Swap spreads and supply: Bond issuance pressure

2023 brings a big ask for private investors: to increase their exposure to government bonds due to plentiful supply and quantitative tightening. Higher yields will help to drum up demand but expect cheapening relative to swaps

EUR gross issuance is on the rise again amid uncertain outlook

There is a great sense of uncertainty surrounding the eurozone countries' funding outlooks for next year. Many government support measures to shield households from surging energy bills are only now taking shape; how much support is eventually needed will depend on the development of energy prices. Furthermore, when governments submitted their budget plans to the European Commission, most were pencilling in a reduction of general government deficits. Of course, elevated inflation will continue to support the revenue side, but the growth assumptions in most plans, while lower compared to 2022, still look relatively optimistic for 2023.

Issuers, of course, also have the option of tapping into funding instruments other than bonds. The issuance of bills could still gain importance. These are often increased first in case of unforeseen additional funding needs. At the same time, the desire to hold precautionary liquidity buffers may be dampened by the ECB ending the remuneration on government deposits, so that running down these still sizeable cash holdings may contribute to keeping a lid on other funding. Currently, these deposits stand at around €500bn, though they also include non-central government and EU holdings.

General government deficits seen to improve

EUR net supply to private investors also determined by the ECB

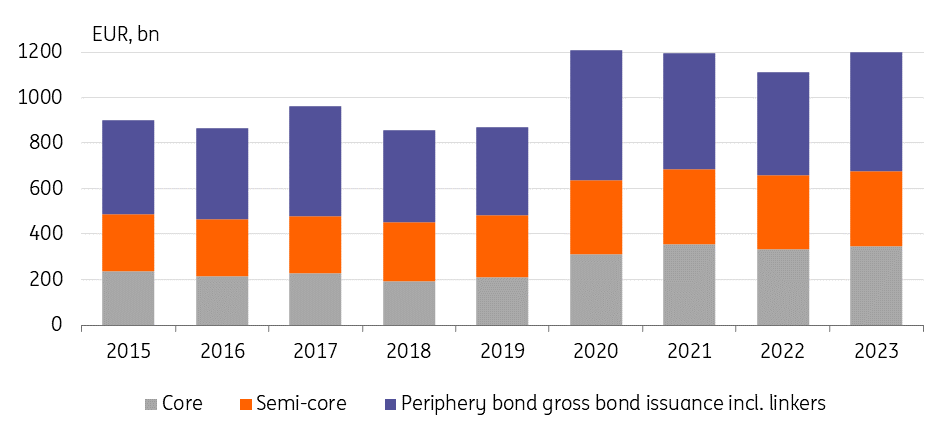

Taking into account preliminary plans and rising bond redemptions for 2023, we see gross European government bond issuance in the vicinity of €1.2tn, thus still below 2021 and the 2020 peak. Compared to this year, it would be an increase of at least €85bn, though with risks that it could turn out even higher. In net terms, the increase should be less daunting, as we still see net issuance remaining below €400bn after €385bn this year.

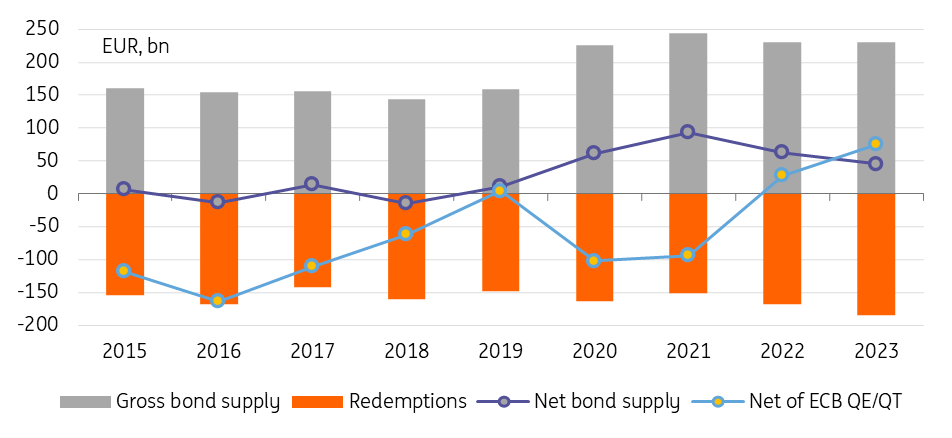

For European government bonds in aggregate, the relatively stable net issuance implies that the ECB should be the main swing factor in determining what private investors will eventually have to absorb. ECB public sector net purchases in the sub-group of countries we observe here were still at €187bn in 2022, but in 2023, the ECB could now well reduce its holdings by €120bn if reinvestments under the Asset Purchase Programme are phased out next year. Net issuance to private investors would thus rise from around €200bn to above €500bn. Note that on a country level, the ECB’s flexible Pandemic Emergency Purchase Programme reinvestments could dampen the net impact for the periphery, while aggravating it for core issuers.

EGB gross issuance increases towards prior peaks

EUR collateral scarcity eased by sizeable rise in German net supply

Among core issuers in the eurozone, Germany is one example of how alternative funding sources have been employed when tackling the pandemic and now, the energy crisis. The debt agency is relying increasingly on repo markets as a flexible funding tool and has only recently increased its own bond holdings by €54bn for use as collateral. The gradual sale of these own holdings also adds to funding, previously around €20bn per year. This helps to keep gross German government bond issuance relatively stable. Press reports have suggested that net issuance next year will come in at €45bn, well above the previously flagged €17bn. This, however, is below the €61bn foreseen for this year, which should keep gross issuance at around €230bn in 2023 despite higher bond redemptions.

German net issuance to private investors could double to €75bn in 2023

German issuance receives more scrutiny as German Bund supply goes to the heart of current collateral scarcity issues plaguing the market. How much is available to private investors is of course very relevant so it is more important to look at the net change of issuance, including the impact of the ECB. The ECB still bought a net €46bn of German public sector securities under the Public Sector Purchase Programme and PEPP in 2022. With the ECB slated to begin only partially reinvesting redemptions of its PSPP portfolio possibly in the first half of 2023, we estimate that this could contribute around €30bn to the net supply available to private investors. Keep in mind that when looking at Germany specifically, ongoing reinvestments under the PEPP could also be increasingly redirected away from Germany towards countries in the periphery.

Adjusting the flagged €45bn of German net issuance for the impact of the ECB, we could see the effective net issuance to private investors more than double from around €30bn in 2022 to €75bn in 2023 – importantly not yet accounting for shifting PEPP reinvestments next year. Note this estimate requires assumptions about the actual share of Bunds in the ECB’s German public sector holdings.

Significantly positive German net issuance to private investors

The balance is finally shifting towards tighter Bund swap spreads

Collateral scarcity has been an important factor that has kept Bund yields at much lower levels than swap rates. Expensive repo rates for German Bund collateral in money markets propagate out the yield curve, meaning that spreads to swaps of more than 80bp have been the norm. But now the German debt agency is itself seen as more active in the repo market and effective net issuance is about to pick up. At the same time, the quantity of excess reserves in the system chasing the same collateral pool is about to decline. One remaining uncertainty concerns the development of government deposits at the ECB, which could still be redirected into the market for collateral once they are no longer remunerated by the central bank after April next year.

Of course, the supply of collateral is but one factor. Risk aversion is a typical driver of wider asset swap (ASW) spreads. While we have seen some positive developments over recent weeks, the lingering concerns surrounding systemic risks and unstable geopolitics will mean an ongoing healthy appetite for safe assets. At the same time, the hawkish stance of the ECB means that demand for duration risk will remain subdued, at least so long as there are no concrete signs of a policy pivot. ASWs have tended to evolve in a very direct fashion with outright yields.

Looking ahead, we do see the balance of factors further tilting towards tighter Bund ASWs. We have pencilled in a target of 75bp for the 10yr spread.

QT and more German debt supply will chip away at bond scarcity and at wide swap spreads

US issuance to remains heavy in 2023, and the recession won't help

The US redemptions schedule shows a $2.6tn funding need in Treasuries and $160bn in TIPS for the calendar year 2023. For the fiscal year ending September 2022, there was a fiscal deficit of $1.4tn. For 2023, the fiscal deficit is projected at 4.6% of GDP, yielding a cash need of some $1.2tn. Adding this to the redemption amount sums to an all-in financing need of some $4tn for calendar year 2023 (noting that the official numbers are fiscal year ones).

For 2023, the fiscal deficit is projected at 4.6% of GDP, yielding a cash need of some $1.2tn

This results in a rounded $1tn gross issuance requirement per quarter to finance long-term debt (excluding bills rollover). This is a heavy schedule, but not unusual relative to the large funding needs required since the pandemic and its aftermath. It’s enough though to rationalise a continued yield discount in longer-tenor US Treasuries relative to the SOFR swap curve. And further ammunition for this comes from the Fed’s balance sheet roll-off, as this adds to the volume of Treasuries circulating in the marketplace.

US swap spreads impacted by supply, corporate issuance and Fed cuts

The shape of the US swap spread curve is heavily inverted, and this should remain so through 2023. The nuance is 2yr SOFR trading above 2yr Treasuries (+10bp), and then SOFR rates trading through Treasury yields further out the curve, with the 5yr at -20bp, the 10yr at -25bp and the 30yr at -75bp. The structure of the SOFR curve is in part responsible here, but that’s not the dominant reason, as we see a similar progression of swap spreads when we use the Libor curve (which gets killed in mid-2023).

The weight of US Treasury issuance added to the balance sheet roll-off should maintain a Treasury yield discount to the SOFR curve

The weight of US Treasury issuance added to the balance sheet roll-off should maintain a Treasury yield discount to the SOFR curve for most maturities, and indeed there is a prospect for some widening here. At the front end, and let’s say the 2yr explicitly, there is likely to be some volatility. Currently, the 2yr Treasury yield is below the 2yr SOFR rate, as the Fed peaks in the first quarter, the 2yr Treasury yield is more likely to gap lower in anticipation of future cuts, widening the gap between 2yr Treasuries and 2yr SOFR, perhaps by some 10bp.

That spread should narrow back though as the Fed actually begins to cut. Either way, expect more volatility in the 2yr swap spread, at least compared with longer tenor swap spreads that are liable to drift wider as a theme for 2023. That said, ultra-long tenors are very susceptible to big flows, and can cause quite dramatic moves in swap spreads. This is typically driven by receiver interest in 30yr swaps, driving swaps spreads wider.

Corporate issuance is also relevant for mid-tenors, as this can correlate with fixed rate receiving

Corporate issuance is also relevant for mid-tenors, as this can correlate with fixed rate receiving as they swap to floating while interest rates fall. Issuance should be subdued in the early part of the year as rates are high and spreads are wide. Later in the year, even if spreads remain relatively wide, all-in rates should be dragged lower as the Fed cuts. That should encourage issuance, and fixed rate receiving, pressuring swap spreads deeper negative (SOFR rates further below Treasury yields).

Private investors are asked to increase their gilt exposure significantly in 2023

UK supply: the debt tsunami is still to come

Budget matters have jumped to the top of the list of worries for rates investors in 2022 - and in a spectacular fashion in the case of the UK. Developed economies are grappling with a toxic mix of rising debt, soaring interest rates, and pressure to shield consumers from a spike in energy costs. All have a detrimental effect on fiscal balances, and so on debt sustainability. In the previous decade, quantitative easing shielded markets from the jump in bond supply to be absorbed by private investors. This time is different. The Bank of England is not only sending borrowing costs skywards, it is also competing with the Debt Management Office (DMO) for demand for bonds, by running quantitative tightening (QT) in parallel.

The BoE is also competing with the DMO for demand for bonds

The result should be an unprecedented cash draw on investors, to the tune of £165bn in FY 2023-24, compared to a previous peak of £105bn in FY 2020-21. Legitimate questions can be asked about their willingness to take on more interest risk. But we think a better question is at what price, rather than whether they will be willing to buy. Higher interest rates are a powerful incentive for would-be buyers, provided the perceived risk doesn’t increase. Recent budget consolidation decisions and, for foreign investors, a more stable currency are helpful. The more risk-averse investors will probably wait until the peak of this tightening cycle.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Interest ratesDownload

Download article

10 November 2022

Rates Outlook 2023: Belt up, we’re going down This bundle contains 9 Articles