Thai economy shrinks 12% in 2Q20

As key economic drivers of exports and tourism continue to be missing in action, the negative GDP growth trend is here to stay for the rest of the year, and maybe beyond

Steepest GDP fall since Asian crisis

Data on Thailand’s GDP in 2Q20 showed a 12.2% year-on-year and 9.7% quarter-on-quarter (seasonally adjusted) contraction in the economy in the last quarter. The result was slightly better than our -12.8% YoY forecast and the consensus of -13.0% for the period.

It was an outperformance compared to some of its ASEAN neighbours – Singapore -13.2%, Malaysia – 17.1% and Philippines -16.5%. Yet, it was the steepest GDP contraction since the Asian crisis in 1998, just as in the rest of the region. It was also the deepest recession since the Asian crisis, as reflected by the third straight QoQ GDP fall.

As elsewhere, the Covid-19 restrictions on activity dealt a significant blow to domestic spending, while the pandemic brought key economic drivers of exports and tourism to a grinding halt.

Steepest GDP contraction since the 1998 Asian crisis

What caused such a big contraction?

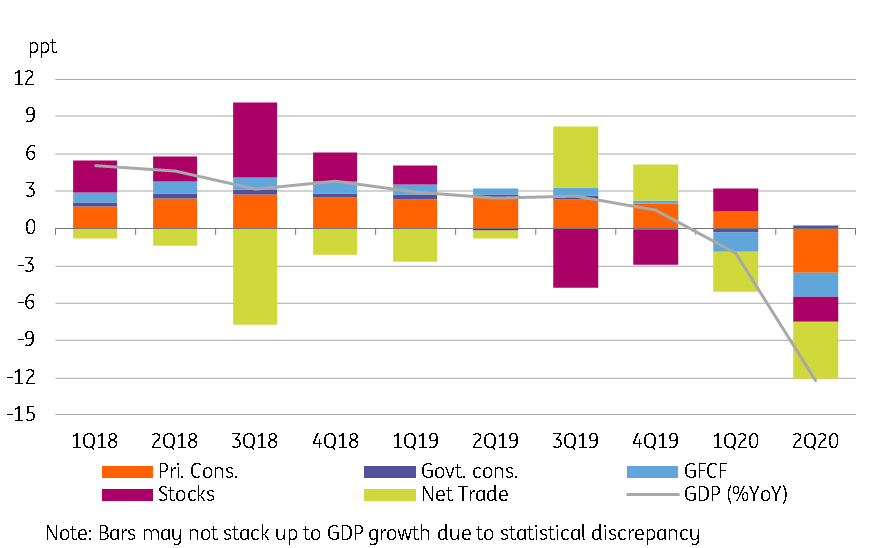

Private consumption was down 6.6% YoY and fixed capital formation down 8.0% YoY. The Covid-19 stimulus helped to spur government consumption growth (+1.4% from -2.8% in 1Q), with total stimulus measures reaching 14.5% of GDP, nearly half of which was on-budget, real spending.

Goods and services exports suffered the biggest blow, falling by 28.3% YoY and imports weren’t far behind with -23.3%, keeping net trade as a drag on the headline GDP growth rate for a second straight quarter (see chart).

Exceptionally weak exports made manufacturing the biggest source of the GDP slowdown from the supply side, with a 14.4% YoY contraction of output in the last quarter. It wasn’t just manufacturing. Utilities, construction and services also posted a double-digit contraction. Huge declines in accommodation (-50%) and transport services (-39%) were the obvious fallouts of standstill tourism.

Expenditure-side sources of GDP growth

The outlook isn’t any more promising

The worst of the economic slump brought on by Covid-19 might be over. But with exports and tourism still missing in action, the negative GDP growth trend is here to stay for the rest of the year, and perhaps well into 2021. And, as if Covid-19 troubles aren’t enough for the economy, political risk is brewing with intensifying anti-government student protests recently, which will weigh on the economic recovery in the rest of the year.

We see GDP shrinking by 7.6% YoY in the current quarter and by 4.8% in the fourth quarter for an average annual fall of 6.6% this year, unchanged from before today’s 2Q data. That said, we don’t anticipate any more macro policy boost ahead to aid the recovery. The fiscal stimulus has almost maxed out and the central bank monetary easing via policy rate cuts has reached its limit.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

17 August 2020

Good MornING Asia - 18 August 2020 This bundle contains 2 Articles