Thailand: A rate cut or two - what good will it do?

The Bank of Thailand remains on an easing course, probably cutting rates again this week and setting the USD/THB on a path towards 36, a level not seen since the end of 2016

| 0.5% |

ING view of BoT policy rate after meeting this weeka 25 basis point cut |

Will the BoT cut again this week?

The Bank of Thailand cut the policy rate by 25 basis points to 0.75% in an emergency move late Friday, just days ahead of the scheduled policy meeting on Wednesday, which will still go ahead. The small reduction illustrates that the central bank remains reluctant to ease compared to its Asian peers. The move potentially reduces the odds of another cut this week but even if the central bank does deliver one more quarter-point cut, we think a single half-point move would have been a more effective sentiment booster. That said, we continue to expect a rate cut at the forthcoming meeting.

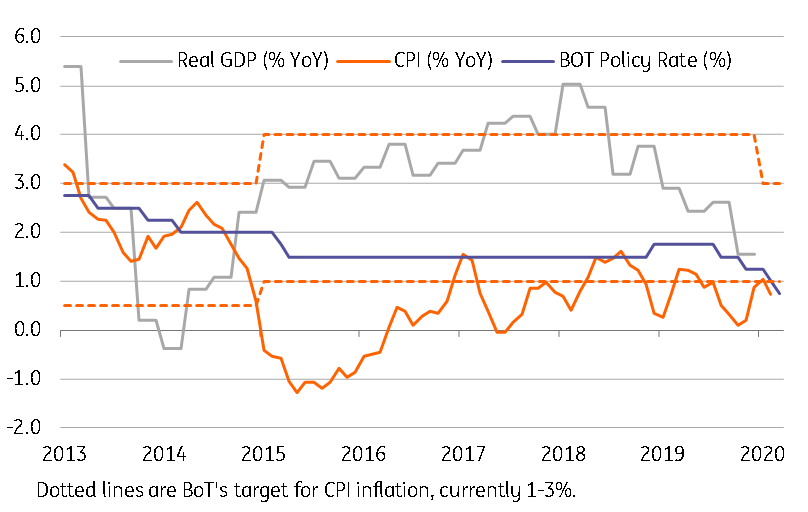

With central banks around the world pushing rates towards zero, we see no reason why the BoT won't do the same, especially as the still relatively large current account surplus continues to be the key support for the currency (Thai baht or THB) and inflation hovers below the BoT’s 1-3% policy goal.

Unfortunately, even if the policy rate falls further from here, we are sceptical about the good it will do to an economy plagued by perennial weak domestic demand, and now added hits from external factors.

Growth, inflation and Bank of Thailand policy

What’s happening to the Thai baht?

The continued sell-off today saw USD/THB briefly trade above what we considered to be a new, higher trading range of 31-33 for this year. But it drifted back into that range, with the spot level of 32.94 as of this writing.

Still, a 9% year-to-date depreciation has wiped out all of the gains that the THB had made against the US dollar in 2019. At this rate, a re-test of the December 2016 high of 36 may not seem to be far off for the pair. It will probably be within the next three months. Absent any consolidation from here, and if the BoT cuts rates again this week, we would be looking to revise our USD/THB view accordingly from the current forecast of 33.30 pencilled in for end-2Q20.

THB per USD

Some positive trade figures

Foreign trade posted a $3.9 billion surplus in February, the highest surplus in a year following a one-off deficit of $1.6 billion in January. The strong surplus came despite a 4.5% year-on-year fall in exports, a retracement from 3.3% growth in January, while imports improved to a fall of just 4.3% from a year ago compared to the 7.9% fall seen in January.

Agriculture and manufacturing remained the main drivers of export weakness while strong gains were seen in exports of rubber, electronics, vehicles and parts, and jewellery. Fuel was the main drag on imports due to falling global oil prices, though we saw across-the-board weakness in capital goods, raw materials and consumer goods imports.

This puts export growth in the first two months of the year at -0.8% year-on-year, with imports at -6.3%. The cumulative trade surplus of $2.3 billion was a significant widening from a surplus of $112 million a year ago.

But the worse is yet to come

Trade growth has yet to capture the impact of the Covid-19 virus, which only began its global spread in late February. Just like every other economy in the world, Thailand is bracing for a significant trade downturn throughout the rest of the year as the global spread of the virus dents demand. As such, a large surplus in February could be a transitory blip.

It doesn’t stop at trade for the economy. Thailand is heavily dependent on tourism and won’t be spared from a record plunge in visitors. All this will mean a big dent to the current account surplus as well as to GDP growth this year. We continue to see a near-halving of the current surplus in 2020 from about 7% of GDP. And, we have just cut our growth forecast for the year to -0.5% from 1.0% (2.4% growth in 2019), making it the worst year for the economy since the 2008-09 global financial crisis.

Near-halving of current account surplus in 2020

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

23 March 2020

Good MornING Asia - 24 March 2020 This bundle contains 5 Articles