Temporary relief on US trade triggers a dollar correction

The fact that trade policy did not feature prominently in President Donald Trump’s inauguration speech has triggered a decent correction lower in the dollar. We cannot rule out a near-term extension when US financial markets fully reopen on Tuesday, but this looks more like a temporary setback for dollar bulls

No economic emergencies just yet

President Trump declared two emergencies today: one on the southern border to address his immigration agenda and one for national energy, which will allow more US drilling of oil and gas. The latter is marketed as a means of lowering US inflation. There was no national emergency today in the economy – a declaration that some had seen would go hand-in-hand with Day One trade tariffs.

And consistent with a Wall Street Journal article which had hit the dollar earlier in the day, there were no Day One tariffs.

What we did get on tariffs were:

- Trump’s inauguration speech, highlighting that an External Revenue Service (ERS) would be established to collect ‘massive’ tariffs from trading partners

- and then a Bloomberg article suggesting there is a factsheet circulating in government circles on trade.

We have not seen this yet, but the suggestion is that this factsheet points to a more measured approach.

Instead of new tariffs on China, and consistent with Trump’s call with President Xi last Friday, the report suggested that the new administration would investigate unfair trade practices globally and determine to what degree China had delivered on its commitments to the Phase One bilateral trade deal agreed in 2020.

Clearly, the above is far less severe than the prospect of a 10-20% universal tariff, a 25% tariff on Mexico and Canada, and a 60% tariff on China - threats that appeared on the campaign trail. It is far too soon to declare that the worst of the tariff threat has passed. But certainly, Day One has gone much better for international trade than most had feared.

Additionally, the Bloomberg report suggested that federal agencies were tasked with monitoring whether trading partners were manipulating currencies for trade gain. That monitoring is already undertaken on a semi-annual basis by the US Treasury. And countries on that Monitoring List now are China, Korea, Singapore, Taiwan, Japan, Vietnam and Germany. At the heart of the designation of a currency manipulator is whether a country is buying FX to stop its currency from appreciating. The thing is that many of the countries (especially in Asia) are using direct and indirect methods to sell FX and stop their currencies from depreciating.

We would not rule out some, let’s say, ‘arbitrary’ use of the currency manipulator tag during this new administration. But suffice it to say the key criteria are not being hit now.

The dollar can probably correct a little further

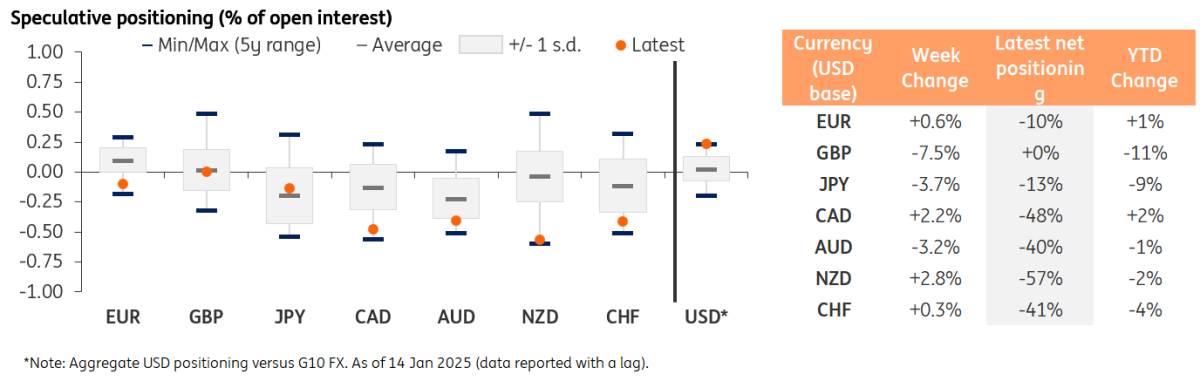

The lack of tariffs today has sparked anywhere from a 0.5% to 1.5% sell-off in the dollar against the G10 currencies. So far, the out-performer has been the New Zealand dollar, the biggest loser over the last three months on the country's big twin deficits. We’re a little surprised that EUR/USD has done so well late Monday(+ 1.5%), but that probably reflects positioning too; short EUR/USD has been a conviction call for many in the G10 space. Take a look at the chart below for the latest speculative positioning data.

We have also seen decent recoveries in emerging market currencies, particularly the Chinese renminbi. Here, USD/CNH is off 0.75% and could correct further in Asia as the US bond market reopens and China trade risk is temporarily re-appraised. You have to ask whether we could see US yields on less aggressive-than-expected tariffs.

Looking ahead, the EUR/USD bounce has stalled at the early January high of 1.0435. We cannot rule out a brief spike to the 1.05/1.06 area if the newsflow over the next 24/48 hours confirms this more measured approach to trade.

Yet we see no reason to change our quarterly forecast for EUR/USD, which foresees losses through the year to 1.01.

What has not surprised the market on Day One of Trump's presidency is volatility. One-week EUR/USD traded volatility has been priced up to 10% around inauguration day. And one-week realised volatility is delivering at 10% as well. More social media-driven, headline-grabbing policymaking is likely to keep FX volatility elevated, at least in the early days.

Speculative short FX positioning against the dollar is stretched

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article