Tax, Trump and Trade: how to halve the deficit

The US trade deficit is not all it seems and President Trump could claim a ‘big win’ should he choose to clamp down on companies’ tax optimisation activities

Why this is huge and how Trump could secure a 'big win'

Is all what it seems with the US trade deficit? Is it really nearly US$600bn, some 3% of US GDP. We think not. We’ve been looking at how tax optimisation, where companies look for the most efficient way to reduce their overall tax burden, is having an impact on the US trade deficit in goods and services. The results of this study suggest that closing those US tax loopholes could possibly reduce the trade deficit by up to 50%. This is a huge story because without it we struggle to see how the US will get its deficit lower near-term. In fact, we expect the actual trade deficit will likely widen in the coming years. Tariffs won’t narrow that deficit and the US$1.5 trillion of income tax cuts given to US households are fuelling a new consumer boom that will suck in imports.

Let’s point out first that removing tax loopholes will not impact physical trade flows; it's largely an accounting matter and therefore will not impact jobs in the US or the rest of the world. It also would not halt the deterioration of America's external balance sheet. However, if Trump can close the relevant tax loopholes, the resulting reduction in the measured trade deficit could be wrapped up as a 'big win' resulting from his 'America First' policy'.

The reduction of the deficit is a primary presidential goal

And that's so important for a man who's made the reduction of the US trade deficit one of the prime goals of his presidency. By way of forcing the issue, the US administration has been implementing tariffs on imports into the US with the threats of more to come unless action is taken. China has responded and this is leading to growing fears of an all-out trade war that could have damaging ramifications for the global economy and, in turn, hurt the job prospects of hundreds of thousands of American workers and millions of people around the world. Such a 'big win' for Donald Trump on the trade deficit may help to ease these tensions.

How tax optimisation works

Tax optimisation inflates the US trade deficit in goods and services. For years companies have used international (internal) transfer pricing to shift profits away from the United States in order to avoid relatively high taxes in the US and other advanced economies. Such structures increase recorded US imports and reduce exports, and therefore lead to an overstatement of the trade deficit.

But tax agencies have become increasingly strict in their scrutiny of internal prices, often only accepting 'arm's length' prices (prices equivalent to what is charged on the market). Now, more commonly used structures to avoid taxation involve the transfer of intellectual property rights to foreign subsidiaries in low-tax jurisdictions. By doing so, the direction of royalty payments can be adjusted so that profits accumulate in tax havens instead of the US.

These royalty flows have a significant effect on the US trade balance. Payments of royalties from the US are recorded as US imports and the payment of royalties from other economies to low–tax jurisdictions reduces the amount of recorded US exports.

In recent years, annual US profits retained in tax havens reached US$ 250bn, equal to 1.4% of US GDP. This implies that the US trade deficit in goods and services could be overstated by as much as half its current measure.[1]

Key to US multinational firms' use of tax minimisation strategies is that:

- The US taxes income of foreign subsidiaries only when profits are paid as dividends to the US parent company.[2]

- Tax minimisation strategies often involve altering the international company structure and the transfer of intellectual property (IP) in such a way that profits are shifted to subsidiaries in low tax jurisdictions ‘tax havens’.

- Accumulated profits may be repatriated to the US when the US government gives a ‘tax holiday’ to do so at a favourable tax rate (which is happening at the moment as a result of the Trump administration’s tax reform).[2]

- Commonly used structures to avoid taxation involve royalty payments to shift profits to tax havens. However, overpricing[3] inputs imported from a foreign subsidiary or parent may also be used to shift profits away from the US.

How tax optimisation affects the US trade deficit

- Tax optimisation lowers US exports. Tax optimisation strategies that involve the transfer of intellectual property have the effect that low–tax jurisdictions become the recipients of royalty payments from other countries, instead of the United States. This means that payments that would otherwise be recorded as US exports of services are considered exports from the low-tax jurisdictions. In other words, the US export data looks worse than it should.

- Tax optimisation may increase US imports. When the US pays royalties for the use of intellectual property transferred to tax haven countries, this is registered as US imports of services. Structures that use overcharging of imported inputs also cause an overstatement of imports.

Other effects on the national accounts

- Tax optimisation increases income on US overseas investment. This is because the subsidiaries located in low-tax jurisdictions earn the profit that would otherwise be earned by the US parent company. The profits earned by the foreign subsidiaries of US companies are booked in the US national accounts as income from overseas investment.

- Tax-optimisation leaves the current account balance unaffected. The lower trade balance (because of lower exports and higher imports) is offset by an overstatement of the foreign income balance so the net effect on the US current account (which is the sum of the trade and income balance) is neutral.

Retained earnings in low-tax jurisdictions much higher than in ‘ordinary’ economies

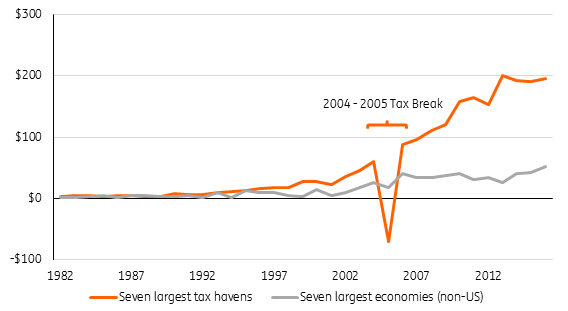

Retained earnings in the seven largest low-tax jurisdictions and the seven largest economies (annual flows in US$ bn)

We estimate that the amount of retained earnings registered in low-tax jurisdictions grew to more than US$ 250bn in 2017.[4] The chart below shows that retained earnings in ‘normal’ economies have been declining in recent years, while retained earnings in low-tax economies have increased strongly. According to our estimates, the rise in total overseas retained earnings in 2017 is entirely attributable to earnings reinvested in low-tax jurisdictions.

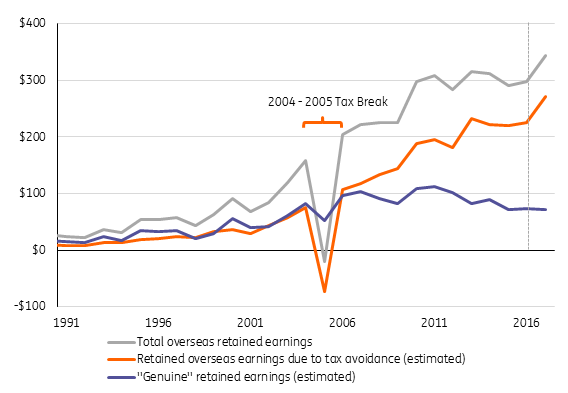

Diverging trends in overseas retained earnings

Overseas retained earnings adjusted for tax optimisation (annual flows in US$ bn)

When correcting for the effects of diverted profits on the US trade balance, the deficit is almost halved from 2.9% to 1.5% of GDP. This implies that in theory, the US could reduce its trade deficit substantially by closing tax loopholes. However, as said before, correcting for the effect of tax loopholes will not affect the overall balance of the current account.

Tax optimisation by foreign companies operating in the US may also add to the US trade deficit. When a foreign parent overcharges [3] the inputs of their US subsidiaries to reduce US taxable income, the value of US imports will be pushed up and hence result in a larger US trade deficit. And non-US multinationals may employ similar tax optimisation strategies, with the effect of inflating royalties paid by US entities. This effect is not captured in this report.

A not so big deficit

US trade balance in goods and services % of GDP

Tax optimisation explains high US income balance

Countries running a trade deficit build up net liabilities to the rest of the world. Since investors generally expect a return on their investment, these liabilities cost the US through payments or dividend or interest to foreign investors (and US investment abroad similarly earn income). When a country runs a persistent deficit, one would expect the net international investment position (NIIP) and therefore the balance of income from and payments to the rest of the world to worsen over time.

Curiously, this has not been the case for the US. The income balance even improved while the trade deficit grew year after year. This puzzling development may in part be explained by tax optimisation structures that artificially increase US overseas income in tax havens. When correcting for this, US net overseas income turns out to be considerably lower (see the orange line in chart).

The other key reason that the US income balance is not more negative is that a fairly large share of foreign investment into the US takes the form of foreign US-dollar holdings and low-yield debt holdings such as treasury bills. US foreign investment is more concentrated in higher yield assets. Therefore, on average, the US earns a higher rate of return on its foreign portfolio than the rest of the world earns on its US portfolio. This helps the US income balance.

US overseas income turns negative

Balance on US net overseas income (in US$ bn)

How large is the trade balance distortion due to tax optimisation?

In recent years, annual retained earnings of US multinationals in the seven most important low-tax jurisdictions have approached US$ 200bn, as you can see in the chart below. At the same time, the amount of annual retained earnings by US multinationals in the seven largest economies was significantly lower (around US$ 50bn). We think the most compelling explanation of the high amount of retained earnings in low-tax jurisdictions is that they are related to tax optimisation strategies.

The chart below also makes clear the effect of the 2004-2005 tax break on foreign profits. At that time, companies actively repatriated accumulated foreign earnings from these low-tax jurisdictions (visible in the chart as negative retained earnings). While there were significant effects for the seven low-tax jurisdictions, only a small dip in retained earnings is visible for the seven largest.

The effect of the Trump Tax Reform

The 2nd of November 2017 Tax Cuts and Jobs Act is the largest US tax reform in the last 30 years. The Trump tax reform will treat all accumulated foreign profits as repatriated and tax them accordingly. It will do so at a reduced tax rate of 15.5% for cash and cash equivalents and 8% for reinvested earnings. This has already had the effect that in the first half of 2018 more than US$ 460bn of foreign accumulated earnings were repatriated to the US (US Department of Commerce data). In addition, the tax reform also includes significant revisions aimed at preventing companies from avoiding taxation.

Parts of the tax reform are still unclear and have yet to be translated into specific rules. But there are four key aspects that may affect the international tax structure of US companies (note that not all of these points discourage tax avoidance):

- It cuts the US corporate tax rate from 35% to 21%. Additionally, it introduces 12.5% tax rate for profits earned by the export of intangibles (i.e. the segment most affected by current tax optimisation strategies).

- It replaces the US worldwide tax system with a territorial tax system for companies

(A worldwide tax system taxes all income by US individuals and companies, including income earned abroad. A territorial tax system only taxes income earned in the US.) - An exception to the territorial tax system is a 10% tax on intangible income of foreign affiliates. (Income of a foreign affiliate is considered intangible if the foreign affiliate does not possess tangible assets but generates ‘excessive’ profits).

- A minimum tax of 10% on income adjusted for “base eroding payments”.

(Base eroding payments are payments to foreign affiliates such as royalties.)

Lowering the corporate tax rate from 35% to 21% or (12.5% on foreign sales) reduces the incentive for firms to book profits outside the US. However, 21% or 12.5% may still be higher than the rate applied in some other jurisdictions

The shift to a territorial tax system makes profit shifting more rewarding. In the worldwide system, taxes became due only when repatriating earnings to the US. The shift to a territorial tax system allows companies to repatriate earnings earned in low-tax jurisdictions without paying (additional) taxes.

The 10% global tax on intangible income is aimed at reducing profit shifting to low-tax jurisdictions. However, 10% is still less than the 21% or 12.5% paid in the US. Therefore, the tax incentive for booking profits in the US may remain weak. In addition, it may be that in some cases the 10% tax incentivises firms to move tangible assets (away from the US) to tax havens in order to book tangible profits in those countries.

The 10% minimum tax on income adjusted for base eroding payments is not applicable to profits made outside the US. However, it may prevent companies from shifting some of their income generated in the United States to low-tax jurisdictions.

The net effect of the tax reform on the use of tax loopholes is not easy to assess but it may not be enough to result in a major shift in international trade structures such that the effects of tax optimisation on the trade deficit and the income balance will continue to be large.

Conclusions

- Tax optimisation strategies mean that US imports are likely significantly overstated while US exports are understated.

- We estimate that the size of this distortion grew to as much as $250 billion (1.4% of US GDP in 2017) in recent years

- When correcting for the effect of tax optimisation strategies used by US multinational companies, the US trade deficit would be roughly half of the current figure; 1.5% of GDP instead of 2.9% (2017 numbers).

- The US current account balance is not affected by tax avoidance, so this is largely an issue of optics. The US external balance sheet is deteriorating regardless of the impact of tax optimisation strategies

- The net effect of the Trump tax reform on the use of tax loopholes will not necessarily result in a major shift away from these tax optimisation strategies

- The Trump administration could use the closure of loopholes through further tax changes to reduce the measured trade deficit but at the moment there seems to be little appetite to make these kinds of changes. However, the situation could change given an altered political reality in the US after the Republicans lost control of the House in the midterm elections, although the party did increase its Senate majority.

End Notes:

[1] Due to data and methodological constraints we cannot estimate the effects of tax avoidance on bilateral trade balances such as the political highly sensitive US-China trade deficit.

[2] This applied prior to the Trump tax reform discussed later in this article.

[3] The US tax authority (IRS) requires arm’s length prices to valuate internal transfers and considers overpricing to be fraudulent. However, overpricing can’t be ruled out for inputs where no equivalent market transaction is available and where the costs of producing such inputs are not transparen

Further reading & references:

The blog posts on the website of the Council of Foreign Relations by Brad W. Setser are very informative and served as a great source of inspiration for this article: Apple’s Exports Aren’t Missing: They Are in Ireland and Tax Reform and the Trade Balance.

Also the work of Gabriel Zucman, Assistant professor at University of Berkeley and the VOX blog post: The Trump tax plan halts tax inversions but increases treaty shopping by Cnossen, Lejour, and van't Riet, have proven to be valuable sources of information.

Note on methods and assumptions:

Profits shifted for tax purposes is estimated by taking the percentage of retained earnings in the seven largest tax havens in total US retained earnings abroad, with an added 10 percentage points to control for other tax havens for which no data is available in the required detail. This brings the estimate for the amount of retained earnings in tax havens to 65% of total overseas retained earnings on average over the past 10 years. The estimations are in the same order of magnitude as those by the Congressional Budget Office (CBO) of the United States. [4]: The 2017 figure is estimated by extrapolating the average 10 year growth trend of the share of tax havens in total overseas retained earnings.

The list of the seven largest tax havens used in the analysis are: Ireland, Singapore, UK overseas islands in the Caribbean, Bermuda, Luxembourg, Switzerland and the Netherlands. These countries have been chosen because earnings in these countries were negative during 2004-2005 taxholiday as well as their inclusion in known tax structures such as the 'Double Dutch Irish Sandwich'.

The list of seven largest economies on the basis of 2017 GDP (World bank data) excluding the US are China, Japan, Germany, United Kingdom, France, India, and Brazil.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article