Swedish elections: Muddy waters

Swedes go to the polls on 9 September. The election result looks likely to be messy. While Sweden’s economic fundamentals and institutions are solid, we think political uncertainty could add some volatility to the exchange rate in the near term

A stable foundation

Swedish elections are usually fairly staid affairs and historically, have not been all that interesting from a market perspective. When it comes to economic policy, the differences between the mainstream centre-left and centre-right political blocks in Sweden are arguably not all that significant. The centre-left tends to favour welfare spending when in power while the centre-right is more likely to pursue tax-cuts, but both are committed to a sound budget underpinned by a fiscal rule.

Fiscal policy is constrained by a requirement to run a structural surplus of 0.33% of GDP over the economic cycle and keep government debt anchored around 35% of GDP. In practice, this means there is limited scope for any government to pursue radically different fiscal policies. And key long-term decisions (e.g. pension reform) have historically been agreed by consensus among the major parties.

But an unfamiliar situation

This election is unusual though, for two reasons. First, the rise of the far-right Swedish Democrat party has disrupted the traditional left vs right dynamic in Swedish politics, and is likely to make it difficult for anyone to form a stable government after the elections.

Second, this year the Swedish krona (SEK) has become a bellwether for global risk sentiment, depreciating at signs of escalating trade tensions or emerging market stress. The wobbly housing market, a peaking economy, and the ultra-dovish Riksbank have also undermined SEK.

The trade-weighted krona index has depreciated 10% since last autumn. We think that in this environment, domestic political uncertainty could easily become another factor driving SEK volatility.

No one is going to win a majority

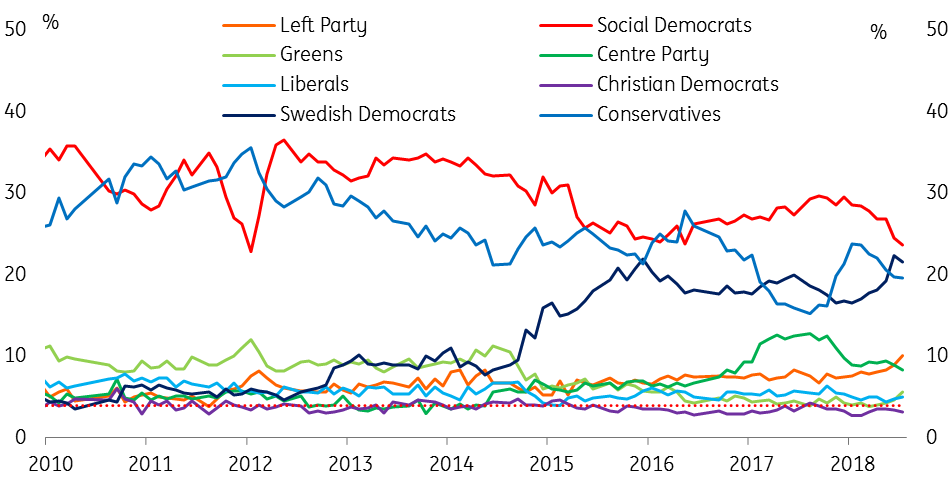

Polls have been pretty clear for some time that neither the current centre-left government nor the centre-right opposition alliance is likely to win a majority in September. Both blocks are polling below 40%, and the leading parties on both sides (the Social Democrats and the Conservatives (Moderaterna) are headed for historically poor showings.

Neither government nor opposition looks likely to gain a majority

In contrast, the populist far-right Sweden Democrats have gone from strength to strength, and are polling around 20% (having only entered parliament in 2010). Some polls even show they could become the largest party, though there is a discrepancy between polls that use self-selecting online panels (which show the far-right winning the largest share) and the standard polls (which have the Social Democrats in first place).

Among the smaller parties, the Greens, the Liberals, and the Christian Democrats are all at risk of missing the 4% threshold for entering parliament. The Christian Democrats, in particular, look to be struggling, though this is a familiar pattern for them and in previous elections they’ve always managed to squeak past the 4% barrier. If one of the smaller parties drops out of parliament it would alter the balance between the two mainstream blocks, but would not leave either much closer to a majority.

Polls by party

Post-election confusion likely

It is hard to say how the post-election negotiations will go. The positions of the main parties during the campaign imply a deadlock: none of the mainstream parties want to work with the Swedish Democrats, the centre-right parties will not govern with the Social Democrats and the Social Democrats will not allow a centre-right government. If the result reflects current polls, these positions imply an impasse.

In 2014 and 2010, neither of the two main blocks had a majority either, but the mainstream parties agreed that the block with the larger vote-share would form a minority government – in effect ignoring the far-right vote.

That is one plausible outcome this time around as well and would result in either a continuation of the current government or a return to the previous centre-right coalition. But there appears to be less willingness on both sides to compromise in this way, and a realisation that ignoring the far-right has only served to strengthen its position.

So two other options are on the table. The Conservatives could chose to govern with support from the far-right. While they have consistently excluded this option, the temptation may become too great post-election (especially if the Conservatives, Christian Democrats and Swedish Democrats win a majority in Parliament).

The other alternative is a centrist coalition led by the Social Democrats with support from the Liberals, Centre Party, and the Greens (and probably implicit support from the Left). A grand coalition between the Social Democrats and the Conservatives is a more remote possibility, given the two parties have always defined themselves in opposition to the other.

In short, the weeks after the election are likely to be very messy. Forming a new government and passing a budget for 2019 could easily take up the rest of the year. New elections, if the deadlock cannot be resolved, are a clear possibility (this almost happened in 2014, and the current situation looks more difficult). That would prolong the period of uncertainty into the first half of 2019.

Economic policy implications

The Swedish economy is doing well. After several years of strong growth, government finances are in good shape (net government debt is below 30% of GDP). Though we see a slowdown ahead, and the potential for a rather nasty downturn if weakness in the domestic economy were to coincide with a global downturn, the immediate situation facing the new government is fairly benign.

Given the fiscal rule, regardless of what shape the next government comes in, fiscal policy will not change materially. Major reforms (a comprehensive tax reform and a new housing policy have been mooted) would likely be undertaken through cross-party consensus, which will be a slow-moving process and likely a story for 2019 or later.

Deliberate disruption (the Swedish Democrats have called for a referendum on EU membership, while the Liberals want Sweden to join the euro) looks unlikely. Neither is a realistic political proposition: polls suggest Swedes are content with the status quo – less than a quarter would support leaving the EU, and less than 20% want to join the euro.

Looking a bit further ahead, a weak minority government could lead to difficulties in some scenarios. If there was a sharp slowdown (for example, due to the housing market taking a turn for the worse, or the global trade war worsening) and difficult decisions had to be taken, a minority government may struggle to take decisive action.

Currency market implications

The election risk premium is already apparent in the option market, with EUR/SEK volatility term structure showing a meaningful kink over the one-month time horizon which covers both (a) the election on 9 September and (b) the likely immediate uncertainty thereafter (note the one-month tenor also covers the September Riksbank meeting). This contrasts with the rather smooth-term structure of other European currencies, in turn pointing to the specific SEK risk premium

EURSEK term structure

EU FX term structure

While EUR/SEK has also been showing a degree of risk premium, it is not extreme (i.e. the misvaluation is still within the 1.5 standard deviation band) and well below the February to May 2018 highs. The lack of an extreme risk premia present in the SEK spot suggests that the krona may experience more weakness in response to the likely hung parliament result and the accompanying uncertainty.

EURSEK Risk premium

We retain our bearish SEK view and target the EUR/SEK 11.00 level by the year-end. The likely political uncertainty following the hung parliament result, the dovish Riksbank, slowing economy, the deteriorating Swedish current account and cheap funding costs should all keep SEK under pressure for the remainder of the year. Needless to say, with Sweden being a small open economy, the spectre of trade wars is a clear negative for SEK.

Although short-term SEK negative, we don’t expect the outcome of the Swedish election to be a structural and persistent negative for SEK (as per above). Rather, its negative effect on SEK should be a matter of months (during the initial phase of uncertainty) rather than quarters. Coupled with cheap medium-term undervaluation, we expect the SEK weakness to trough this year (around EUR/SEK 11.00) and to embark on a very gentle recovery trend next year.

In the relative value space, we continue to favour long NOK/SEK positions as (a) elections will weigh on SEK and (b) Norges Bank rate hike in September will support NOK. NOK/SEK to break above the 1.10 level next month.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

22 August 2018

In case you missed it: De-throning the king This bundle contains 8 Articles