Thailand: Current surplus beats estimates

Authorities have more reasons to be wary about the ongoing currency strength while exports are poised to falter. That said, we are reviewing our USD/THB forecast for a re-test of the 33-level following a change in Fed policy

| $5.027bn |

December current account surplus |

| Higher than expected | |

Huge current surplus, again

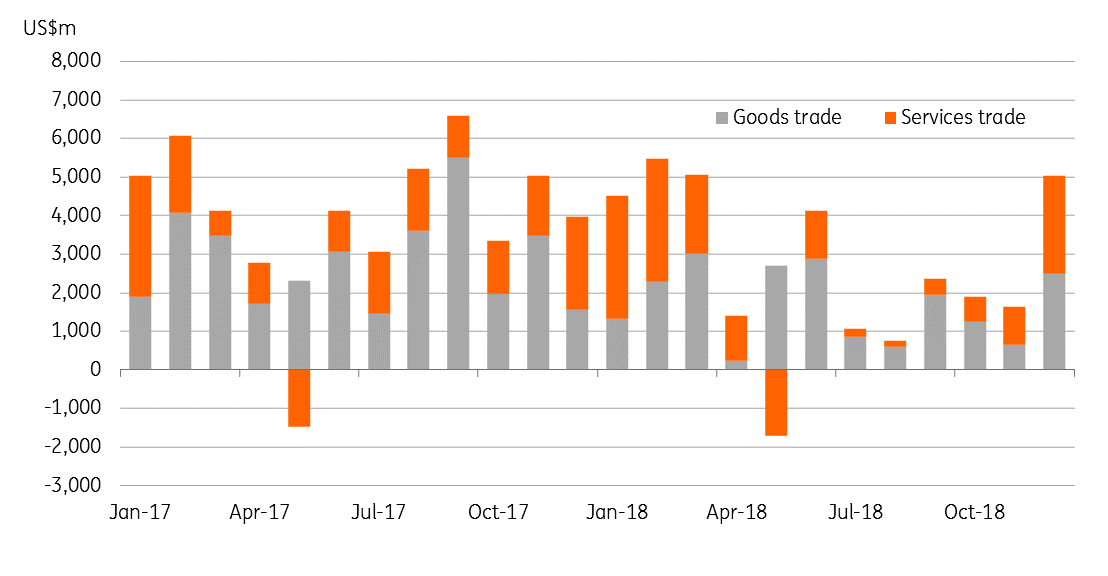

Thailand’s balance of payments data for December today showed the current account surplus bouncing to over $5 billion in the month from $1.6 billion in November. This was way above the consensus of $3.5 billion and our estimate of a $3.9 billion surplus. We knew from the positive swing in the customs-basis trade balance- to a surplus in December from a deficit in November- that the goods trade boosted the current surplus. But there was more to it than just that; the seasonal surge in tourism in December appears to have boosted service-related inflows.

However, the overall payments balance swung to a deficit of $182 million in December from a $384 million surplus in the previous month, a sign of capital outflow. Indeed, foreigners were net sellers of both Thai equities and bonds in December.

Monthly current account balance by goods and services trade

Annual surplus narrowed though

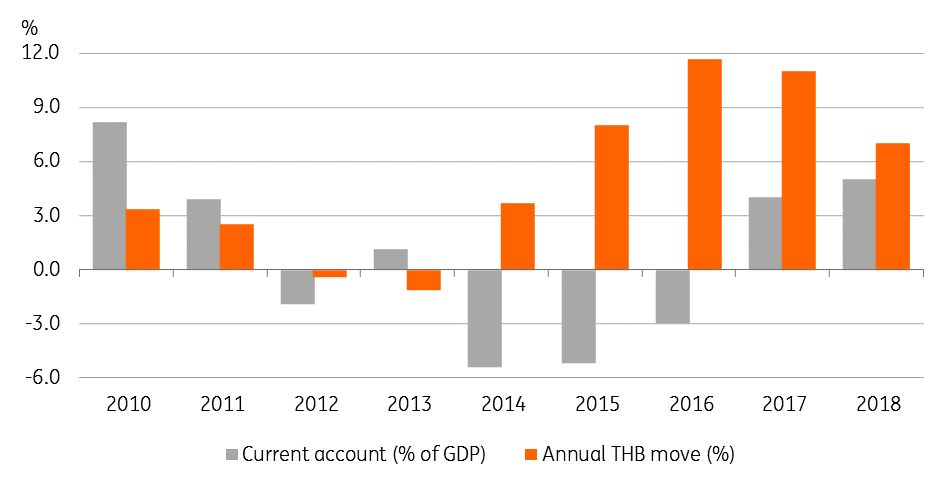

This takes the full-year 2018 current surplus to $34.3 billion or about 7% of GDP by our estimate. This represents a sharp narrowing from 11% of GDP in the previous two years. Weak global demand and an increase in trade protectionism will work to narrow the current surplus further into 2019. The commerce ministry’s projection of 8% export growth in 2019 seems optimistic (6.7% in 2018). A more reliable view by the Thai National Shippers’ Council is 5% growth, whereas we think a low single-digit figure should not be ruled out.

However, domestic demand hasn’t been particularly strong either, which counters the export weakness. As such, we aren’t expecting a significant correction in the external imbalance, with the forecast of a 2019 current surplus coming in at about 5% of GDP (Bloomberg consensus 6.5%).

More reasons to be worried about strong currency

The relatively large surplus among Asian countries has been the backbone of the Thai baht's ongoing outperformance since 2017. The currency retains that spot coming into 2019.

We think the authorities now have more reason to worry about sustained currency strength as export strength is faltering. The government has voiced concern against the strong currency. We expect some weakness to build in the run-up to general elections scheduled for March this year, which is what underlines our view of the USD/THB rate rising to 33 within the current quarter and lingering above this level until the political dust settles.

That said, we are reviewing our forecast in view of the year-to-date performance and likelihood of a softer US dollar following a dovish turn in the Federal Reserve's policy. But the question is, will this move the Bank of Thailand (BoT) to undo the 25 basis point rate hike it implemented in December. We don’t think so, though we wouldn’t be surprised if the central bank moves in that direction later in the year. Look out for some clues from the BoT policy statement next week (6 February).

Large current surplus, strong currency

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

31 January 2019

Good MornING Asia - 1 February 2019 This bundle contains 5 Articles