Taiwan: Revising currency and GDP forecasts on trade war worries

Taiwan's industrial production surprised on the downside on both a monthly and yearly basis. This could suggest that manufacturers are cautious about maintaining inventory during a possible trade war. We are revising GDP down to 2.4% in 2018 from a previous forecast of 2.6% and expect USD/TWD to depreciate to 31.00 from a previous forecast of 30.6

Manufacturing activity dims

Manufacturing activity slowed even before bilateral tariffs between Mainland China and the US were imposed on 6 July.

While Taiwan could win some orders from the substitution of Mainland products (for example, electrical machinery), manufacturers could be hit by a fall in global demand if the trade war intensifies.

We therefore revise our GDP growth forecast downward to 2.4% in 2018 from 2.6%, and USD/TWD to 31.00 from 30.6 (spot 30.64).

| -3.5% |

Taiwan industrial production MoM down from 8.2% MoM in May0.36% YoY in June from 7.61% in May |

| Lower than expected | |

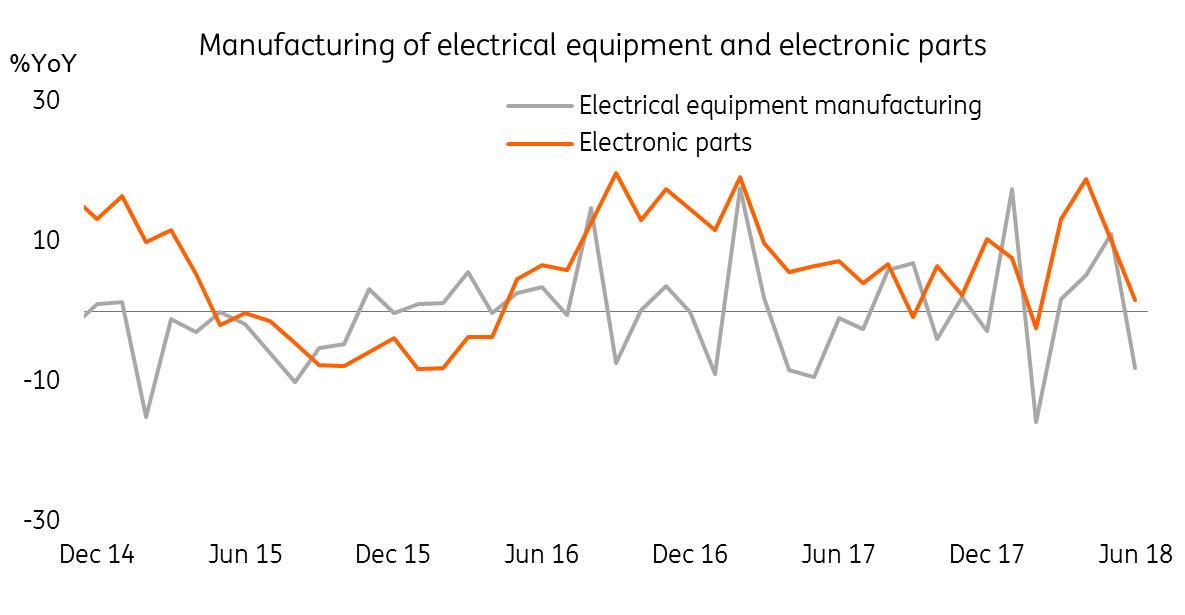

Taiwan's electronic-related production growth dims

Manufacturers should be de-stocking

Manufacturing activity fell to 0.36% year-on-year from 7.61%, though the drop was partly a result of the high base effect last year. The monthly data also pointed to negative growth (-3.5% MoM) for all manufacturers except for tobacco, other transport equipment and those involved in the repair and installation of industrial machinery, who posted the strongest monthly growth. The data suggests that manufacturers have been cautious about building up inventories. They could be using inventories before increasing production.

Taiwan's central bank can do little but TWD can weaken further

Taiwan's central bank is in a difficult position if it's considering an interest rate cut, as the level of its current policy rate is 1.375%. If the economy faces a further downturn, there's little room for additional cuts. We believe the central bank will likely save its bullets for a more severe economic environment, which is why we expect it to stay put.

Still, this doesn't mean the Taiwan dollar can't weaken against the US dollar. Unless the USD were to weaken amid a tit-for-tat trade war, the TWD together with other Asian currencies would likely weaken further. So we revise USD/TWD to 31.00 at end 2018 (spot 30.64).

Taiwan central bank has little room to cut rate

With little fiscal and monetary power, GDP growth will slow

As a small and open economy, Taiwan is subject to volatility in external demand. The bilateral trade war between Mainland China and the US is likely to lead to a fall in global demand. It is just a matter of time. And today's industrial production data sends a signal that the economy is fragile in the face of such a trade war.

We are therefore revising our GDP growth forecast for Taiwan to 2.4% in 2018 from our previous forecast of 2.6%.

Taiwan relies on exports to grow

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

23 July 2018

Good MornING Asia - 24 July 2018 This bundle contains 2 Articles