Taiwan’s economy facing slowdown

The focus on electronics production and exports has been the strength of the small and open economy but could become a pain point if global trade flows shrinks. This is why we revise our GDP and USD/TWD forecast

Why Taiwan is prone to risks from global demand

Taiwan is famous for its strength in producing electronic parts for smart-devices. This has been the growth engine of exports as well as GDP growth of the economy since late 2016.

But as global demand for smart-devices slacks, as we highlight in this note, past strengths could become a pain point for the future. If global demand for smart-devices and related parts continues to slow and combines with Taiwan's lack of buffer to make up for the loss of growth from trade, the negative impact would first hit trade volumes, then business investments, production, wages, and finally consumption.

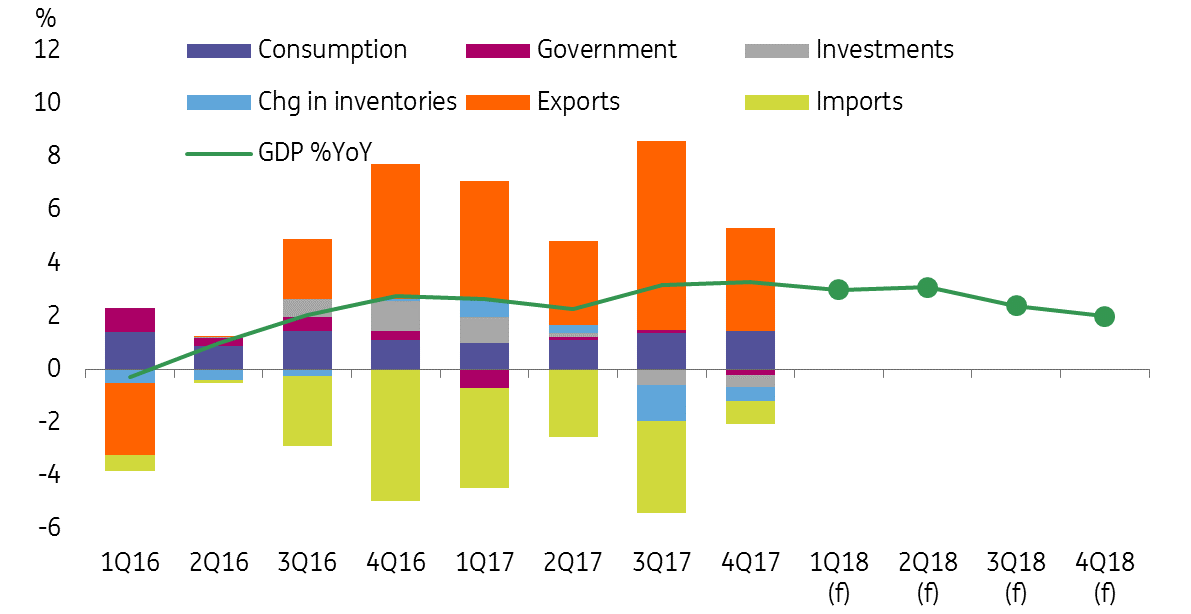

As a result, the economy would slow down from 2.9% year on year in 2017 to 2.63% in 2018. We expect 3.0% YoY in 1Q, 3.1% in 2Q, 2.4% in 3Q and 2.0% in 4Q, respectively.

Softer GDP growth ahead

If trade tensions escalate, things could get worse

It is tempting to conclude that trade tension between mainland China and the US, especially in the telecom and IT production sector would benefit Taiwan as it focuses on production related to these sectors.

But we would like to reiterate that if there is a trade war in the sector, neither side would win because trade volumes are likely to shrink.This would hurt the whole supply chain of electronic products. It is likely that the sector would suffer from a smaller pie, so not all the sellers of substitutes for the "banned" Chinese products could enjoy sales increase.

We believe Taiwan export growth would slow from 11.75% in 2017 to 4% in 2018, and imports would slow from 11.63% to 6%. Higher raw material and energy import prices would be the reason behind the narrow trade surplus.

Investment not looking so rosy

If you look at the details, investment has contributed negatively to GDP growth both in the third and fourth quarter of 2017. The trend indicates businesses do not believe that a bright outlook for their sector would continue. Data from the statistic office shows that imports of equipment from the private sector fell 5.8% in 2017, in particular, the fall dived to -13.3%YoY and -11.57%YoY in the third and fourth quarter respectively.

The weakness in investment came in even before trade tension between mainland China and the US started, which implies if they escalate then investment would experience an even dimmer outlook.

We expect investment growth to further decline from 0.0% in 2017 to -0.5% in 2018.

Wage and consumption would also be affected

The 1.8% trivial increase in wages in 2017 was already the fastest in three years, and it was a reflection of good growth in the production of smart-devices parts.

The projection of milder growth in exports implies that wage growth would also shrink in 2018 to around 1.5%.Weaker wage growth and an ageing population at a rate of around 5% are likely to have a direct impact on consumption growth which is also likely to shrink from 2.2% in 2017 to 1.0% in 2018.

Retail sales growth comes from domestic and external drivers. When domestic consumption growth slows, the economy has to rely on tourist spending. But Taiwan has suffered negative growth in tourist revenue for three years after mainland China largely stopped mainlanders visiting Taiwan for leisure tourism. Though the US has offered some reprieve, the contribution to total tourist arrivals and retail sales in Taiwan is limited.

Government spending to be limited

The government contribution to GDP was -0.15% in 2017, partly because the economy ran well last year with the recovery of global demand.

It is quite certain that the economy needs help from the government in 2018. However, this would still be small as seen in the past. We expect a mere contribution of 0.2 percentage points by the government in 2018 given that it has been running at a deficit.

Central bank to stay put

Similar to the government, the central bank of Taiwan has little room to boost economic growth by lowering interest rate as the 1.375% policy rate is already very low and close to the historic low level of 1.25%. The softness of the economy in 2018 is not comparable to the dive down global economic cycle in 2009-2010, so we're not expecting the central bank to lower the policy rate in 2018.

USD/TWD follows stock market closely

Weaker TWD driven by a lower stock market index

The dim outlook for the sales of smart-devices is already reflecting in the lower stock market index of Taiwan. Foreign capital flowing out of Taiwan's stock market has created a weakness in TWD. If trade tensions between mainland China and the US escalate, a lower earning prospect of Taiwan companies could put further pressure.

But if the dollar continues to weaken, which is our house view, then the weakness on TWD might be offset.

By considering these two factors together, we revise our forecast of USDTWD from 28.50 by the end of 2018 to 29.00. We expect 29.40 in 2Q, 29.2 in 3Q and 29.00 by the fourth quarter respectively.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

25 April 2018

Good MornING Asia - 26 April 2018 This bundle contains 3 Articles