Telecom Outlook: 5G will evolve to offer more than just high download speeds

This will be the year when 5G really takes off. In this article, we will describe the availability of handsets, the speed differences among 5G networks, future benefits of 5G, and the need for a thorough pricing model

5G handsets are available

A limitation to the increasing use of 5G networks has been the availability of handsets. Last year, however, we did see many high-end models come to the market which enable 5G connections, such as the iPhone 12, iPhone 13 and Samsung Galaxy S21. Verizon mentioned in its 3Q21 results call that: “On the commercial front, we've got great momentum in the 5G adoption, with more than 25% of our consumer phone base using a 5G capable device”. The US is likely to be a frontrunner in this respect. Given that the average revenue per unit in the US is higher than in Europe, the cost of a new 5G enabled device is relatively low in the US compared to the annual subscription revenues that are paid by consumers. It is easier for operators in the US to make deals subsidising handset sales to customers because they make larger profits on the subscription contracts. It is therefore likely that the penetration of 5G-enabled devices will be higher in the US than in Europe. If customers own the handset, they'll also want a network – fortunately, network rollouts are going well.

Network rollout progressing

Across the world, operators are rolling out 5G networks. According to the Ookla® 5G Map™, there were 5G deployments in 112 countries as of 30 November 2021. That’s up from 99 countries on the same date a year ago. However, not all 5G networks have nationwide coverage.

- In September 2021, Deutsche Telekom covered 87% of the population with 5G. This was up from 67% at the end of 2020. The target for the end of 2021 is >90% of the population.

- In Spain, the Telefonica 5G network covers 80% of the population.

- KPN and Orange have rolled out 5G in cities and are preparing their networks for a further rollout.

- In the US, T-Mobile reached 308m citizens in September 2021 with its extended range 5G (600Mhz band), which is a material increase from the 280m at the end of 2020. Coverage with its Ultra Capacity 5G (2.5Ghz band) is 190m citizens, which is up from 106m.

- The Verizon 5G Nationwide Network covers approximately 230m people (according to its 2020 annual report filing), while Verizon announced in January 2022 that it would cover 100m people with its 5G Ultra Wideband network in the month.

The differences between 5G networks will be further discussed below because there are huge differences among networks.

Network differences

Fortunately for those of us who do not have a 5G-enabled device, 4G LTE solutions already bring a substantial improvement in speed versus earlier 4G technologies. An advantage of 5G is that it operates at higher frequencies than 4G technologies. These higher frequencies allow 5G equipment to provide higher speeds than 4G technologies. However, these higher frequencies also have a drawback. Firstly, they are not yet available everywhere. In the Netherlands, the government still has to auction these frequencies due to issues with existing users of the spectrum. Secondly, higher frequencies have a lower reach, which is especially true for the so-called millimetre-wave spectrum. The millimetre-wave spectrum has the added disadvantage that it has great difficulty penetrating walls and other objects. However, this is not as bad for other 5G specific spectrums.

Nonetheless, operators need many more antennas to provide nationwide geographic coverage. Some operators have therefore chosen to launch 5G services on a spectrum that is already available with 4G technologies. This has the advantage for operators that 5G is available quickly throughout many regions. That being said, the advantage for customers is limited since they have a similar user experience with 4G LTE. Vodafone’s chief executive Nick Reed made a remark about this issue during the 3Q20 earnings call: “The question is how should we deploy? Some operators are taking dynamic spectrum sharing, so DSS (Dynamic Spectrum Sharing), which is effectively giving you a 5G symbol but 4G performance. And what we said as a company is no, we don't want to do that because it will be misleading to consumers and businesses. What we want to do is 5G built right so we want the real 5G performance”. In the US, operators have found an interesting solution to this. They market 5G on the low spectrum and high spectrum in a different way, such that it is clear from the service name whether one has the high-speed option.

Apart from the technology angle, one could also look at 5G speed differences across the globe. Ookla provides an overview of median 5G speed performance in the world's capitals. Findings for a couple of capitals are summarised in the figure below. Speeds in Seoul and Oslo top 500Mbps and these capitals lead the ranking. Speeds in Rome and Amsterdam are around 135 Mbps, while speeds are at 86 Mbps in Warsaw. Speeds in Paris are 242Mbps and in Berlin 156Mbps, while speeds in most other European capitals fall in between these figures. Other European capitals with relatively high speeds are Stockholm (425Mbps) and Sofia (338Mbps). Although these figures are not a scientific study, they show that 5G is not the same everywhere. Notably, in Amsterdam, one can get similar speeds at 4G compared to the 5G speeds as presented by Ookla. But speed is not the only new thing about 5G. 5G also brings new services.

Seoul and Oslo lead world capitals for 5G

5G will bring much more over time than just high download speeds

At the moment, the focus for customers is mostly on the increased speed that 5G enables. However, 5G will bring much more. To improve broadband coverage in rural areas, operators are exploring ways to offer broadband connections to homes using 5G technologies. This way households could get better connectivity than with outdated, fixed, digital subscriber line (DSL) technology. Higher speeds and improved response times also enable more innovative services. Such services are delivered through the network from intelligent servers. These servers can analyse data, perform calculations and send the output back quickly to the user through the 5G network. These solutions may be required to analyse the huge amount of data that a self-driving car collects, for example, or when users want to play complex electronic games against each other, where the game runs on a central server.

One could also think of examples where the reality as we perceive it is augmented with additional information that is projected on our glasses (augmented reality) or where we perceive a virtual world when we look into our glasses (virtual reality). These examples could be provided through so-called edge computing. New or transformed data will in these cases quickly be transferred to users. Besides investments in connectivity networks, operators probably need to find partners to provide many of these services. Investment in servers close to networks is therefore required. Expect more on this in 2022.

Finally, 5G promises to unlock many new use cases where a high degree of network reliability is required. In industrial environments, the current Wi-Fi technology is not good enough to connect or track equipment. New 5G technologies promise to have higher reliability and are supposed to improve the connection between objects that move. This is something Wi-Fi is not particularly good at. Mobile network operators and equipment vendors expect a lot of solutions that could improve productivity in industrial environments under the umbrella name “Industry 4.0”. One key element that enables these solutions is the ability to slice the network into different segments. Each of these segments can get different priority levels, which guarantees high reliability for vital processes. This segmentation could potentially be monetised by operators.

New release of 5G standard: 5G Advanced

The 5G technology as we know it today will evolve further. The technology that users see as 5G has been built around different standards, with Release 17 expected to be finalised in 2022. Release 17 should enable better performance levels of antenna systems (MIMO antennas), user equipment power savings, spectrum sharing enhancements, coverage enhancements and positioning enhancements to address improved accuracy, and improving 5G use cases through a new standard for the reduced-capability user equipment, to give a few examples. There are also plans for another update on 5G standards, dubbed Release 18, or 5G Advanced which should be further discussed in 2022. This standard will likely incorporate artificial intelligence and machine learning elements, besides improved network energy savings. Release 18 should build on the Release 17 standards for the reduced-capability user equipment, it should further improve 5G radio systems (such as MIMO antenna technology) and enhance mobility such as through improved handover latency. Discussions on the 5G Advanced standard should end in 2024.

What will 5G bring to operators?

Of course, it's great that customers of mobile network operators experience better speeds and network quality. But what is in it for the operators? Looking back, the upgrade from 3G to 4G came with a lot of initial promises. Consumers expected higher speeds, while telecom companies expected to sell more data through which they could generate more revenues. However, tough competition in many markets implied that the benefits went largely to consumers. They got more data, better speeds and often paid less. Governments also got good proceeds from spectrum auctions.

Operators do not want to repeat these mistakes. It is therefore interesting to see that Verizon is applying speed tiering to their offering. In Europe, commercial 5G offers are still limited, especially when it concerns high-bandwidth 5G. Interestingly, Orange and SFR in France only provide 5G with their higher-tier plans on their websites. These plans come at relatively high price points. It will be interesting to see if these offers gain traction, especially since SFR does not yet seem to offer 5G on a fast 3.5Ghz frequency in many places outside large towns. In 2022, we are going to see if customers are willing to pay for 5G, and how competitors will act when 5G networks are rolled out. Operators should try to avoid past mistakes by giving away new technology for free.

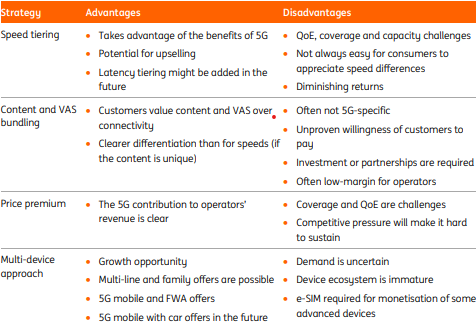

This is not easy when there are many operators in a market, while net neutrality makes it difficult to differentiate products. Consultant Analysis Mason describes a couple of pricing strategies for 5G products. Operators could apply speed tiering, bundle content, apply a surcharge for 5G networks or try to develop new use cases which could be sold as different products. All pricing strategies have advantages and disadvantages, as can be seen in the chart below.

Advantages and disadvantages of various (not mutually exclusive) 5G pricing approaches

Questions about 5G abound

Interestingly, 5G provides the opportunity for new revenue streams. So far, however, we have not seen many innovative products. This is partly because networks are not ready for, for example, network slicing, which is needed for some Industry 4.0 solutions. We do see a field trial with advanced online game playing, using edge computing. However, it's unclear when these trials will be transformed into products or what kind of revenue and profitability streams these could generate. It's also unclear at what point in time operators will be able to shut down legacy networks and technologies to reduce costs. To summarise, 5G is here. But there are still many questions about it, which we hope to find answers to in 2022.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

28 January 2022

Telecom Outlook 2022: innovation and M&A This bundle contains 8 Articles