Swiss economic growth comes to a halt

Swiss GDP surprises again as it contracts by 0.2% in 3Q18 while the consensus forecast was a 0.4% expansion. On an annual basis, GDP grew by 2.4%

Both domestic demand and foreign trade were a drag

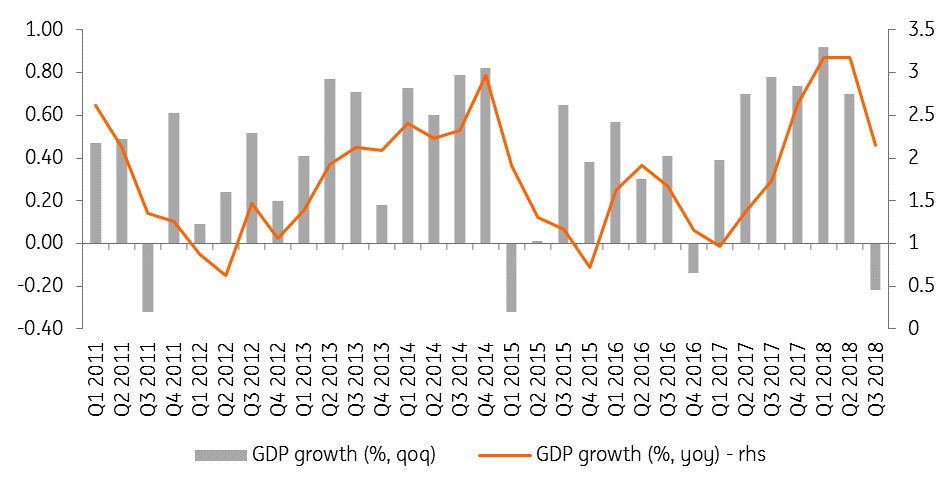

After 0.9% quarter on quarter growth in 1Q18 and 0.7% growth in 2Q18, it is the third quarter in which Swiss GDP has surprised forecasters and markets. But this time, it was to the downside. The -0.2% GDP growth in the third-quarter abruptly interrupted a series of five quarters of above 0.7% QoQ GDP growth and is the worst performance of the Swiss economy since 1Q15.

The contraction of GDP is due to several negative elements - both domestic and external demand were drags to economic growth.

Exports of goods (excluding non-monetary gold and valuables) fell by -4.2% QoQ and exports of services declined by 0.6%. This negative trade contribution is linked to the weak growth observed in Q3 in Europe, and especially in Germany. With 19% of Swiss exports going to Germany, the drop in German GDP, caused mainly by the problems in vehicle production following the change in pollution standards, had a very negative impact on Swiss exports.

However, we expect a rebound in 4Q18, especially in exports of semi-finished and investment goods, which were among the hardest hit in 3Q18. Other one-off factors also played a role including the value addition of the energy sector that decreased severely (-2.2% QoQ) because of the dry summer resulting in lower production of hydropower plants.

Domestic demand also contributed to the fall in Swiss GDP, mainly because of a decline in investment in equipment and software (-2% QoQ). Household consumption hardly increased (+ 0.1% QoQ), as it was still held back by weak real wage developments despite the low 2.48% unemployment rate in October.

Importance of the EU as a trading partner

Therefore, the third quarter once again shows that Switzerland relies heavily on its European neighbours for its growth dynamic. A good economic situation in Europe, easy trade relations with neighbouring countries and a stabilised exchange rate at a reasonable level are therefore keys to strong growth in Switzerland.

Regarding easy trade relations with neighbouring countries, Switzerland and the EU are currently negotiating a "framework agreement" that would replace the 120 existing treaties and would bring more long-term ease for trade between the two entities. The negotiations are extremely complicated, and the Swiss opposition to such an agreement is strong.

But last week, the Swiss voted against "self-determination", in a referendum which proposed to put Swiss laws above all international treaties which indicates that the Swiss aren't fundamentally opposed to peaceful trading relationships with Europe. It is, therefore, a good sign for the negotiations that this vote could help unblocking.

The central bank is likely to stay on hold

Another important point for growth in Switzerland is the value of the Swiss franc, which directly impacts the price of goods and services exported to Europe and therefore the performance of exporting Swiss companies. In this context, one of the main goals of the Swiss National Bank, when it conducts its monetary policy, is to stabilise the value of the franc - a currency traditionally considered a safe haven, at a level that it considers reasonable, which we currently estimate at 1.1 against the euro.

The Q3 data suggests that the central bank will maintain its current monetary policy for a while, which consists in keeping its rates in negative territory and intervening in the foreign exchange markets when deemed necessary. But more than everything, the SNB wants to avoid “excessive” appreciation of the currency.

We, therefore, believe it won't raise interest rates until the ECB has done so, which is why we don't expect any rate hikes in Switzerland before 2020.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more