Taiwan’s economic outlook for the second half of 2022

We look at Taiwan's economic situation, including the risks and opportunities, and fiscal and monetary policies

The semiconductor industry is a key pillar of Taiwan's economy

Taiwan is the 21st largest economy in the world, just behind Switzerland and the Netherlands with a nominal GDP of US$807bn in 2021, and GDP per capita of $33,011.

The economy grew 6.57% in 2021, the fastest growth since 2010, thanks to strong global demand for electronic products that benefited Taiwan’s semiconductor industry.

In 2021, Taiwan accounted for more than 64% of the global foundry market – the outsourcing of semiconductor manufacturing. The strong demand was partly a result of demand for computer equipment due to the Covid-induced working from home trend, and from the rising demand for automobiles, including electric vehicles.

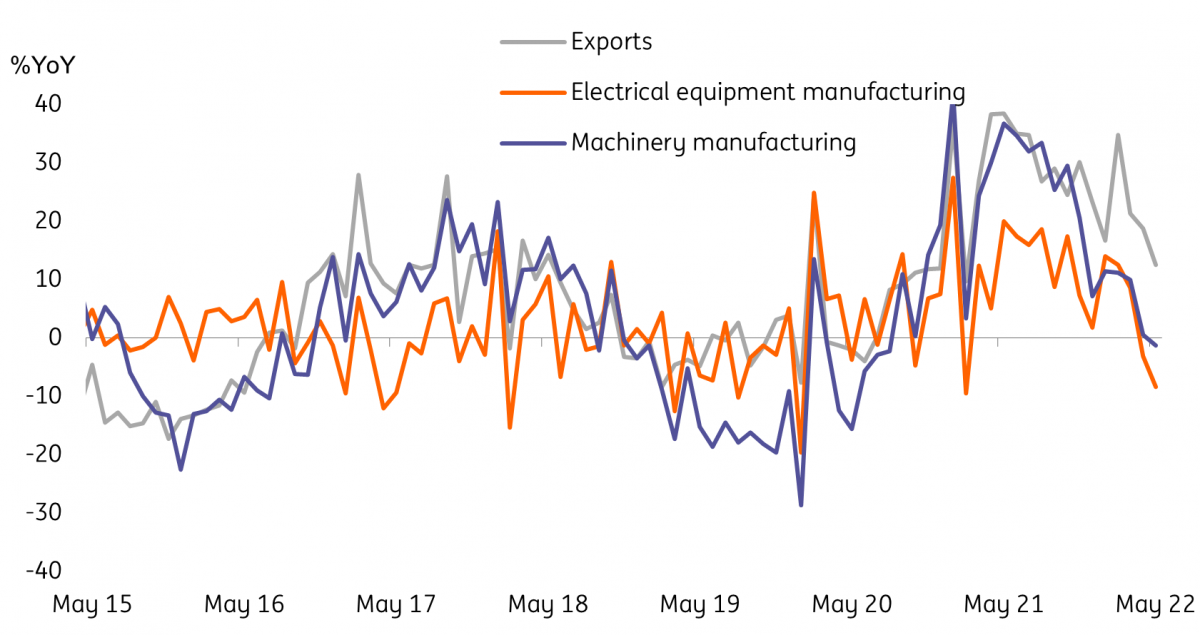

Taiwan's total export and electronic export growth

The risks of being too specialised

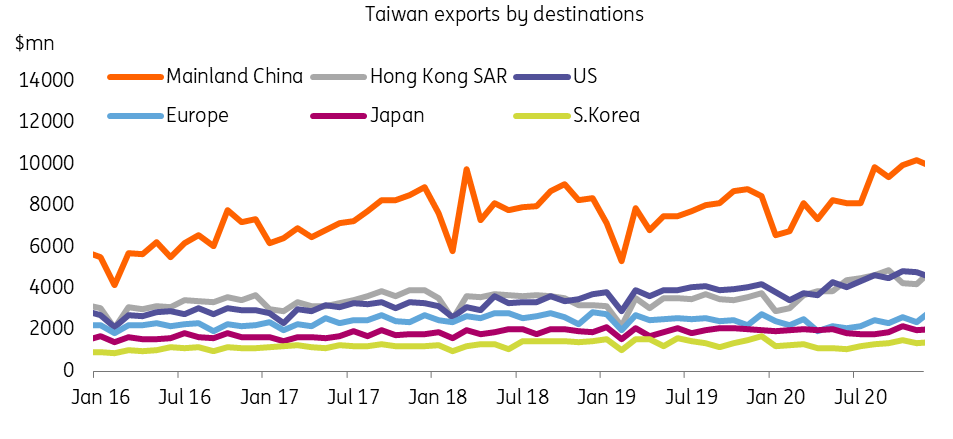

However, this strong demand did not continue into 2022. As the Taiwan economy relies on a single growth pillar, it is difficult to be upbeat about Taiwan's economic growth while Mainland China’s consumer market is suffering from lower purchasing power after the prolonged lockdowns that have occurred since March 2022.

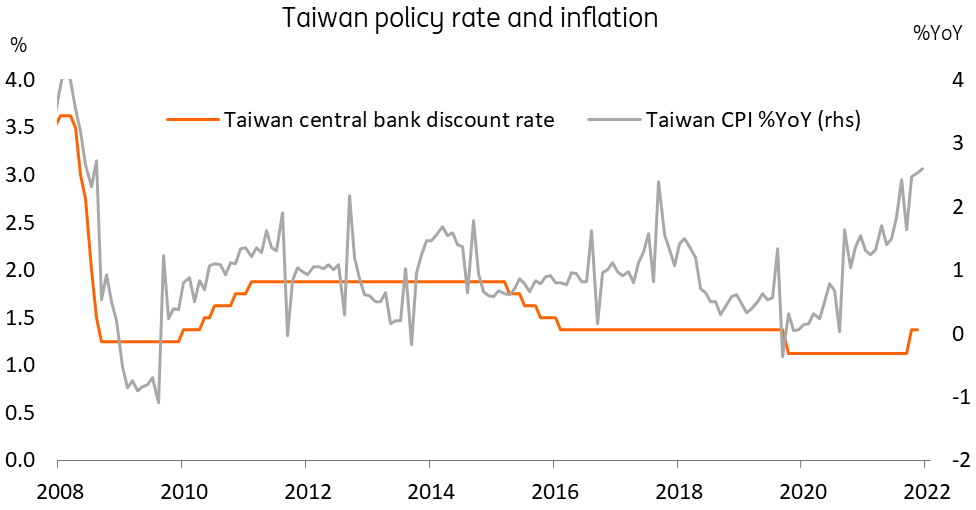

Another risk that Taiwan is facing is a high consumer price level as import prices of energy and food become higher. The central bank has reacted by raising interest rates and increasing the deposit reserve ratio. These tightening monetary policies are expected to continue in the second half of the year and could dampen demand for domestic investments.

The risk of capital outflows is also mounting as global fund managers seem to become more doubtful about the prospects of the semiconductor industry.

Taiwan's exports of electronic parts by destination

Monetary policy: further rate hikes possible

As inflation has edged higher from 2.63%YoY at the end of 2020 to 3.39% in May 2021, the central bank has raised the policy discount rate twice, once in March and once in June. The rate hike in June (12.5bp) was less drastic than March’s hike of 25bp. The discount rate now stands at 1.5%. More rate hikes by 12.5bp are expected in 2H22 to curb inflation.

Taiwan's central bank policy rate and inflation

Fiscal spending rises to offset damages from Covid

As Covid numbers surged in Taiwan the government handed out fiscal stimulus for consumers and producers. This will continue to put pressure on fiscal health when tax revenues are expected to fall due to lower profits from the semiconductor industry. This may put fiscal health at risk. General government debt was 33.8% in 2020. The fiscal deficit reached a record high of 2.28% of GDP in 2020.

A longer-term issue on fiscal health is that Taiwan’s aging population is a structural problem that has not been addressed by the government. By 2026, Taiwan will have at least 20% of the population aged 65 or above. Tax revenues will shrink and spending on the elderly will increase. The fiscal position will deteriorate more dramatically by 2025.

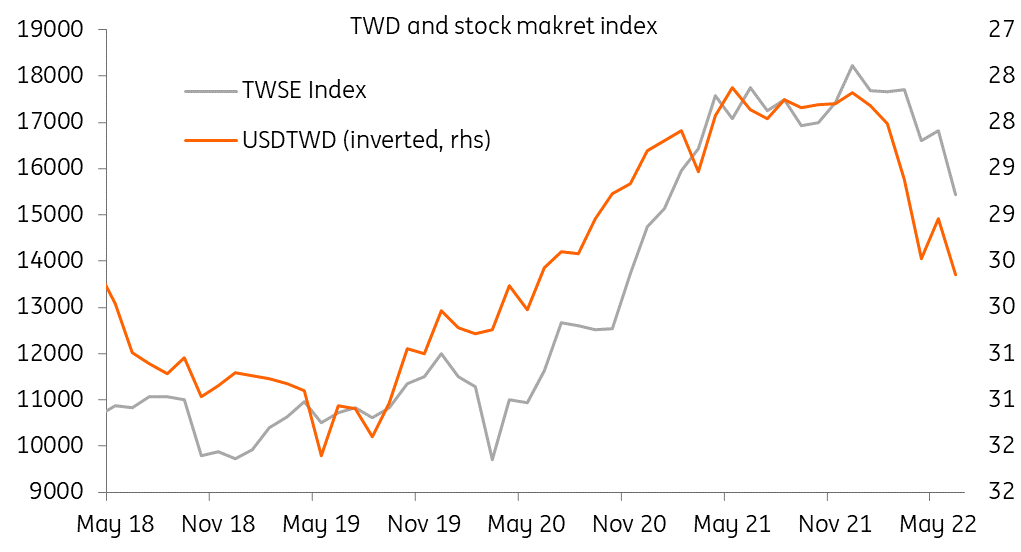

A weak New Taiwan dollar

The New Taiwan dollar (TWD) should be weaker from the start of 2022 due to less appetite for Taiwan equities compared to 2021. The TWSE stock index has fallen by 16% since the end of 2021. This has led to a depreciation of TWD against USD by more than 7.5% as of 24 June 2022. The TWSE stock index and USD/TWD has a statistically significant relationship.

For long-term exchange rate risks, we look at the external position.

Taiwan continues to run a current account surplus thanks to the exports of semiconductors. Even with a softer trade surplus from slower semiconductor sales, Taiwan should still enjoy a current account surplus of more than 20% of GDP.

External debt per GDP is still high at 113%, although this has fallen from more than 130% in 2018. Most of the external debts are corporate debts. Foreign exchange reserves have been about 280% of GDP, which is equivalent to 13 months of imports. The ample foreign exchange reserves indicate that the economy’s structure is stable.

TWD and the stock market

Political risk

Political tension is the key long-term risk faced by Taiwan, and uncertainty about the recovery of consumer demand in Mainland China poses short-term risks to the semiconductor industry and exports. But the external position of Taiwan is strong with a high level of foreign exchange reserves, and it should be able to offset these risks in sovereign rating calculations.

Forecasts

We have revised the GDP growth forecast lower to 3.8% for 2022 from 4.2% previously, mainly because of lower prices and a slower sales growth of semiconductors.

We keep USD/TWD forecast at 29.2 by the end of 2022 as we expect mild capital inflows into the Taiwan stock market nearer the end of the year. Although this indicates a stronger TWD against USD than the spot of around 29.6, 29.2 is a lot weaker than the beginning of the year at around 27.7.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article