Telecom Outlook: What’s in store for the sector in 2022?

In this series on the telecommunications sector in 2022, we look at the build-out of 5G and fibre networks, mergers in the telecom and mobile tower industries, cybersecurity trends, and the growth of mobile payments

What will 2022 bring to the telecom industry? Digital connectivity is frequently in the news nowadays. Because of strong developments in the industry, but also because it is a key policy area of the European Commission (EC). We believe the main themes of 2022 will be better connectivity as well as mergers and acquisitions (M&A). We, therefore, write in this outlook about the build-out of 5G and fibre networks and rural connectivity. We will also discuss M&A in the telecom sector and specifically about M&A developments in the mobile tower sector. Finally, in addition to the main trends, we will discuss cybersecurity risks, as well as developments in the mobile payments sector.

European agenda for digital and data strategies

Let’s first discuss the subjects that will be discussed by the European policy-making bodies this year. The European Commission will execute its agenda for digital and data strategies in Europe. The EC defines two targets for our Digital Decade: Gigabit broadband for all households and 5G in populated areas, which should be reached by 2030. It has also published proposals for the Digital Services Act (DSA), the Digital Markets Act (DMA), the Data Governance Act (DGA) and the Regulation on a European approach for Artificial Intelligence (AIR). These proposals will likely be discussed this year with the European Council and European Parliament to become legislation. Many will welcome these proposals if they reduce the dominance of the large technology platforms and create a level playing field in Europe. Hopefully, the competitive position of telecom companies will improve on a relative basis. But more importantly, we hope consumers will benefit from better privacy regulation, as well as fairer competition on platforms that should benefit consumer choice.

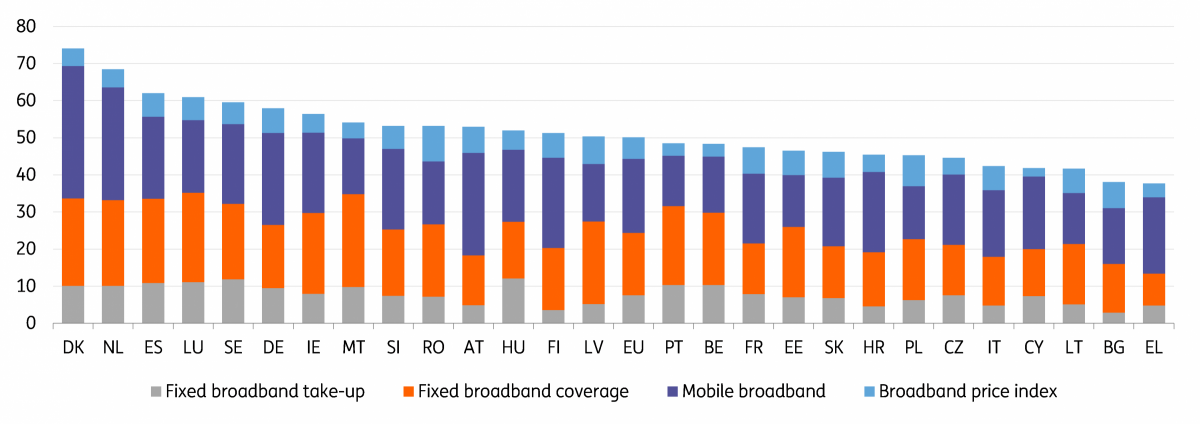

This year will also see the likely start of substantial investments from the European Recovery Fund (ERF), aimed at accelerating the digital transition. The European Commission has measured digital competitiveness in EU member states through the DESI index since 2014. The DESI index tracks digital competitiveness with respect to human capital, broadband connectivity, the integration of digital technology and digital public services. In the figure below, the broadband connectivity ranking from the European Commission can be found. It is a sub-index from the DESI index. We can see that Denmark, the Netherlands and Spain are well-connected, while, when looking at the larger countries, Poland and Italy have some work to do. A description of the methodology can be found on their website here.

The European Resilience and Recovery Plan can help with improved broadband connectivity in these countries since 20% of expenditure is allocated to the digital transition. Plans have been presented already to invest €13bn in digital connectivity. Also, other European programmes and facilities will help the rollout of broadband networks in Europe. So, broadband connectivity will likely improve across Europe.

Broadband connectivity ranking European Commission

What do we expect to happen in 2022?

A couple of trends will likely continue. 5G is here to stay and we expect that 2022 will be the year when its uses will become more widespread, although there are likely still speed differences across Europe. Mobile operators will need to find good pricing policies for 5G services. The build-out of fibre networks is progressing according to plan, also with the help of EU funds. In this report, we pay special attention to alternative ways to connect in remote areas. The technologies that are discussed in this outlook are Fixed-Wireless Access (fixed broadband connectivity over mobile networks) as well as satellite connectivity. Expect, therefore, that investments in fibre broadband and 5G networks will continue.

The ownership of some telecom operators will likely change, either through M&A or LBOs (leveraged buyouts). The same holds true for the ownership of mobile tower operators. Countries where M&A could take place are the UK, Spain, Italy and France, amongst others.

There are two other trends that are either going to benefit or possibly hurt consumers in 2022. To the possible benefit of consumers is the continuing innovation trend towards mobile banking. We expect financial services to become mobile-centric in 2022, leading to lower costs, more choice, and better ease of use of financial services, also in emerging markets. Better connectivity has the disadvantage that criminals could also profit from it. In 2022 the risk of the disruption of digital services remains high and could become higher, as will be explored in our article on cybersecurity. Nevertheless, providing security services could also provide a business opportunity for telecom operators.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

28 January 2022

Looking forward to looking back This bundle contains 7 Articles