Thailand: Expect no monetary policy support for baht

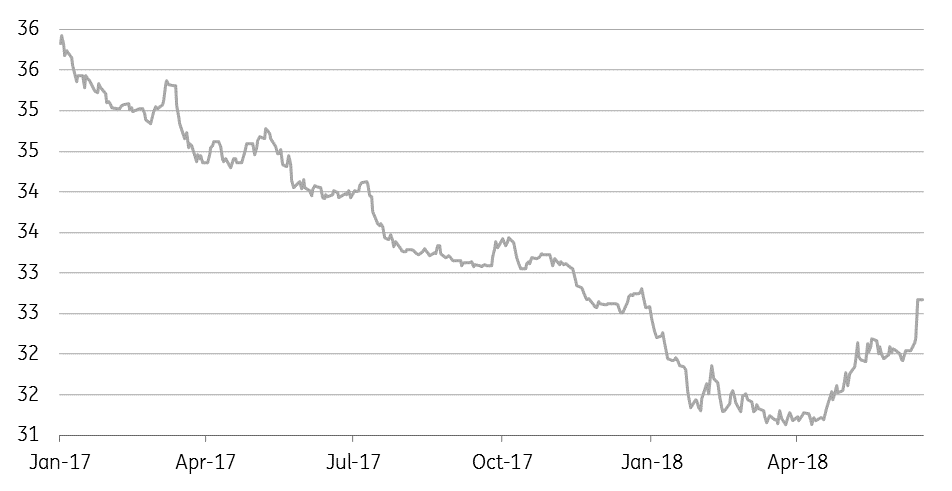

The lack of interest rate policy support and deteriorating external trade balance suggest that the Thai baht will remain under weakening pressure. We revise our USD/THB forecast for end-2018 to 33.8 from 32.3

A big question for the markets this week is whether the Bank of Thailand tweaks monetary policy at the forthcoming meeting on Wednesday (20 June) to support the Thai baht (THB). In its biggest single-day depreciation in more than a decade, the THB weakened by 1.4% to 32.7 against the USD last Friday. This takes the pair through our 32.30 forecast for the end of this year, which we now revise higher to 33.8 on our view that a continued deterioration in the external trade balance will be the key negative for the currency.

THB performance isn't weak enough to justify policy action

A counter question is whether the latest USD/THB spike has been strong enough to provoke a response from the central bank, which has been vocal about the need for continued accommodative monetary policy to support growth and less worried about a weak currency. We don’t think so. An accelerated THB depreciation in recent months has reversed the appreciation early in the year and maybe a bit more. But it’s still an Asian outperformer; the 0.2% year-to-date depreciation compares with big losers such as the Philippines, Indonesia and India- countries whose central banks moved to tighten recently. We don’t think THB performance is weak enough to justify central bank action yet.

USD/THB moving higher

Growth-inflation dynamic warrants a policy status quo

Among other monetary policy drivers, Thailand’s GDP growth has been firm – 4.8% year-on-year in the first quarter of this year was the fastest in five years. And inflation has been benign despite a spike to 1.5% year on year in May from 1.1% in the previous month. This growth-inflation mix provides no compelling reason for a change to policy while central bankers have recently intensified rhetoric for a prolonged period of monetary accommodation. Hence the unanimous consensus behind an on-hold BoT policy decision this week.

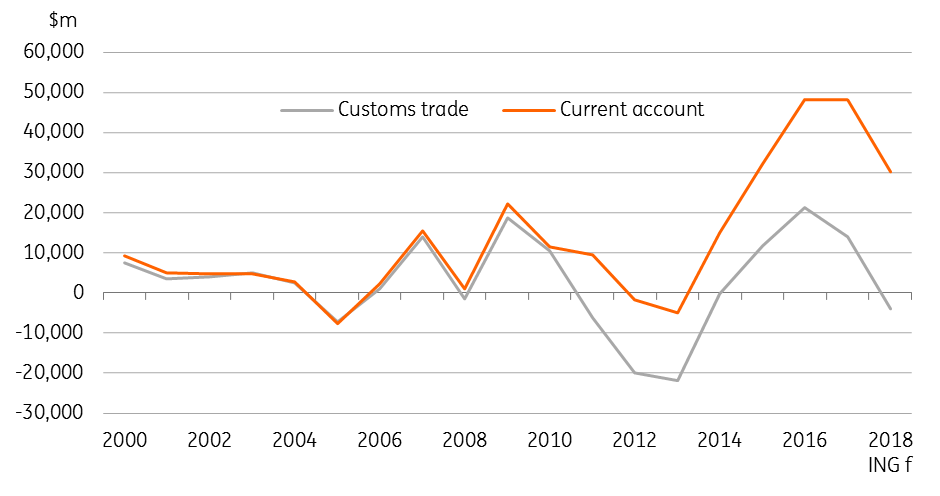

Deteriorating external trade surplus is the main negative for the currency

The THB derived its strength last year and early this year from large external trade and current account surpluses. But that support is now fading. The customs-basis foreign trade data for the month of May due later this week (21 June) is expected to reinforce this view. The consensus forecast of an $88 million trade deficit in May will be a big improvement from a $1.3 billion deficit in April. However, this also implies a roughly $4.5 billion negative swing in the cumulative five-month trade balance from a year ago.

With global trade wars weighing on exports and rising oil prices boosting imports, the narrowing trade surplus trend is here to stay. As we see it, 2018 is shaping up to be the first year with an annual trade deficit – to the tune of $4-5 billion – after three years of surpluses ($13.9 billion surplus in 2017). We expect this to be associated with a near-halving of the current account surplus in relation to GDP to about 5.5% this year from 10.6% in the last, which is a key negative for the THB.

We retain our forecast for the BoT to remain on hold this year. The lack of interest rate policy support and a deteriorating external trade balance suggest that the Thai baht will remain under weakening pressure for the rest of the year. We revise our USD/THB forecast for end-2018 to 33.8 from 32.3.

Narrowing external surpluses

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

18 June 2018

Good MornING Asia - 19 June 2018 This bundle contains 3 Articles