Thailand: Has inflation bottomed?

We don’t think the price gains seen in June will be durable enough to bring inflation back into positive territory for the rest of the year

| -1.6% |

June CPI inflation |

| Better than expected | |

An upside inflation surprise

Thailand’s consumer price inflation remained in negative territory for a fourth straight month in June, though a rate of -1.6% year-on-year was a significant recovery from the post-global financial crisis low of -3.4% reached in May. The consensus median was for a modest improvement to -3.1% (ING forecast was -3.3%).

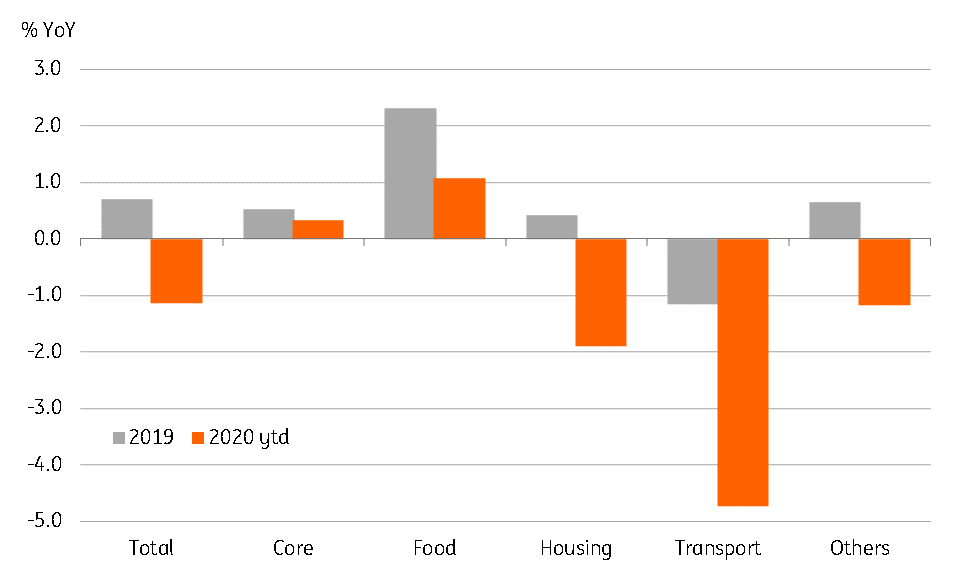

The relaxation of the Covid-19 lockdown should have brought back some pent-up demand. However, a sharp recovery in inflation appears to be largely a supply-side phenomenon instead, explained by the surge in utilities and transport prices. Utilities and transport components suffered the most at the start of the lockdown with month-on-month plunges of 21% and 4.3%, respectively in April. Both returned with 24% and 2.6% surges in June as the lockdown ended.

Inflation in most other CPI components was little changed from May. And so was core inflation, which remained close to zero, indicating a lack of demand-side pull on prices.

What's driving CPI inflation?

Has inflation bottomed?

The economy is facing a continued downdrift ahead as the key drivers of exports and tourism remain missing in action, and weakness from external sectors has broadened out to domestic demand. Consumer confidence has been at a record low and the threat of rising job losses offers little hope of it coming back to the pre-Covid level anytime soon.

For now, inflation appears to have bottomed. But we don’t think the extent of price gains observed in June will be durable enough to bring inflation back into positive territory in the rest of the year. However, it is enough to provide a boost to our annual inflation forecast. If it does not worsen from here, we see inflation staying near June's pace for the rest of 2020. We revise our annual inflation forecast to -1.5% from -2.3%.

While persistent negative inflation calls for further monetary easing, there isn’t any easing space left for the Bank of Thailand in this cycle.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

3 July 2020

Good MornING Asia - 6 July 2020 This bundle contains 4 Articles