Thailand: Economy isn’t screaming out for tighter policy, yet

But the central bank (BoT) has already started thinking about the timing of policy normalisation. Although we aren’t expecting any change to BoT policy this year, the currency's (THB) position as one of Asia's outperformers since July has prompted a revision of our year-end USD/THB forecast to 33.5 from 35.0

Two things setting a mixed tone for THB

First, the trade data showed a significant negative swing in the trade balance to a deficit of $516 million in July from a $1.6 billion surplus in the previous month. This came amid steady trade growth; export growth of 8.3% year-on-year and import growth of 10.5%, both little-changed from their pace in June. The cumulative trade balance of a $2.9 billion surplus in the first seven months of the year compares with a $7.5 billion surplus a year ago.

The trade surplus is on track to narrow in 2018 for a second straight year. The annual surplus narrowed by $6 billion year on year in 2017 to $15 billion. At the year-to-date pace, we anticipate an $8-9 billion full-year narrowing in 2018, with the potential escalation of a global trade war also boding ill for exports and the trade balance in the rest of the year. This is negative for the Thai baht.

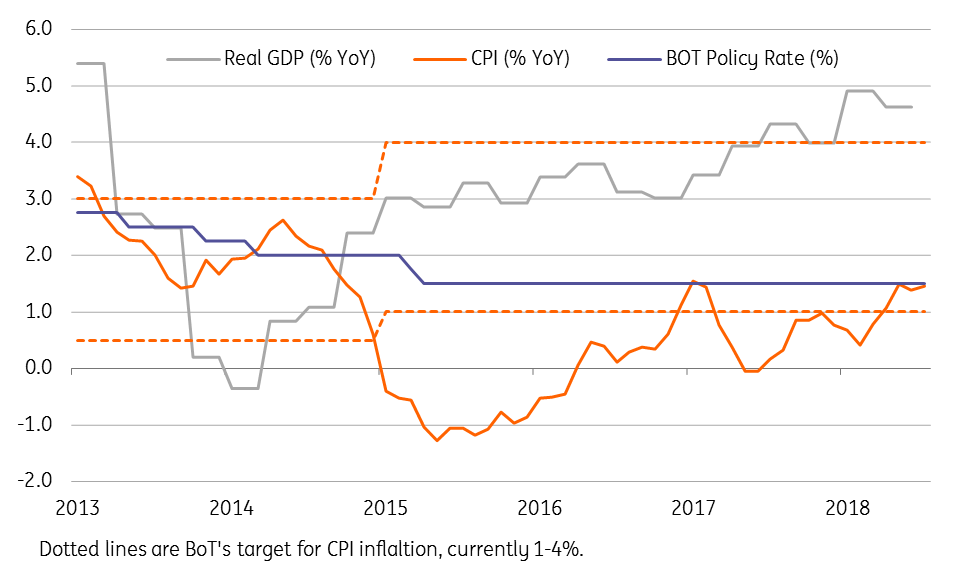

Second, the Bank of Thailand’s minutes of the policy meeting held earlier this month revealed that policymakers pondered over the timing for monetary policy normalisation. However, the timing depends on continued economic growth and inflation ‘firmly’ in the target range of 1-4%. In his response to better-than-expected 2Q18 GDP growth earlier this week, BoT Governor Veerathai Santiprabhob signalled the unwinding of an 'extremely accommodative stance'. This has set the positive tone for the THB.

We need to look at policy space in the future, we need to have enough bullets in hand - BoT Governor Veerathai

However, the central bank’s optimism on growth and inflation remains at risk. Growth eased to 4.6% in 2Q18 from a five-year high 4.9% in 1Q18. The high base effect together with still-weak domestic demand and the global trade war could push it below 4% in the second half of the year, imparting a downside risk to the BoT’s 4.4% forecast for 2018. And absent a food or oil price shock, inflation is likely to slow below the BoT target in coming months.

Economy isn’t screaming for tighter policy

Unless it’s simply to create policy space for the future or to prevent the currency from weakening, the economy isn’t screaming for monetary tightening just yet. We maintain our view that the BoT will keep policy on hold for the rest of the year. We need to see a significant shift in consensus within the BoT policy board in favour of tightening, from the 6-1 vote for no change at the last meeting, before revising our forecast.

Our view of the THB depreciating to 35 against the USD by end-2018 assumed a continued narrowing of the trade surplus and potential escalation of the US-China trade war weighing on the currency. However, the THB has returned to be among Asian outperformers since July, from the worst-performer in the second quarter of the year. This together with the fact that the central bank (BoT) is already deliberating tightening, prompts a revision of our USD/THB forecast for a smaller depreciation to 33.5 by the end of the year (spot 32.8).

Growth, Inflation and BoT Policy

Download

Download article

24 August 2018

Good MornING Asia - 24 August 2018 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).