Swiss Quarterly: Diplomatic tensions to weigh on recovery

After a weak 2019, the Swiss economy seems to be entering a slight recovery phase, which could be threatened by a series of diplomatic risks. This context, together with extremely low inflation and the expensive Swiss franc, will not allow the Swiss National Bank to change monetary policy in the near future

2019: Not very dynamic

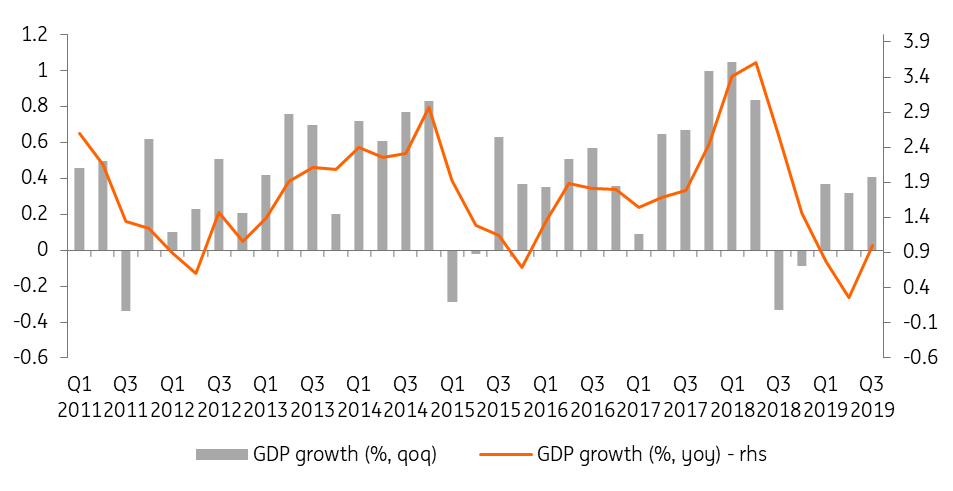

After recording GDP growth of 2.8% in 2018, 2019 was a more complicated year for the Swiss economy and growth is expected to be around 0.9% for the full year (19Q4 figures have not yet been published). As in neighbouring European countries, 2019 has been synonymous with deceleration due to the trade war, the slowdown in global growth and the sharp slowdown in the German economy, its main trading partner. While Swiss industry has slowed down less than in the other European countries, this is mainly due to the pharmaceutical industry, which is currently doing extremely well.

Interestingly, the good performance of the pharmaceutical sector kept Swiss exports dynamic in 2019 (3.9% growth over the year in nominal terms and 9.8% growth for pharmaceutical exports), despite the context of a slowdown in world trade. In particular, trade with the United States was extremely dynamic (exports to the US rose by 9.1% in nominal terms over the year), and the US could even become Switzerland's leading trading partner ahead of Germany. On the other hand, exports of machinery and metals, which are much more cyclical and affected by the exchange rate, are on the decline.

2020: A small rebound expected

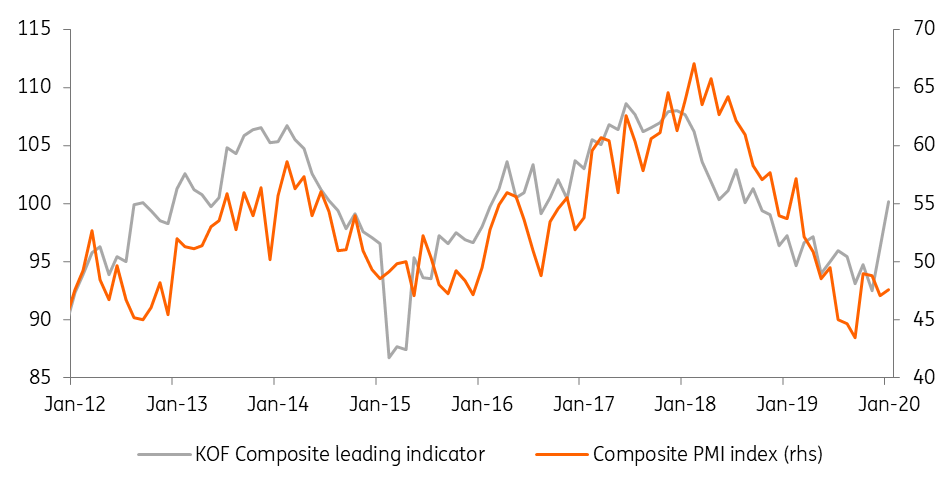

Looking at leading indicators, the KOF Economic Barometer, the most important leading indicator for Switzerland, rose to 100.1 in January from 96.4 in December, after leaping in December. By gaining 7.6 points in two months, it reached its highest level since September 2018 and has now returned to its long-term average. The composite PMI index also rose in January to 47.6 from 47.1 in December, but it still remains below the 50 threshold that separates contraction from expansion in economic activity. Indicators for the manufacturing industry are no longer as unfavourable as before and the outlook for services has improved. Also, external demand appears to be recovering, although the recent appreciation of the Swiss franc may damage the competitive position.

Given the outlook for the euro area and the risks that the coronavirus poses to world trade, exports of goods are expected to remain subdued, while exports of services, boosted by royalty payments and sporting events, are expected to grow more strongly in 2020. Against this background, and given the lower capacity utilisation rate, growth in investment in capital goods is expected to remain lower than its long-term average (1.5% growth forecast for 2020).

On the other hand, consumption is expected to support economic growth (1.1% growth expected in 2020), thanks to the healthy labour market and very low inflation, which supports household purchasing power. In addition, consumer confidence recovered in January. This context of solid domestic demand, and the appreciation of the Swiss franc, leads us to believe that import growth should strengthen in 2020. The outlook for construction investment remains very moderate. Extremely favourable financing conditions continue to support the sector, but weak population growth and rising vacancy rates are weighing on it, which should lead to weak growth in construction investment of around 0.6% for the year.

The Swiss economy can therefore be considered to be in a phase of slight recovery. Nevertheless, the economic outlook remains muted and the risks are tilted to the downside. It should be noted that GDP growth in 2020 will be positively impacted by the effect of major sporting events (Olympic Games and UEFA European Cup), which have a serious influence on GDP due to the important television rights for companies domiciled in Switzerland. These events can increase GDP by 20 to 40 basis points in the year of the events, before reducing GDP by the same amount the following year. Taking these events into account, we expect a gradual recovery in GDP growth over the next two years, leading to a figure of 1.4% in 2020 and 1.3% in 2021.

Political risks

For 2020, the risks to the Swiss economy are primarily international: a weaker-than-expected recovery in world trade or the German economy will have a negative impact on growth prospects. In addition, the coronavirus epidemic could impact the Swiss economy if it were to have a significant impact on the global economy.

However, alongside these international risks, there are also political risks for the Swiss economy, mainly because relations between Switzerland and the EU will again be under strain in 2020. As explained here, Switzerland and the EU are engaged in a process of negotiating a new framework agreement to define their overall relations in the future. These negotiations are in very serious difficulty, despite the pressure put on Switzerland by the EU, which led to Switzerland not being granted stock exchange equivalence at the end of June 2019 (read here). This did not have the desired effect and relations between the EU and Switzerland have become even more tense since this episode.

In 2020, the negotiations are still at a standstill, despite a genuine desire on the part of the new European Commission to speed things up. Pending a breakthrough, the EU has suspended all negotiations on sectoral agreements, which affect electricity, food safety, and even public health. Applying the same strategy used with stock market equivalence (which had no effect), the EU has even warned that Swiss medical technology companies risk losing recognition of the equivalence of their devices.

The problem for the Swiss authorities is that they cannot really negotiate at this time. Indeed, in accordance with Switzerland's specific system of direct democracy, a popular vote will be held on 17 May 2020 on the free movement of people. The SVP party (far right), which is initiating the vote, wants the free movement currently in force with the EU to come to an end and for Switzerland to regulate immigration autonomously. If this initiative wins popular support, the Swiss authorities will be obliged to end the free movement of people within a year. The problem is that the free movement of people is the "guillotine clause" in all agreements between the EU and Switzerland. The end of this principle would therefore endanger all types of relations between the two blocs. Pending the vote, the Swiss authorities cannot make progress in negotiations with the EU and nothing will change between now and then. Moreover, a "yes" to the limitation of free movement would permanently damage all ties between the EU and Switzerland. The potential impact of this referendum is therefore enormous for the Swiss economy and is clearly a risk for the 2020 outlook.

Ever-lower inflation

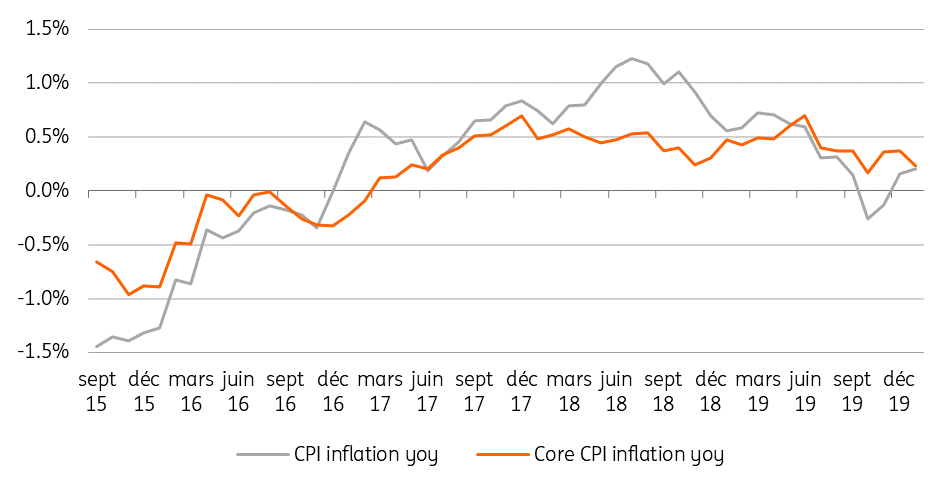

In 2019 as a whole, headline consumer price inflation stood at 0.4% year-on-year, down from 0.9% in 2018. Inflation fell sharply at the end of 2019 and even entered negative territory in October and November, due to the fall in oil prices compared to the previous year and the appreciation of the Swiss franc, which pushed import prices down. Given the recent fall in oil prices and the fact that the Swiss franc has appreciated further in recent weeks to reach the highest level in more than three years, inflationary pressures for the coming months are very low. We expect inflation to be around 0.2% for 2020 as a whole and 0.3% in 2021, forcing the SNB to maintain a very accommodative policy.

More of the same for the SNB

At the December monetary policy meeting, the SNB left its key interest rate unchanged at -0.75% and said it remains ready to intervene in the foreign exchange market if necessary. As with every monetary policy assessment for the last two years at least, it still considers the franc to be highly valued and says the situation on the foreign exchange market remains fragile. Moreover, the SNB has revised its inflation forecasts downwards, at 0.4% in 2019, 0.1% in 2020 and 0.5% in 2021. These downward revisions can be seen as a rather dovish signal from the Bank because the extremely low level of the forecasts implies that monetary policy will remain extremely accommodative in the coming years. With inflation forecast by the SNB at 0.1% in 2020, far from the SNB's target and capable of falling below 0% in the event of a negative shock, the SNB will have no choice but to keep interest rates in negative territory and fight against the appreciation of the franc on the foreign exchange market. As things stand now, no rate increase should be anticipated over the forecast period. We expect the rate to remain unchanged at its current level of -0.75% in the coming years. Nevertheless, risks are tilted to the downside, which means that if the Swiss economy is hit by a negative shock or if the franc appreciates too much, the SNB could be forced to reduce its key interest rate even further, possibly to -1%. This is not our base case, but the risk of a fall in interest rates remains very present.

Currency manipulator?

In mid-January, the US authorities published their "US Treasury FX" report which identifies countries considered to be currency manipulators and countries placed on a watch list for possible currency manipulation. As explained by our FX team here, the US Treasury believes that three conditions must be met to be considered a currency manipulator: (i) show a trade deficit with the US of more than $20 billion, (ii) have a current account surplus of more than 2% of GDP, and (iii) make persistent purchases of foreign exchange of more than 2% of GDP in six of the last 12 months. The problem for Switzerland is that it meets two of the previous three criteria. Switzerland's current account was in surplus above 10% of GDP in 2018 (mainly due to the importance of commissions and trading activities (e.g. metals) and the pharmaceutical sector) and the bilateral trade deficit with the US was over $28 billion in 2019. Boosted by the pharmaceutical industry, Swiss exports to the US have doubled since 2011 and the US is on its way to becoming Switzerland's leading trading partner. In addition, the SNB intervenes regularly on the foreign exchange market.

As a result of these various factors, Switzerland has been placed on the watch list, but not on the list of manipulators, since foreign exchange purchases currently amount to $3 billion or 0.5% of GDP, i.e. less than the 2% limit. That being said, with the rise in risk aversion linked to the coronavirus, the Swiss franc has recently appreciated significantly, with the EUR/CHF falling below 1.07 at the beginning of February for the first time since spring 2017. Against this backdrop, the SNB is likely to be forced to step up its currency purchases in order to limit the appreciation, which would be a very great risk for the already very low inflation rate (-0.1% in the fourth quarter of 2019).

There is therefore a risk that Switzerland will be labelled a currency manipulator in the next US Treasury report, which could lead the way to possible sanctions. This being said, while the risk is real, our FX colleagues do not think that the US will in fact label Switzerland a currency manipulator in the future. Indeed, the SNB's purchases of foreign currencies are far from reaching the threshold of 2% of GDP (this would imply a considerable amount of $12 billion of net purchases in one year). Moreover, the SNB's purchases of foreign exchange are generally one-off and do not meet the US Treasury's criterion of purchasing in six of the last 12 months.

Even in the unlikely event that Switzerland were to be labelled a currency manipulator, we believe this would have no impact on the SNB. Of course, the central bank would prefer to avoid such publicity about its activity, but it's unlikely to change its monetary policy. Indeed, the credibility of the SNB's interventions in the foreign exchange market is extremely important. If it believes that the Swiss franc is too expensive and that this threatens the conduct of its monetary policy, it will probably continue to intervene on the foreign exchange market as it is currently doing, regardless of whether this leads to being labelled a currency manipulator.

The Swiss economy in a nutshell (%YoY)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article