Switzerland: Economic activity is growing strongly, beating peers

Swiss GDP grew by 7.2% quarter-on-quarter in the third quarter, recouping much of the loss in the first half of the year. Economic activity is now 2% below its pre-crisis level, which is much better than in other European countries

A good recovery for the Swiss economy

After a decline of 1.7% in the first quarter and 7% in the second quarter, Swiss GDP grew by 7.2% QoQ in the third, thanks to the lifting of restrictions put in place to combat the coronavirus pandemic. This is better than the consensus expectation. At the end of the third quarter, Swiss GDP was 2% below its pre-crisis level. The strong rise in GDP is mainly due to household spending, which increased by 11.9% over one quarter to reach 98.6% of its pre-crisis level. Investment in capital goods (+8.8% QoQ) and construction (+5.1% QoQ) also rebounded strongly. Construction even moved above its pre-crisis level. Strong domestic demand allowed imports of goods and services to rebound strongly (+11.2 and +9.9% QoQ, respectively). However, exports did not rebound as strongly. While exports of non-valuable goods rose by 6.9% in one quarter, exports of services increased by only 1.4%. This is due to the much lower number of foreign tourists visiting Switzerland this summer than in other years.

Swiss GDP grew by 7.2% QoQ

Better than European neighbours

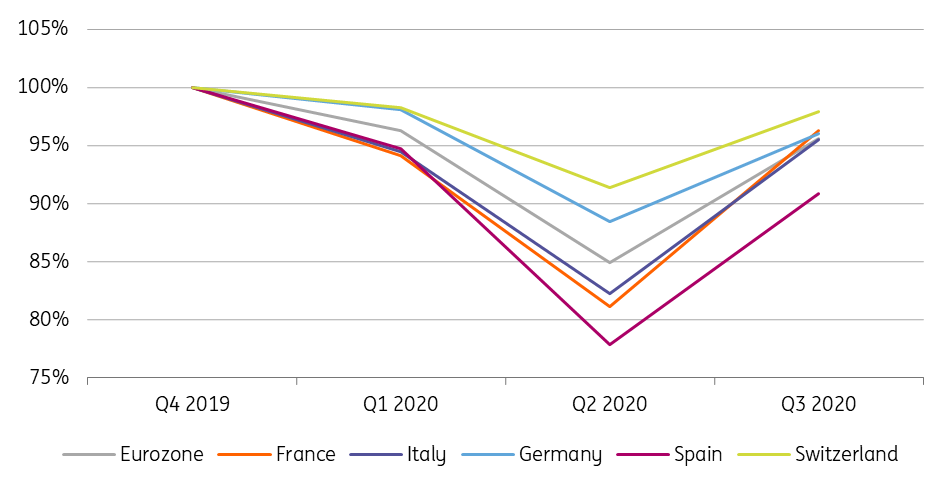

Overall, the recovery of the Swiss economy in the third quarter was very solid. Compared to the situation at the end of 2019, the level of activity in Switzerland at the end of the third quarter was well above that of its European neighbours. The decline observed in the first half of the year was smaller in Switzerland and the recovery was very dynamic. This can probably be explained by a number of factors. The lockdown measures introduced in the spring in Switzerland were less stringent and lasted for a shorter period of time than in neighbouring countries, allowing for a smaller economic shock. Businesses were probably also helped by a very effective deployment of the aid measures put in place by the government. Finally, Swiss exports of goods suffered less and recovered much better than in other countries such as France. This is probably due to the fact that they are traditionally largely oriented towards the pharmaceutical sector, for which the pandemic has had a rather positive impact.

Switzerland is doing better than European neighbours

Prospects for 4Q are less good

Despite this good performance, the Swiss economy is likely to be hit again in the fourth quarter of 2020. Indeed, as in many European countries, the second wave of the pandemic has hit Switzerland hard. Nevertheless, unlike the situation in the spring, the Federal Council has not introduced any strong measures to restrict travel or activities to combat the pandemic. Instead, it left the decision to each region based on its particular health situation. As a result, some localities (including the Geneva region and the Jura) decided to implement a relatively strict lockdown, with the closure of bars, restaurants and non-essential shops in November. Other regions have decided to close only bars and restaurants, while others have requested no closure at all. For the country as a whole, economic activity is therefore expected to deteriorate in November, but not as much as during the spring lockdown. For December, the situation should be better than in November, as non-essential shops were able to reopen everywhere, but not as good as in October. Bars and restaurants remain closed in some areas until 15 December. And the start of the ski season is not expected to be the same as usual. Unlike France, Germany or Italy, Switzerland does not want to close ski resorts for the end-of-year holidays. Nevertheless, limitation measures will be put in place in order to avoid an influx of foreign tourists due to closures in other countries.

All in all, we expect slightly negative quarterly growth in the fourth quarter of 2020. For 2020 as a whole, we forecast a contraction of 3.2% of GDP. The recovery in 2021 should be solid, mainly in the second half of the year once the Covid vaccine eliminates any risk of a third wave of the pandemic. We expect growth of 3.1% for the year 2021 as a whole.

Negative inflation

Switzerland, which is always struggling to keep inflation at a normal level (inflation stood at 0.4% in 2019), saw inflation weaken even further in 2020. Since the beginning of February, headline inflation has been negative every month and even fell to -1.3% in May. Despite the rebound in activity observed in 3Q, inflation has still not been able to recover above 0%. This situation is likely to continue to the end of 2020 and the beginning of 2021. Therefore, for 2020 as a whole, inflation is expected to be -0.7%. In 2021, thanks to the expected economic recovery and a Swiss franc that could weaken slightly, it could return above 0%. We forecast inflation of 0.2% in 2021, with risks pointing downwards.

In this context, the Swiss National Bank can only maintain its ultra-accommodative monetary policy, based on the world's lowest key rate at -0.75% and intervention on the foreign exchange market to weaken the Swiss franc when necessary. We expect a monetary policy status quo at the meeting on 17 December. In addition, we expect this policy to be maintained throughout 2021.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article