Telecom Outlook: More consolidation expected among mobile towers companies

Expect further consolidation in the European tower sector. It will be especially interesting to see what is going to happen this year with the tower companies of Vodafone, Deutsche Telekom and Orange

Further consolidation expected

Over the last few years, we have witnessed the establishment of several large stand-alone mobile tower companies in Europe. Today, there are quite a few large operators: Cellnex, Inwit, Vantage Towers, TOTEM, American Towers, and GD Towers (Deutsche Funkturm). In 2022, we expect further consolidation and the emergence of a second large operator. We deem Spain and Germany the countries where consolidation is most likely.

There are two catalysts for tower disposals by telecom operators. They need to find a cost-effective way to roll out their 5G network, which requires more towers than previous technologies. Also, most operators need capital to fund the fibre rollout or have shareholders clambering for larger payouts. The proceeds of tower disposals could help with these objectives. Also, most lease contracts today include targets to build new antenna sites. This can be done more easily if it is done for two network operators (or if two tower companies merge) since there is often some natural overlap with respect to existing tower locations, but also regarding new build requirements. Mobile tower operators therefore could help to improve network coverage.

Recent developments

Cellnex has been the European front runner, building out a network of tower companies. It has established market positions in France, Spain, Portugal, Ireland, Poland, Switzerland, Austria, Italy, the Netherlands, Denmark and Sweden, and has announced an intended acquisition in the UK, which ran into regulatory difficulties. Another listed company is Inwit in Italy, the joint venture between Telecom Italia and Vodafone Italy. The listing of Inwit was followed by the listing of Vantage Towers, the former captive tower company of Vodafone. At the start of 2021, American Towers acquired the towers from Telefonica in Spain and Germany. Other large operators in Europe are GD Towers (Deutsche Funkturm) in Germany which is owned by Deutsche Telekom and TOTEM, which is owned by Orange and operates tower infrastructures in France and Spain.

Largest European tower companies

Stand-alone tower operators

There are two main reasons to have stand-alone tower companies. The first is that they can operate more efficiently, especially when the objective is to increase the tenant rate. An example of this can be found in France, where Cellnex will run mobile towers for three telecom operators. This will facilitate the rollout of additional towers across France. More importantly, it will bring cost synergies, because towers could more easily be shared by multiple operators.

The second reason why telecom operators spin out their tower businesses is that financial valuations for telecom infrastructure are very high. Telecom operators could monetise the elevated value of these assets by (partially) selling their tower assets. Also, the tower companies have very easy access to capital. Therefore, a standalone tower operator could expand the tower network more easily. Such an expansion of the network is needed for new 5G services. Recently we have witnessed a lot of tower transactions since the financial argument is compelling, but also because of the aforementioned need for more towers because of the increasing network density.

This marks a difference from the past when many telecom companies were reluctant to share their infrastructure, as they considered their high-quality network to be a key competitive advantage.

Differentiating factors

Not all tower companies are alike. In Europe, there are two so-called independent tower companies, Cellnex and ATC. They provide their services to several telecom operators and are not controlled by telecom operators themselves. This is opposite to TOTEM and GD Towers, which are fully owned by Orange and Deutsche Telekom, respectively. Also, contractual arrangements with the first, anchor client determine the attractiveness to other customers, since the anchor tenant often negotiates the best spot on the mast, leaving a somewhat inferior position to others.

In the case of Inwit, Vodafone Italy and Telecom Italia have the best spots on the towers. This is to the annoyance of Iliad, which has difficulty finding good quality spots on towers to roll out its 5G network. The question of whether former owners retain control in partial tower disposal is a prominent one. If both former owners want to maintain control, two of them can’t merge. One of them must be willing to relinquish control. They could possibly design a shareholder agreement with the aim of joint control. An example is the corporate structure of Inwit. About 37% of its shares are publicly listed, but the company is jointly controlled by Vodafone and Telecom Italia.

Regulation

Many markets in Europe still have four mobile operators. This is often the result of national and European competition policy, which favours four operators to keep mobile prices low. Having four operators may not be optimal from a cost perspective though. Operating one or two networks that could be used by all customers is more efficient than having four networks. European countries have one nationwide electricity grid, which is not duplicated by competitors. This example shows that it sometimes makes sense to share infrastructure.

Two types of mergers: in market consolidation and pan-European consolidation

Since there are still quite a few players left in Europe there are many consolidation scenarios possible. If two operators in the same market merge, this obviously provides for the largest cost-cutting opportunities. However, some operators may look to cross-border mergers. By doing so, they could become shareholders of a larger entity with growth prospects and bigger scale while maintaining some form of control of the entity, outside the rental contract. If such an entity is operated at arms-length, third party clients could see it as an independent operator.

Cellnex is the first pan-European tower operator. We anticipate that other tower companies will also try to gain scale in 2022. US competitor, American Towers, is already building a presence in Europe. Vodafone, Deutsche Telekom and Orange have all stated that they want to manage their tower portfolios as a separate business. If their tower companies merge, this would create another pan-European infrastructure leader.

Separation

Large telecom operators such as Orange, Deutsche Telekom and Vodafone could unlock a lot of value through selling their assets. These assets should be very good collateral for bond financing. However, bondholders of the telecom operators may want to think twice about credit risk if the assets are sold. In evaluating the attractiveness of telecom operators that are likely to sell their towers, much depends on a credible leverage objective or rating objective.

Cellnex European portfolio (macro sites)

Vantage Towers European portfolio (macro sites)

American Tower European portfolio (macro sites)

Orange European portfolio (macro sites)

GD Towers (Deutsche Telekom) European portfolio (macro sites)

What we expect to happen in 2022

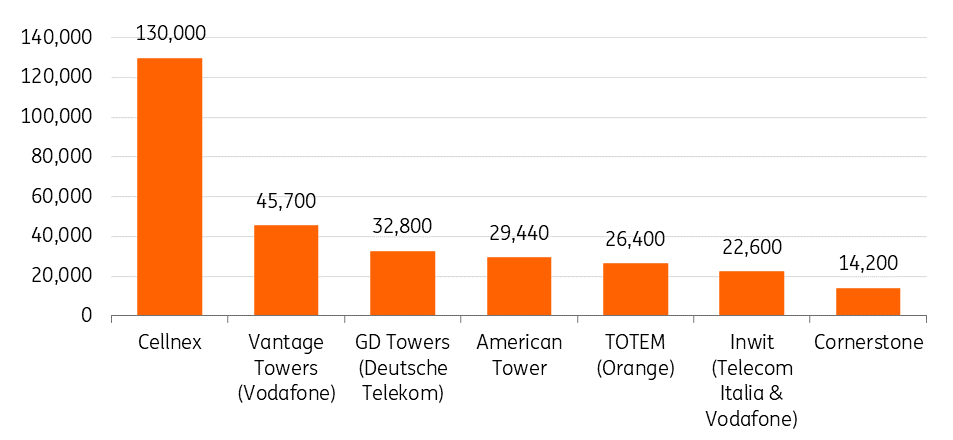

Consolidation would clearly change the landscape of tower companies in Europe. There is now one market leader, operating 130,000 towers, followed by two tower companies with more than 40,000 towers and three companies with more than 20,000 towers. While the companies mentioned here have only commented on this in general terms, what are the possible routes for consolidation? Cleary, a combination of DT Towers and Vodafone would have a lot of scope for cost-cutting since both operate in the German market. It would also establish the company as the second-largest operator in Europe. Spain is another market where consolidation is possible, as American Towers, Cellnex, Vantage Towers and TOTEM all operate towers. A merger between Vantage Towers and TOTEM would bring both cost synergies as well as establish an operator with sufficient size. If the former parent exerts less control, this raises the attractiveness for third-party tenants. Orange and Deutsche Telekom could also take their Polish tower joint venture as an example and combine TOTEM and GD Towers. This would establish a tower company in two core European markets, bringing scale, although cost synergies would be limited.

It is also unlikely that the current setup in the UK remains unchanged where both CTIL (Vodafone, Virgin Media O2) and MBNL (BT, H3G) are in flux. Virgin Media O2 is evaluating its ownership stake in CTIL and H3G has agreed to sell its towers to Cellnex. In the Netherlands, KPN and VodafoneZiggo both own their towers. This could also change over time. VodafoneZiggo may like the cash, although the joint ownership structure could complicate matters. Finally, Cellnex could take pride in buying masts in Germany to become the first tower operator with a presence in all major European markets. But would GD Towers or Vantage Towers be willing sellers?

A positive take from the above is that the establishment of tower companies will likely increase the quality of mobile networks throughout Europe because the trend contributes to the densification of mobile networks. Another take is that it becomes increasingly likely that Deutsche Telekom, Orange or Vodafone will sell (more) shares of their tower businesses. Expect cash to go to shareholders and investment, if (hopefully tightened) leverage requirements have been met.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

28 January 2022

Telecom Outlook 2022: innovation and M&A This bundle contains 8 Articles