Swedish krona: A forecast revision

We expect the battered Swedish krona to remain under pressure as global trade tensions, domestic politics and low summer liquidity weigh on the currency. We thus revise up our EUR/SEK forecast and expect it to reach the 11.00 level over the next three months

Trade war risk premium to rise again

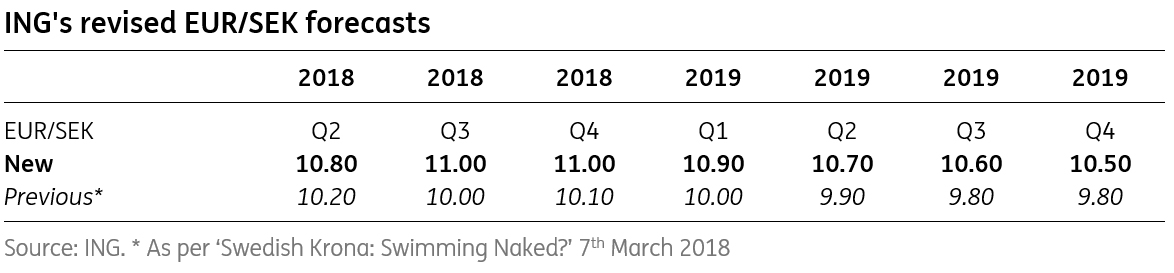

We see further upside risks to EUR/SEK and revise our previous EUR/SEK forecast higher. We look for EUR/SEK to reach the 11.00 level in the next three months and stay there for the remainder of the year.

As per USD: Curb Your Enthusiasm, we expect the theme of protectionism to return in June following the recent calm after the US administration recorded some quick wins, with trade negotiations with Mexico, Canada and South Korea being a good example. As Chris Turner points out, the focus will now turn to China and the EU, as both are preparing retaliatory tariffs should the US go through and implement its threats.

On the Chinese side, it will be late May/early June when President Trump decides which of the proposed tariffs on China will stick. We doubt Beijing can offer enough in early May to significantly water down these tariffs. Instead, we look for a residual of those US tariffs to be implemented in June and the Chinese to reciprocate. These concerns about a global trade war should be negative for the krona.

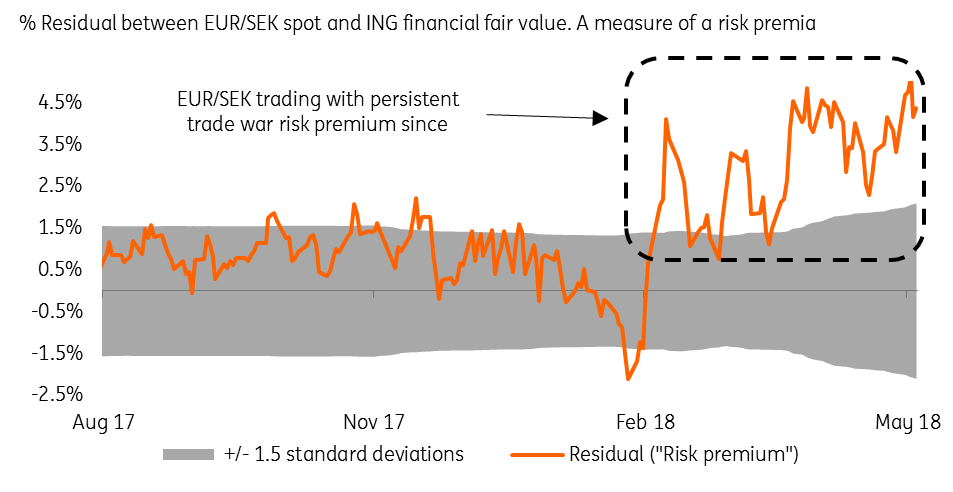

As per SEK: Swimming naked?, we see SEK as one of the G10 currencies most vulnerable to escalating trade tensions due to the openness of its economy (one of the highest in the G10 FX space) and its high beta to global growth. This is depicted in Figure 1 which shows a material rise in the SEK risk premium (against EUR), with the trade war risk premium now being at around 4%.

While extreme, we don’t rule out a further rise in the risk premium given the SEK’s high vulnerability and its cheap funding costs (SEK being the second cheapest G10 currency to short). SEK vulnerability to the global trade tensions was one of the main reasons why we turned bearish on the currency earlier in the year and why we now revise our EUR/SEK forecast even higher.

Persistent risk premium evident in SEK

Dovish Riksbank to remain dovish

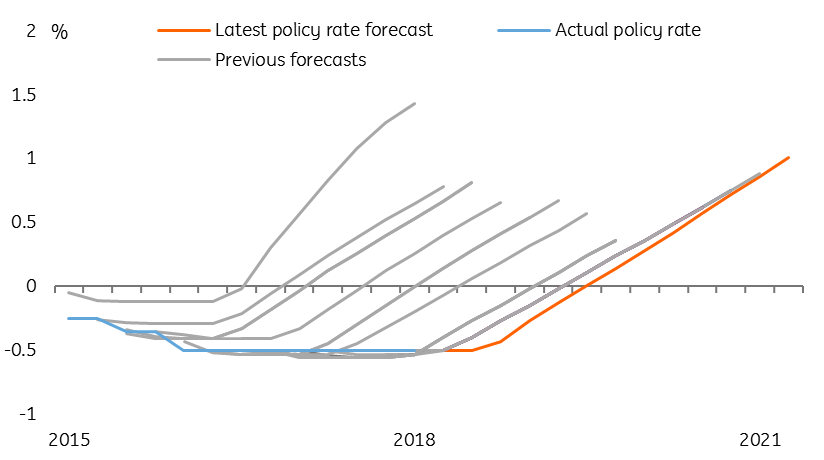

On the Riksbank side, history teaches us that one should assume a dovish stance as a base case. The Swedish central bank has repeatedly pushed back the date for its first rate hike. Its April decision to push the projected first rate hike into December was the eighth revision to the policy rate forecast since negative rates were first introduced in 2015 (Figure 2).

So we have to ask ourselves, what would it take for the Riksbank to change its behaviour and actually deliver a rate hike in 4Q 2018? In our view, it’s hard to see why this time will prove any different. The Riksbank’s dovish bias remains intact and there is little sign of domestic price pressure accelerating to push inflation above 2%.

Rate hike continuously postponed

The bar for a Riksbank response is set very high

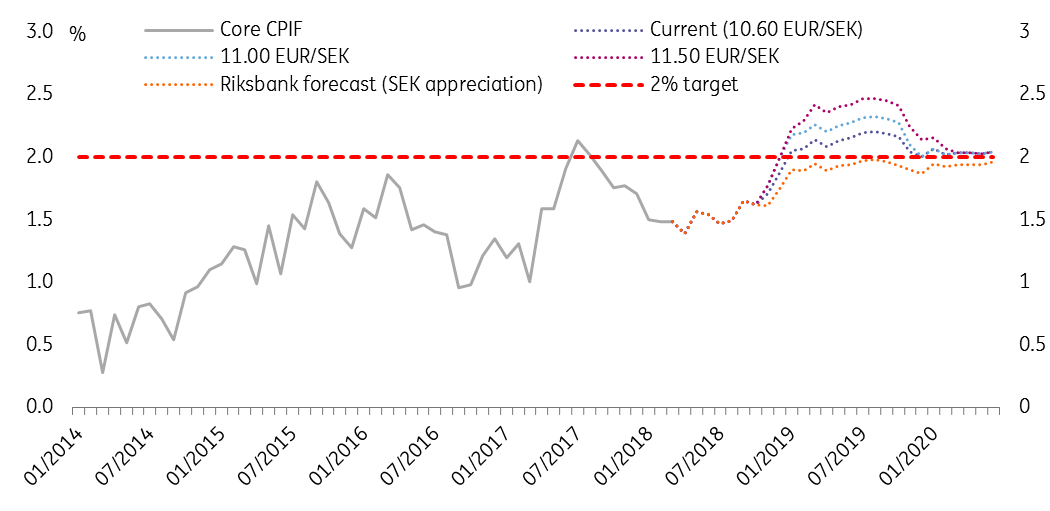

The krona’s latest depreciation could lead to inflation printing above the 2% target towards the end of 2018 and early 2019. However, as we show in Figure 3, a simple projection based on the Riksbank’s latest forecast and different scenarios for the currency suggests that even a further depreciation (i.e. EUR/SEK at or above 11.00) would not necessarily lead to a significant overshoot in core inflation.

Even with EUR/SEK at 11.50, the core inflation would still remain within the +/- 1% tolerance band around the 2% inflation target.

Importantly, as seen in the chart below, this is likely to be a temporary effect and the Riksbank can probably look through above-target inflation were that to be driven by external factors. Hence, we see the EUR/SEK 11.00 as achievable and the journey towards it not necessarily drastic enough to trigger an actual Riksbank response via rate hikes (bar some occasional verbal interventions).

Given its inherent dovish bias, we no longer expect the Riksbank to hike this year (provided SEK does not experience an extreme sell off well above our target of EUR/SEK 11.00) and will only hike next year in line with the ECB in the middle of 2019.

Inflation overshoot limited

Economy to slow down

While the main reason for the Riksbank’s dovish shift this year has been the weaker-than-expected inflation figures in 1Q, the wider Swedish economy also looks a bit softer. Forward-looking indicators have come off and household spending weakened at the start of the year. This is in large part due to the housing market slowdown that started in the second half of 2017. Though house prices have stabilised over the past couple of months, construction is set to slow materially in 2018 and 2019. This will drag overall economic growth down from the 3% average of the past five years.

Though the Riksbank has factored this housing slowdown into its forecasts, we see downside risks to its expectation of 2.6% in 2018 and 2.0% in 2019. The housing market turmoil could easily end up doing more damage to household consumption than anticipated.

And the global growth story, a key support for Sweden’s export-oriented economy, looks a bit less solid than a few months ago. We see a material probability that the Swedish economy slows more abruptly than expected, which would become another reason for the Riksbank to delay rate hikes.

Domestic politics

Another factor that could weigh on SEK over coming months is the upcoming Swedish election in September. The rise of the far-right Swedish Democrats means that neither of the traditional centre-right and centre-left party groupings are likely to win a majority in parliament. That means we are likely to see a repeat of the 2014 stalemate situation, resulting eventually in a weak minority government.

While Sweden benefits from strong institutions and an underlying consensus on key issues among the mainstream parties, political uncertainty could nevertheless provide an additional negative factor for SEK in an environment where investors are looking for any negative headline news to sell the battered SEK.

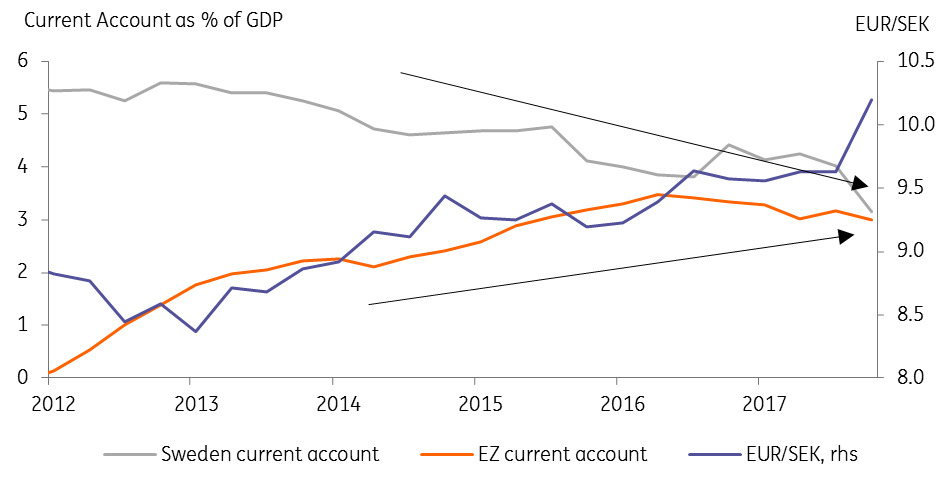

Current account surplus shrinking

As noted SEK: Swimming naked?, the SEK has all but lost the relative current account surplus advantage vs the EUR. The deteriorating Swedish current account surplus (from 4% of GDP early last year to a projected 2.5% by end 2018) contrasts with the Eurozone current account dynamics which remain stable at around 3% of GDP (Figure 4).

As the relative current account positions converge, the krona’s cushion vs the euro fades away, making the currency more vulnerable to the direct effect of global risk sentiment or the relative monetary policy position.

We thus see further upside risks to EUR/SEK and we revise our previous EUR/SEK forecast higher. We look for EUR/SEK to reach the 11.00 level in the next three months and stay there for the remainder of the year.

SEK losing the tailwind of the current account advantage

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

8 May 2018

In case you missed it: Over-reaction and under-performance This bundle contains 6 Articles