Thailand: Current surplus beats estimates

Authorities have more reasons to be wary about the ongoing currency strength while exports are poised to falter. That said, we are reviewing our USD/THB forecast for a re-test of the 33-level following a change in Fed policy

| $5.027bn |

December current account surplus |

| Higher than expected | |

Huge current surplus, again

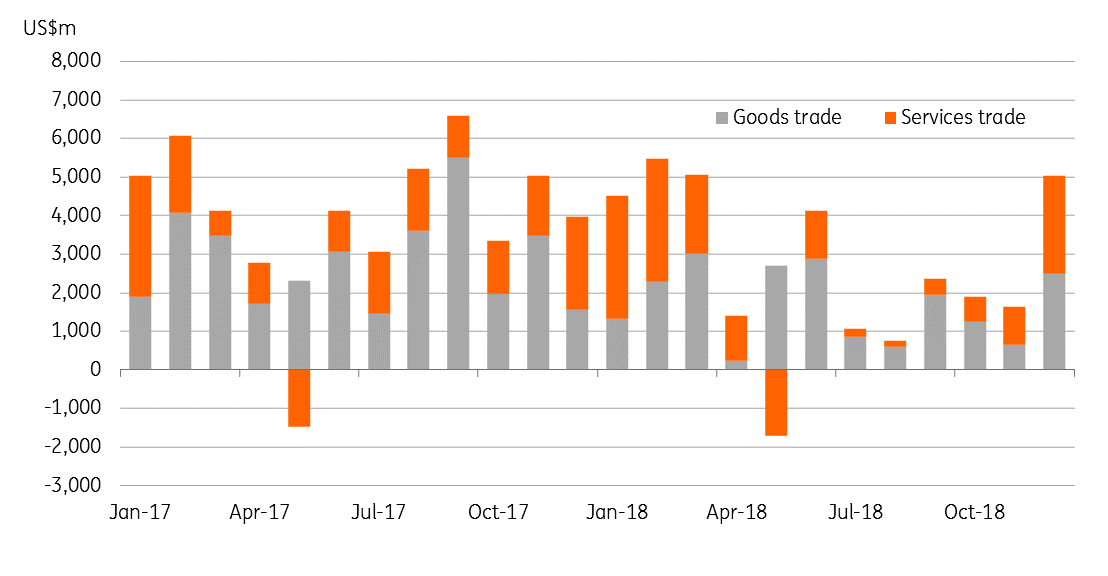

Thailand’s balance of payments data for December today showed the current account surplus bouncing to over $5 billion in the month from $1.6 billion in November. This was way above the consensus of $3.5 billion and our estimate of a $3.9 billion surplus. We knew from the positive swing in the customs-basis trade balance- to a surplus in December from a deficit in November- that the goods trade boosted the current surplus. But there was more to it than just that; the seasonal surge in tourism in December appears to have boosted service-related inflows.

However, the overall payments balance swung to a deficit of $182 million in December from a $384 million surplus in the previous month, a sign of capital outflow. Indeed, foreigners were net sellers of both Thai equities and bonds in December.

Monthly current account balance by goods and services trade

Annual surplus narrowed though

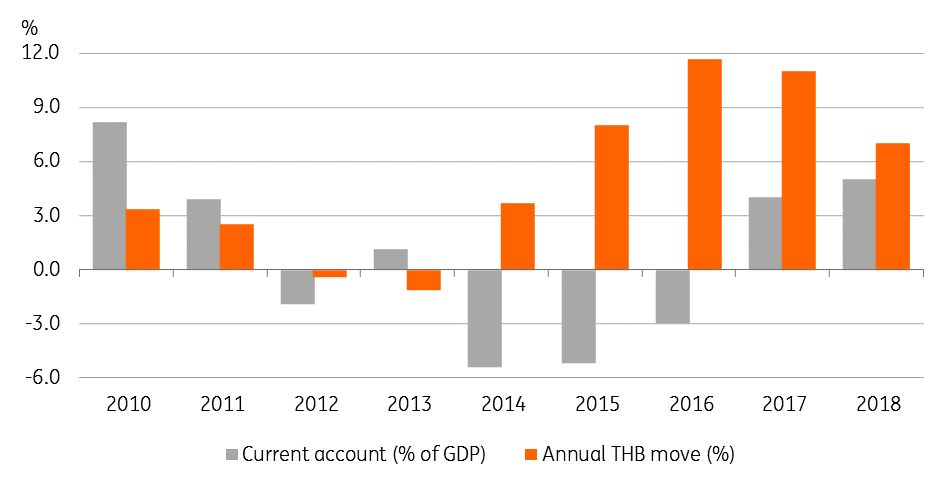

This takes the full-year 2018 current surplus to $34.3 billion or about 7% of GDP by our estimate. This represents a sharp narrowing from 11% of GDP in the previous two years. Weak global demand and an increase in trade protectionism will work to narrow the current surplus further into 2019. The commerce ministry’s projection of 8% export growth in 2019 seems optimistic (6.7% in 2018). A more reliable view by the Thai National Shippers’ Council is 5% growth, whereas we think a low single-digit figure should not be ruled out.

However, domestic demand hasn’t been particularly strong either, which counters the export weakness. As such, we aren’t expecting a significant correction in the external imbalance, with the forecast of a 2019 current surplus coming in at about 5% of GDP (Bloomberg consensus 6.5%).

More reasons to be worried about strong currency

The relatively large surplus among Asian countries has been the backbone of the Thai baht's ongoing outperformance since 2017. The currency retains that spot coming into 2019.

We think the authorities now have more reason to worry about sustained currency strength as export strength is faltering. The government has voiced concern against the strong currency. We expect some weakness to build in the run-up to general elections scheduled for March this year, which is what underlines our view of the USD/THB rate rising to 33 within the current quarter and lingering above this level until the political dust settles.

That said, we are reviewing our forecast in view of the year-to-date performance and likelihood of a softer US dollar following a dovish turn in the Federal Reserve's policy. But the question is, will this move the Bank of Thailand (BoT) to undo the 25 basis point rate hike it implemented in December. We don’t think so, though we wouldn’t be surprised if the central bank moves in that direction later in the year. Look out for some clues from the BoT policy statement next week (6 February).

Large current surplus, strong currency

Download

Download article

1 February 2019

Good MornING Asia - 1 February 2019 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).