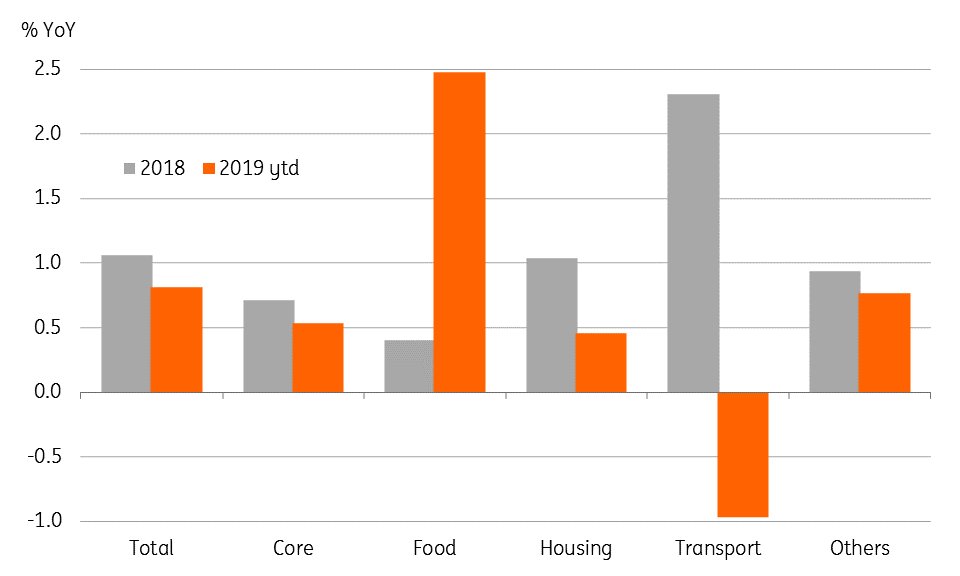

Inflation has been drifting away from the Bank of Thailand’s 1-4% medium-term target range for the monetary policy operation. And this is not just about the monthly rate. The year-to-date average inflation rate of 0.8% YoY is also under the BoT's target and down from 1.1% a year ago.

The base year effect is turning favourable and this could result in some pick-up in the annual inflation rate over the rest of the year, possibly taking it up to the 1% low end of the BoT’s target by December. However, with persistently weak domestic spending and absent any severe supply shocks to food or fuel prices, it’s hard to imagine it staying in the target range on a consistent basis.

We are revising our inflation forecast for 2019 to 0.8% from 1.0% and for 2020 to 1.0% from 1.4%.

There is no inflation outside food prices

Cut rates sooner rather than later

Increasingly weak activity data supports the call for more policy accommodation from the central bank. Less than a week ago at the routine monetary policy meeting, the BoT downgraded its growth and inflation outlook but stopped short of cutting the policy rate.

Central bank is ready to review the key rate and use policy tools if economic situation veers away from forecast -- BoT Governor Veerathai

We see no merit in the BoT delaying what looks to us to be an inevitable and much-needed rate cut. If nothing else, it might help to rein in the currency appreciation that the authorities are increasingly concerned about. There was some relief on that front in September when the THB turned out to be an Asian underperformer, though that may not become a trend against a backdrop of a large current account surplus. We maintain our view of a 25bp policy rate cut to 1.25% before the yearend.

Download

Download article

1 October 2019

Good MornING Asia - 2 October 2019 This bundle contains 3 Articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).