Taiwan’s economy: Still waiting for an export rebound

The US-China trade war has hit Taiwan's manufacturing, exports and the demand for new smartphones, and fiscal and monetary policy can only do so much to help drive the recovery. 5G equipment production could provide some support, but before that happens weaker corporate earnings may lead to capital outflows and a softer currency

Taiwan economy is currently under pressure from external factors

Taiwan's economy is a small and open one, which is why the export sector is important to its manufacturing and related service industries such as ports and logistics. But since mid-2018, the external environment has turned negative for Taiwan.

Latest figures show export orders have contracted by 10.94% in February 2019, while exports have contracted by 8.8% since November 2018.

Exports have fallen considerably

Taiwan's electronic related sectors have been hit the hardest

This is mostly the result of the trade war between mainland China and the US, which has made businesses defer investment decisions, and therefore orders for electronic equipment have decreased.

Another reason is that the tech giant Apple, who manufactures some parts in Taiwan is experiencing a falling product life cycle for its phones and other smart devices. As a result, exports of integrated circuits have shrunk by 1.1% year-to-date in February, printed circuits have also contracted by 13.2%YoY, and the DRAM market has dwindled by 4.8% YoY.

Historically, electrical equipment manufacturing does not pick up until electronic parts have recovered, so factory expansion may not pick up until there has been a prolonged increase in orders for such items.

There is only so much fiscal stimulus can do to help

The government has taken up the main role in supporting the economy and will probably increase spending by 2.8% to TWD 2.022 trillion in 2019, which will be around 11% of nominal GDP.

This includes raising infrastructure spending and giving rebates to consumers on energy-saving automobiles.

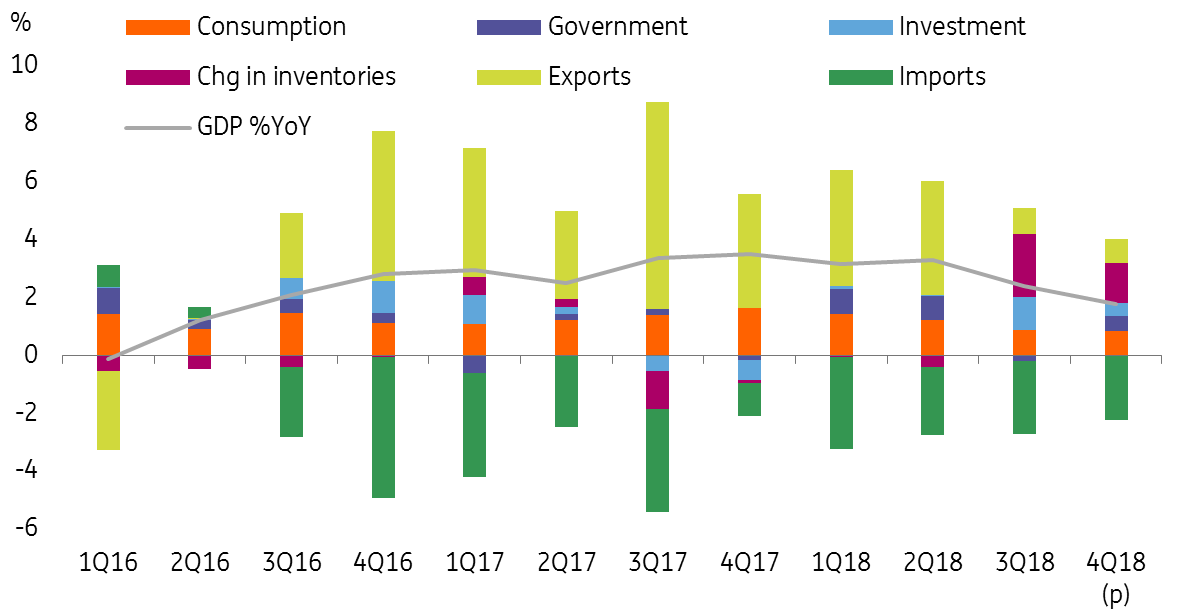

As you can see in the chart below, historically, fiscal spending can only support the economy for so long. For example, government spending in 1Q16 couldn't prevent GDP growth from falling below zero in annual terms, and it wasn't until export growth rebounded in 3Q16, the economy picked up momentum. So in light of that, we believe, the economy still needs to see a bounce back in exports to see faster economic growth.

GDP growth falls as export sector contributes less to the economy

Monetary easing would be the last resort

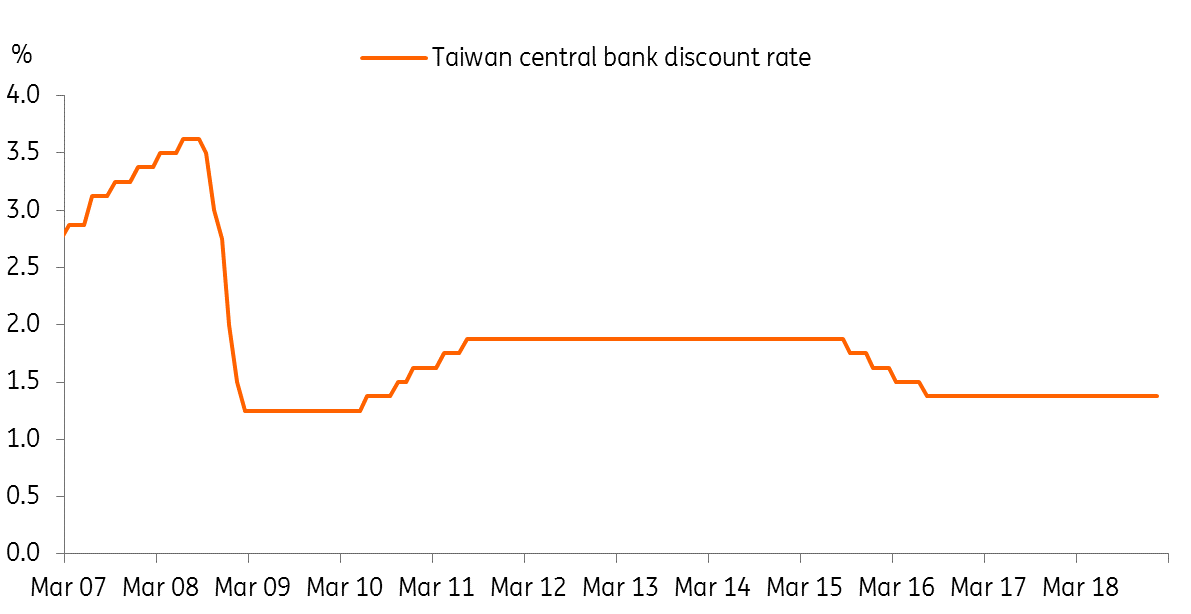

Monetary easing in 2009 brought Taiwan into the low-interest-rate economy territory, and for the last 32 months, the policy rate has been on-hold at 1.375%. Like other economies suffering from the indirect effects of the trade war, inflation at 0.23% year on year isn't really a concern for a future rate cut, but external headwinds are a challenge for the central bank.

The central bank's recent history of cutting rates by only 0.125 percentage points per move would be too small to have a meaningful impact, and would likely require multiple cuts over successive meetings to provide any noticeable stimulus. Even then, with rates as low as they already are, cutting rates further isn’t really going to have a significant impact on the availability of credit, and as we have seen elsewhere (e.g. Japan), as rates approach zero, further easing can deliver the opposite response to that intended.

Therefore, we believe the central bank is saving the bullet until economic growth turns close to negative. But even that doesn't guarantee a rate cut will be an effective tool to rescue the economy.

A rate cut maybe the only trump card the central bank has

5G to the rescue?

5G could be the opportunity Taiwan needs. As 5G mobile networks begin to develop around the world, there is a demand for 5G equipment from upstream to downstream, and Taiwan has the labour force to produce it all.

But as most of the production demand will arrive when 5G infrastructure coverage worldwide is ready for commercial use, the demand for 5G downstream equipment will come in around late 2020. So 5G may not be able to provide timely support to the open economy, but it should still be a positive in a couple of years.

Domestic politics intertwined with external force

The issue that is likely to dominate the presidential elections in January 2020 is whether the new Taiwanese government would like to be more pro-mainland China to be able to get some economic support. But before we see the election results, this debate is likely to create confrontations between the two main political parties - the Kuomintang (KMT), and the Democratic Progressive party (DPP).

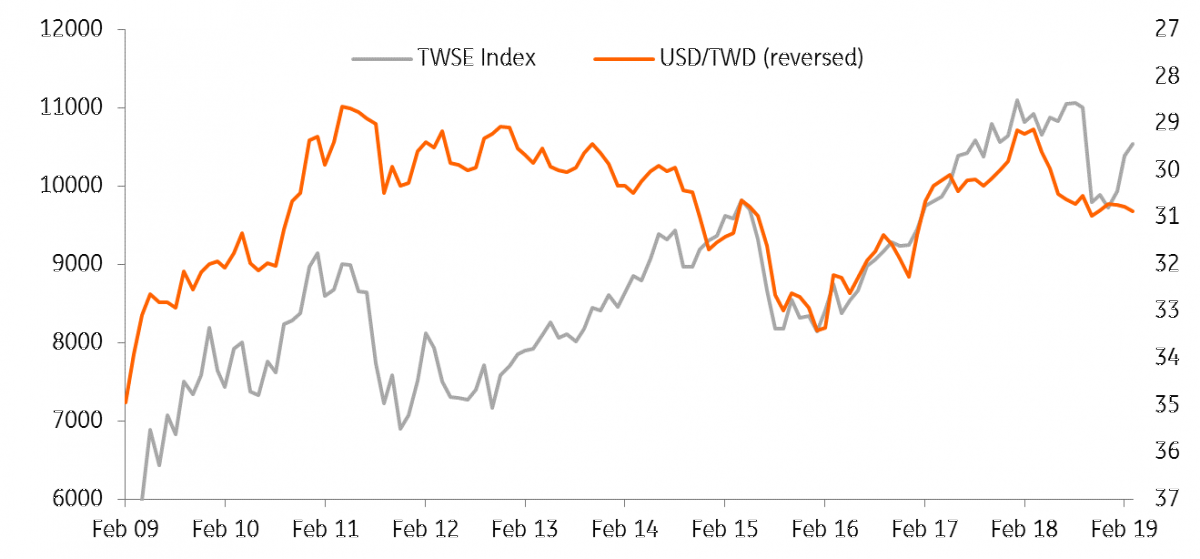

The currency will be sensitive to corporate earnings

Taiwan's stock market movements impact the country's exchange rate a great deal because of foreign investments in the stock market.

We are concerned that there could be downward surprises in corporate earnings because of the weak sales of smart devices and this will put downward pressure on the Taiwan dollar against the USD.

As such we've revised our TWD forecast from 30.40 to 30.95 by the end of 2019.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

TaiwanDownload

Download article

1 April 2019

What’s happening in Asia ? This bundle contains 9 Articles