Sweden: The krona’s recovery is delayed again

Despite a hawkish Riksbank, SEK may struggle to recover before next year. Europe’s energy crisis is impacting Sweden both directly and indirectly, while global risk sentiment remains unstable. Riksbank’s FX reserve build-up may also get in the way of a near-term recovery. This week’s general election shouldn't have much impact on the currency

Sweden isn't immune from Europe's energy crisis

Sweden is far from immune from Europe’s energy crisis and rising recession risk. That’s perhaps a little surprising, given Sweden uses little-to-no gas in its power system and uses relatively little for domestic heating either. Instead, the country relies predominantly on hydro (in the north of the country) and nuclear power (in the south). And in the case of the former, reservoir levels are fuller than usual for this time of year, despite drought conditions in much of Europe. That typically bodes well for keeping power prices in check.

But the reality is the energy system isn’t balanced. Hydro-rich Luleå in the north, one of Sweden’s four electricity bidding zones, has typically paid less than 30 EUR/MWh for power in recent months. However, in the much more populous south, which saw nuclear power plant closures last year, prices have topped 300 EUR/MWh in recent days. The reality is that the electricity grid in southern regions is often reliant on imported power, which in some cases comes from gas-powered generation. It’s these areas that account for the vast majority of Sweden’s power usage, and these prices have often proven closely comparable to Germany and other European countries.

Sweden's electricity prices vary dramatically across the country

The bottom line is that Sweden is just as exposed as many of its neighbours to energy price spikes this winter. And that means that, like the eurozone, Sweden is likely heading for a recession – even if it's a mild one. Consumer confidence has hit all-time lows, and real consumer spending has begun to inch lower. A contraction in house prices is also underway, where the sharp rise in mortgage rates is affecting the 40-50% of customers on a floating rate.

Riksbank should remain hawkish

For the time being, this isn’t getting in the way of aggressive Riksbank tightening. The jobs market is exceptionally tight right now, and that’s very important ahead of multi-year wage negotiations due to conclude in coming months. Almost 90% of Swedish employees are covered by collective bargaining, and inflation expectations among both employer/employee organisations have spiked. An agreement that locks in faster wage rises over the next three years, compared to the last set of negotiations that took place in the midst of the pandemic, is likely and is at the heart of the Riksbank’s argument for hiking rates.

We expect a 75bp rate hike at the September meeting, which partly reflects a need to front-load hikes, but is also because the Riksbank has fewer scheduled meetings than many of its counterparts. It has to make each meeting count.

SEK recovery delayed as European growth worries mount

Despite the central bank’s hawkish pivot this year, the krona has been the worst performing G10 currency (-15% vs USD) after the Japanese yen since the start of the year.

The reasons are well known: the Ukraine conflict, the equity sell-off, and an ever-worsening outlook for Europe on the back of high energy prices and inflation. We had held a relatively sanguine approach on pro-cyclical currencies like SEK for most of the year, assuming a rather optimistic base-line scenario for the global economy and risk sentiment. Recent developments have convinced us that what appeared to be short-term woes before the summer are now more serious and long-lasting concerns, especially when it comes to Europe’s recession risks.

The implications for SEK are big. With our economics team now expecting a eurozone recession around the turn of the year and flagging a very elevated risk of the gas supply crisis extending into the next year, SEK’s role as a proxy trade for European sentiment as a whole is set to limit its ability to stage a major recovery.

In our view, this story will prevent EUR/USD from climbing back to 1.05 before early next year, and given SEK’s high sensitivity to Europe’s growth outlook, we forecast EUR/SEK at 10.60 in 4Q22. In the coming weeks, the balance of risks remains tilted to the upside, and a further deterioration in risk sentiment could prompt a re-test of July’s recent high (10.78) and potentially March’s highs (10.86).

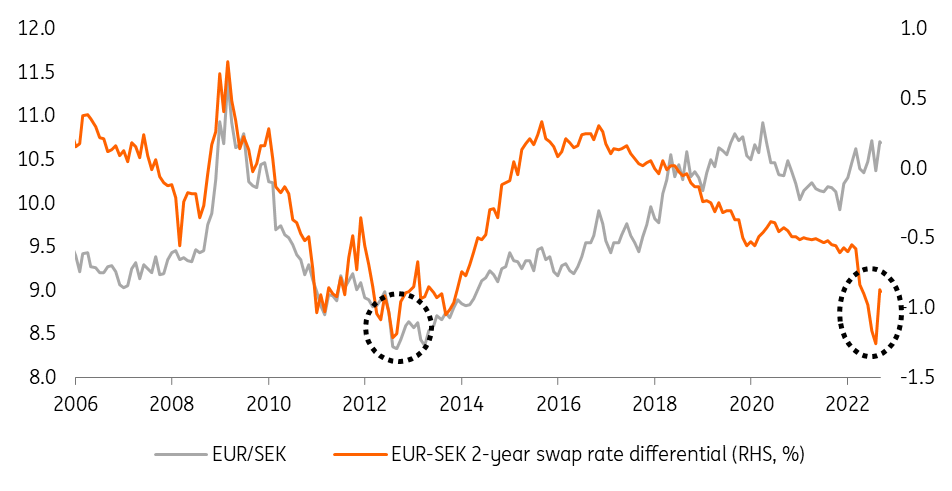

In 2023, some improvement in the eurozone’s story and the end of global tightening cycles should help pro-cyclical currencies, including SEK, to re-appreciate. A calmer market environment may also revamp the search for carry and allow SEK to benefit from its relatively more attractive rate profile compared to EUR. As shown in the chart below, the 2-year EUR-SEK swap rate differential (which mirrors the ECB-Riksbank policy divergence) is the widest in favour of SEK in nearly a decade.

We expect a gradual return to 10.00 over the course of 2023, although geopolitical and energy-related developments do pose non-negligible risks to this profile.

Policy divergence points at weaker EUR/SEK

Riksbank adding pressure on SEK with reserve build-up

While the likes of the ECB and Bank of England are vocally protesting against their weak domestic currencies, the Riksbank’s acceleration in FX reserves build-up since February (from SEK 5.5bn to SEK 11.6bn per month) may well have exacerbated SEK weakness. Even more crucially, it does send a counterintuitive signal to markets as a weak currency neutralises the anti-inflationary effects of monetary tightening.

However, Riksbank’s Deputy Governor Martin Floden recently ruled out any tweak to FX purchases as – he said - reserve management is independent from monetary policy.

Assessing the effective impact of the Riksbank’s FX purchases on SEK is quite hard, especially in a period of elevated FX volatility. Since the end of 1Q22, the Riksbank’s foreign currency reserves have risen by SEK 88bn, and if the reserve composition has remained the same as of April 2022 (chart below), and we exclude valuation effects, the Riksbank would have sold around SEK 55bn versus USD and SEK 18bn versus EUR in five months.

We think the ongoing FX build-up could help keep a cap on SEK in the near term, but we doubt that would be able to counter any strong macro-driven recovery in 2023.

Riksbank has accelerated FX reserves accumulation

Election unlikely to have material impact on currency

Sweden goes to the polls on Sunday, and it’s looking highly uncertain. The incumbent Social Democrats are polling at roughly the same level as in 2018 at roughly 30%. But broken down by the two potential broad coalitions or groupings, it’s virtually neck-and-neck. Having said that, the impact on the broader financial market is less clear.

Economic issues haven’t dominated the campaign, and perhaps surprisingly it’s crime and the country’s migration policy, that has instead been the central focus. And while the election has the potential to deliver a more right-leaning government, Sweden is among the most favourable towards the EU among member states, according to Pew Research.

A tight election race

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article