Taiwan grows strongly but its dependence on chip production’s a worry

Covid has taken its toll more on retail sales than on manufacturing in Taiwan, but the latter is still at risk. Taiwan depends a lot on semiconductors and production capacity is near its peak due to the global chip shortages. It highlights the interwoven relationship with Mainland China, and the situation isn't expected to change anytime soon

Taiwan GDP slowed from Covid

GDP in Taiwan grew 7.47%YoY in 2Q21, beating the consensus of around 6.5%, but slower than the 8.92% we saw in the first quarter.

The slower growth can be blamed on Covid that has led to a tightening of social distancing measures that at first hit both manufacturing and retail sales, then latterly mostly retail sales as factory workers returned to work.

This quarter was not easy for Taiwan manufacturing as it eventually started to resume operations. Coronavirus aside, the production sector also suffered from water shortages which lead to almost a stop in semiconductor chip production, and electricity shortages that led to blackouts. Even now, Taiwan households come second to factories when it comes to using electricity.

From the chart, we can see that the unemployment rate is still climbing, a result of job losses in the retail and catering sectors because of the pandemic. The gradual loosening of social distancing measures should help the retail sector to recovery, albeit slowly.

Unemployment rate is still peaking, CPI could fall

Chip shortage helps Taiwan to sell more expensive chips

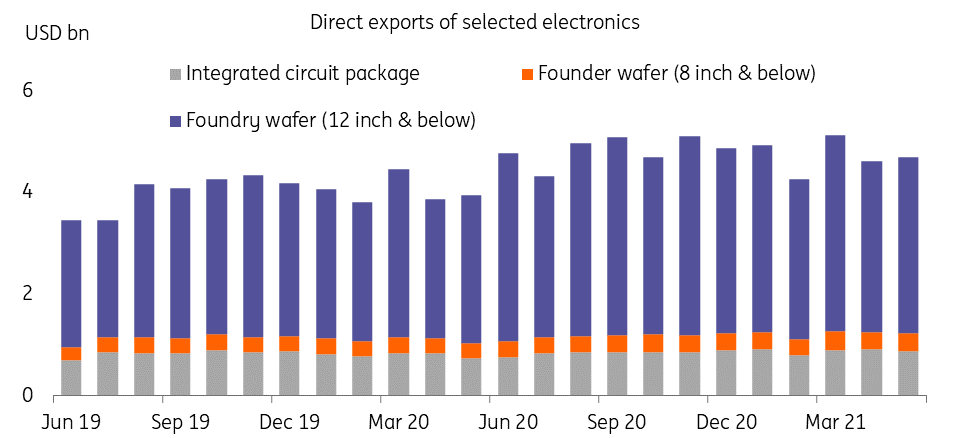

Taiwan's economy depends very much on semiconductor chip production. Chip shortages mean that cheaper electronics are selling out and Taiwan factories have been replenishing stocks with more expensive chips. And when it comes to chips, it's all about the size of the wafer which is essential in the production of integrated circuits.

As you can see in the chart, direct sales of 12-inch foundry wafers dominated the direct sales of all electronics. This is due to the shortage of 8-inch wafers. The bigger the size of wafer, the more expensive it is. And we can see that there have been almost no stocks of the 8-inch wafer. This has pushed users over the world to advance their electronic products.

This has led to a higher export value of semiconductors, and therefore better GDP contribution from the manufacturing sector even it faced difficulties from Covid, water shortages and blackouts.

Direct exports of major electronic items from Taiwan

Electronics inventories

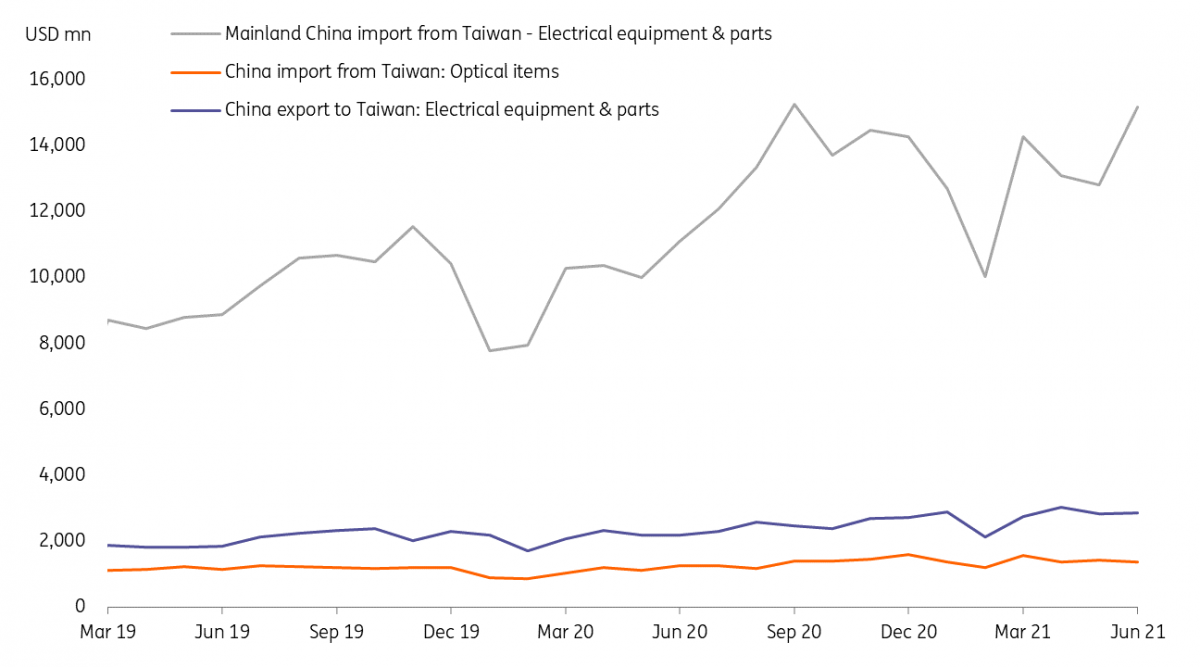

Interwoven production relationship between Mainland China and Taiwan

Taiwan's production capacity is not that much, it cannot increase its capacity in a short period of time. But this may not be a difficult problem to solve because Taiwanese semiconductor companies have factories in various locations around the world, which include Mainland China.

We can see that Taiwan exports electronic equipment & parts to Mainland China. Profits from selling those chips belong to the Taiwanese companies, but the exports of these chips are recorded as exports from Mainland China.

The focused growth engine of Taiwan results in a close production relationship with Mainland China. This is not going to change anytime soon.

Trade of electronics equipment and parts between Mainland China and Taiwan

GDP growth will slow tremendously in 2H21 from high base effect

Taiwan has enjoyed the low base effect in the first half of 2021, and therefore recorded fast GDP growth. This factor will disappear from 3Q21. We, therefore, expect 2.3%YoY growth for 2H21, and 5.2% for the whole of 2021.

Both the upside and downside risks of the forecasts depend on Covid. A positive is that Taiwan can enjoy faster growth if Covid subsides quickly, and so the retail sector can hire more workers, and increase consumption. In contrast, if Covid returns to major export markets, then the needs for semiconductor production will be more uncertain.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

30 July 2021

Good MornING Asia - 2 August 2021 This bundle contains 5 Articles