Thailand: Baht’s reversal of fortune

We view 31-33 as a new higher trading range for the USD/THB rate in 2020 and we see it trading close to the top end of this range over the next three months. We are also downgrading our current account and GDP growth forecasts for 2020

From Asia’s best to worst

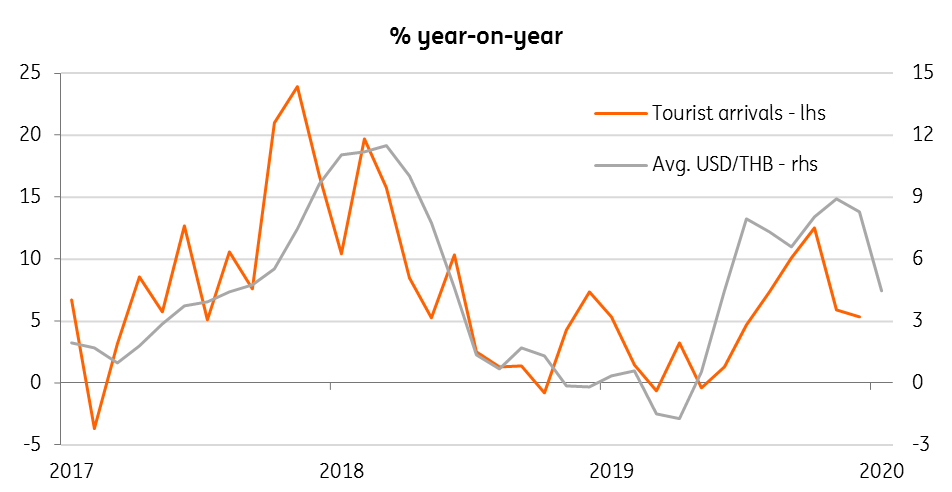

The Thai baht’s (THB) 3.7% depreciation against the US dollar in January represents a reversal of fortune for a currency which had been one of the top performers in the emerging markets in recent years. The 8.6% appreciation in 2019 was the highest among Asian currencies and the second-largest in the emerging market universe (after the Russian rouble). The performance so far this year puts it at the bottom of the pack.

The USD/THB rate appears to have moved to a new higher trading range of 31-33, up from the 30-31 range held in the second half of 2019. We see the pair trading close to the top end of the new range within the next three months. We should see some retracement once the threat from the coronavirus diminishes, something that may not happen until later this year. We have revised our end-2020 view for the pair to 32.50 from 30.5 earlier.

What’s changed?

The year started with both the Finance Ministry and the Bank of Thailand (BoT) intensifying their efforts to curb the currency's appreciation. A strong currency is bad for the country's export recovery and also weighs on the tourism sector, which now faces an added threat from the coronavirus. Up until now, tourism was the only really good sector in an otherwise sluggish economy.

Tourism makes up a fifth of the economy and visitors from China alone account for about a quarter of total tourism receipts. A sharp fall in tourism spending will undoubtedly put a big dent in the current account surplus, which has been the main reason behind the Thai baht's appreciation in recent years. Data released today on the balance of payments in December showed the annual current account surplus at $37 billion in 2019 (about 7% of GDP), up from around $28 billion (5.6% of GDP) the year before.

Tourist arrivals drive THB

Depressed growth outlook

The knock-on effect of the ban on Chinese tourists alone could reduce the current surplus this year to half the level of last year; receipts from Chinese tourists in 2019 are estimated at $18 billion, out of total tourism receipts of $64 billion. Moreover, the impact isn’t going to be limited to Chinese tourists, nor is it going to be short-lived. This could mean even more damage to the current account, which will put sustained pressure on the Thai baht throughout this year.

We are cutting our current account forecast for 2020 to 3.5% of GDP from 5.6% earlier. This, together with broader demand weakness, is expected to hold back any recovery in GDP growth this year from the five-year low of about 2.3% estimated for 2019. Hence, we are also cutting our 2020 growth forecast to 2.3% from 3.0%.

The possibility of an extended central bank easing cycle is another factor that could weigh on the currency this year. We expect a 25 basis point BoT policy rate cut to 1.00% at the meeting next week (5 February).

Narrower current account surplus in 2020

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

31 January 2020

Good MornING Asia - 3 February 2020 This bundle contains 3 Articles