Taiwan economic update: Inseparable from semiconductors

Taiwan grew strongly in 2020 thanks to few cases of Covid-19 and increased demand for semiconductors - the core components in computer equipment used to work and study from home. In this economic update, we discuss whether this strength can extend into 2021 and the risks of relying on a single industry as a growth engine

Strong growth in 2020

GDP grew 2.98% in 2020 to TWD 19,767 billion, a slight slowdown from 2.96% in 2019.

Taiwan GDP growth was led by exports

Even though there were only a few Covid cases by international standards, people flows in Taiwan have fallen due to preventative measures to eradicate Covid as well as a steep fall in international visitor numbers. This has negatively affected the domestic market.

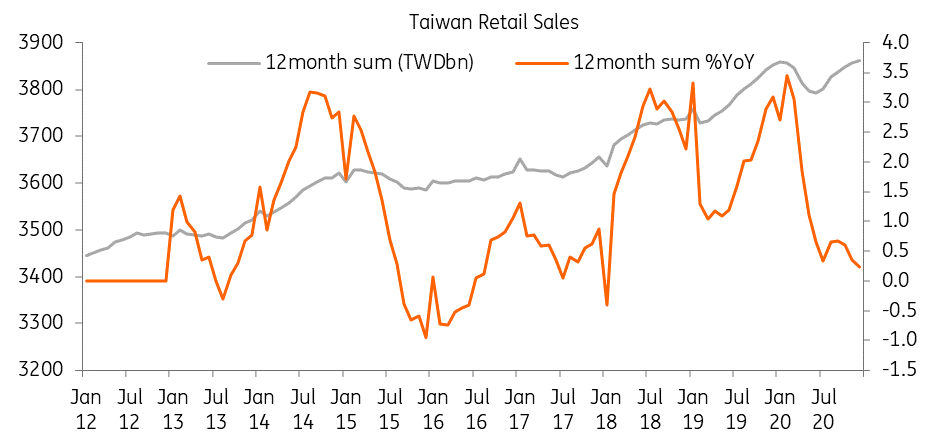

The job market was also hurt, though only slightly. The unemployment rate rose to 3.76% at the end of 2020, with the peak at 4.16% in May 2020, up from 3.72% at the end of 2019. Most of the job losses were in areas related to domestic demand. Retail sales reached TWD 3862bn for the whole of 2020, growing a mere 0.24% from 2019. This is in contrast to 3.08% growth in 2019. Among all the retail sales items, catering suffered the most. This is similar to what we have seen in the rest of the world, except that there have only been a few Covid cases in Taiwan. Catering sales of TWD 778bn in 2020, were down 4.2% from 2019.

Strong growth to return in 2021

The question is whether this growth story can return in 2021. We believe that this is very likely. The main growth engine for Taiwan is electronic exports. Semiconductor chips are now in shortage across the globe. This excess demand has come from a variety of sources, including increased work-from-home and study-from-home equipment as well as AI-equipped automobiles, not to mention the latest generation of advanced smart devices.

Taiwan exports and manufacturing of electronic products and parts

According to IC Insight, Taiwan had the largest wafer capacity in 2019 with about 22% of worldwide capacity installed. The economy is likely to hold on to the number one position through to at least 2024 by adding nearly 1.3 billion wafers (200mm-equivalent) in monthly fab capacity between 2019 and 2024.

The shortage of chips should also result in a rise in the price of semiconductors, and more export income should follow.

Lone growth engine but fine for 2021

Electronics is the backbone of Taiwan’s economy. This industry is the main economic driver for manufacturing activity as well as exports.

Electronic parts and components manufacturing, computers, electronic and optical products manufacturing, telecommunications and IT contributed 17% of GDP in 2019. The industry contributed 34% of all investment in the same year, according to Taiwan's official statistics.

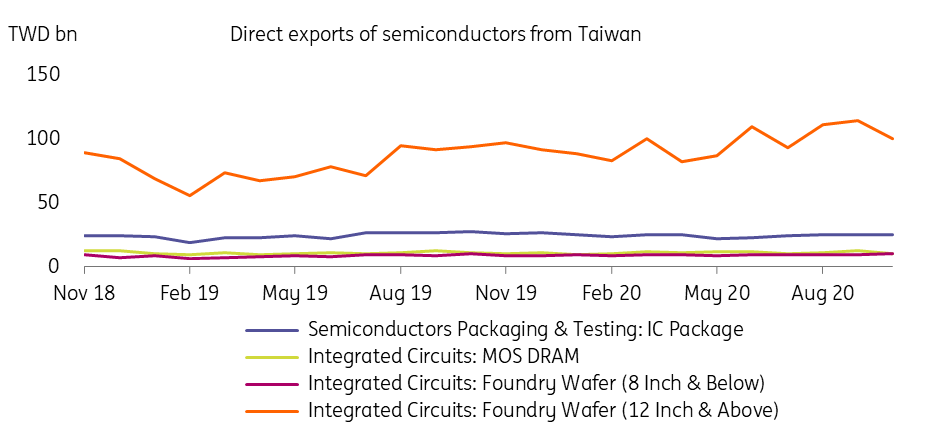

From direct export data, we can see that exports of integrated circuits (12 inch & above wafers) contributed the most to GDP.

12 inch wafers are used in computers, smartphones and pads, and automobiles. As discussed above, Covid has increased demand for work/study from home equipment, e.g. laptops. This has created a large, sudden increase in demand for 12 inch wafers, and therefore shortages in semiconductors.

Taiwan direct exports by items

In 2021, we believe that demand for upgrades of laptops will slow down as not everyone will be upgrading their computer equipment every year. But demand for upgrades to 5G smartphones and pads could increase if the job market recovers from Covid. With more 5G networks equipped globally, automobiles will rely more on 5G for navigating systems and semi/fully autonomous driving will need more chips for advanced computing. This will give an extra boost to demand for 12 inch wafers. All this suggests the market prospects for Taiwan’s semiconductor manufacturers are bright this year.

So even if Taiwan arguably depends too much on the electronics sector for economic growth, job opportunities and investment, this is less of a problem given that other economies cannot compete on capacity and technology.

Nothing is forever

The main threat to this positive picture is the possible technological advancement of Mainland China. US restrictions on Chinese companies buying American technology parts and products have induced enormous investment in technology R&D in Mainland China. It is just a matter of time before Mainland China is able to match Taiwan as a high-technology provider and manufacturer.

R&D comparison by selected economies

Relationship with Mainland China

Until then, Mainland China will continue to import electronics from Taiwan. The electronics industry may be the most important economic relationship between Mainland China and Taiwan. With China investing more in technology R&D, Taiwan will gradually find itself too dependent on Mainland China to buy its products. A few years from now, when Mainland China starts to achieve self-reliance in advance technology, not only will it not buy as much from Taiwan as before, it will also become Taiwan’s main competitor in the global market.

Mainland China - Taiwan trade relationship

Even when Covid subsides and vaccines become adequate for frequent international travel, Mainland China is unlikely to set a big quota for Mainlanders to visit Taiwan, which made up 23% of total visitors in 2019. We expect Mainland China's government to only allow a small number (e.g. 100,000 visitors to Taiwan per month), compared to the monthly peak of more than 300,000 visitors from Mainland China in May 2019. This is another way for Mainland China to show Taiwan's ruling government that Taiwan is economically dependent on Mainland China.

Conclusion

We expect that Taiwan will register even stronger growth in 2021, at 4.3%, after the reasonable performance of 2.98% in 2020. This will mostly be because of the higher export value of semiconductors stemming from an increase in both prices and volumes. But relying too much on a single growth engine is dangerous. A few years from now, when Mainland China starts to reach the cutting edge of technological innovation, Taiwan’s leading role in semiconductors could be at risk. Taiwan needs to compete on the speed of advancement to keep its number one place as a manufacturer of advanced chips. It is also in Taiwan’s interests to develop a supplementary growth source for the economy to provide some balance and to diversify risk.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

TaiwanDownload

Download article

29 January 2021

Good MornING Asia - 1 February 2021 This bundle contains 3 Articles