Sustainability reporting overhaul: unpacking the European Commission’s Omnibus proposal

The European Commission wants to tear up its existing sustainability reporting rules to cut the administrative workload by 25%. While the changes could ease the burden on corporations, banks are likely to encounter challenges related to data availability, regulatory uncertainty, and reporting costs

The European Commission is proposing to overhaul its rules on how companies disclose their sustainability efforts in a bid to cut red tape, ease the burden on businesses, and boost competitiveness.

The suggested changes to the three sustainability reporting Directives aim to slash the number of entities required to report by a staggering 80% - a move that could benefit many corporations but create more nuanced challenges for banks.

Our analysis from a sample of 140 banks across 15 European jurisdictions shows that the new rules would lift the reporting burden for roughly a fifth of the banking industry, with half of our Nordics sample falling out of scope and about a third of it in Belgium, the Netherlands and Germany, a 15 to 35 percentage points (pp) change to the current levels.

But while that's good news for smaller banks, the proposal also suggests that a significant share of banks’ clients won’t be reporting their sustainable data. This could be less positive for banks that still fall under the scope of the Directives, as banks inherently rely on their clients' data for their own reporting. Banks still in scope could face several challenges, such as data availability and reliability issues, as well as legislative uncertainty.

An Omnibus to streamline EU sustainable reporting directives

At the end of February, the European Commission’s proposal to overhaul the Union’s sustainable reporting directives drew considerable attention. Using an Omnibus package—the Union’s legal mechanism for merging and streamlining multiple policies—the Commission aims to simplify the European Sustainable Reporting Directives. However, by doing so, the proposal introduces changes that somewhat alter the essence of these policies.

The idea of an Omnibus package targeting EU sustainable policies was announced by Commission President Ursula Von der Leyen back in November 2024. It targets three sustainable reporting policies: The Corporate Sustainability Reporting Directive (CSRD), the Corporate Sustainability Due Diligence Directive (CSDDD) and the European Taxonomy. In addition to that, it also introduces changes to the Carbon Border Adjustment Mechanism (CBAM) policy. In this piece, we review the proposed changes to the reporting Directives before turning to the impact those could have on the European banking sector.

The proposed changes

The eagerly awaited Commission proposal for the sustainability Omnibus was disclosed in February for both the CSRD and the CSDDD. As for the EU Taxonomy, a draft proposal was shared and submitted for consultation during a four-week period ending on 26 March. This section dives into the changes proposed.

CSRD: A major reduction in scope

The European Commission has proposed significant changes to the Corporate Sustainability Reporting Directive (CSRD), suggesting a staggering 80% reduction in its scope. The current policy outlines a gradual expansion, aiming to include nearly all entities ranging from large corporations to listed SMEs by the end of 2029. For this year’s disclosures, only corporates and financial entities with over 500 employees were in scope and reported under the CSRD for the financial year 2024 (wave one).

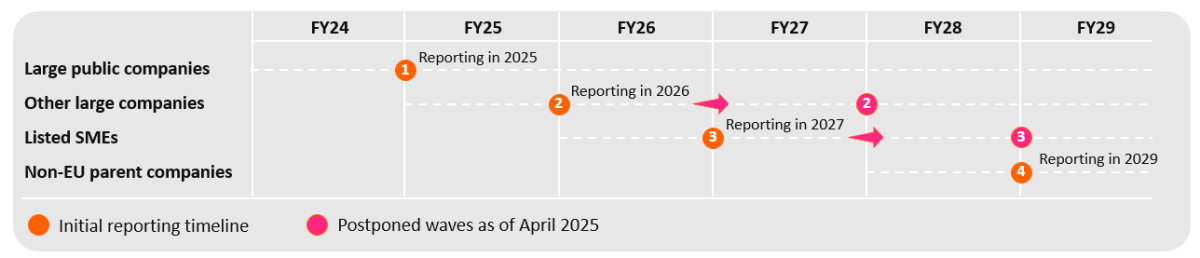

The enforcement timeline is visualised in the graph below and also reflects the proposal to delay the second and third waves as part of the ongoing Omnibus discussions. This amendment was approved by the European Parliament on 3 April and subsequently by the Council 10 days later. As a result, the changes will be implemented and incorporated into Member States' regulations by December 2025.

Current enforcement timeline of the CSRD

Including the postponement of wave two and three

The Omnibus proposal aims to significantly cut the CSRD’s final scope to include only enterprises with over 1000 employees and either a turnover above €50m or a balance sheet above €25m. Consequently, all smaller entities and listed SMEs would be exempted from any disclosures on their activities’ impact on environmental and social factors. This not only means that entities originally scheduled to fall within scope in the coming years will no longer be included, but also that a significant portion of entities already in scope will fall out of it.

For non-EU entities, the threshold would also be raised to reflect the general changes. Consequently, foreign entities would be required to report under the CSRD at the group level once they generate €450m within the EU. At the branch level, reporting would be required for revenues of €50 million, while subsidiaries would adhere to the same obligations as EU entities.

Considering the major drop in entities required to disclose their sustainability information, the Commission suggests introducing proportional standards for voluntary use. This is already in place for non-listed SMEs, which fall outside the initial scope of the CSRD. These standards would thus be expanded to a wide range of institutions and developed by the European Financial Advisory Group (EFRAG).

Significantly reducing the scope of the CSRD is not the only change the Commission is willing to implement through the Omnibus package. The proposal further extends the value-chain cap to entities with up to 1,000 employees. This implies that entities in scope of the CSRD will not be able to request data from their business partners who fall within the cap. This poses a particular challenge for financial institutions, which inherently rely on client data for their own reporting but we will come back to this later.

In addition to that, the Commission proposes eliminating sector-specific standards and removing the option to go from limited to reasonable assurances. Regarding the European Sustainability Reporting Standards (ESRS), the proposal doesn’t dive much into the specifics but aims to improve the current templates. This includes clarifying the materiality assessment and significantly lowering the number of data points to be collected. These changes would be implemented through a Delegated Act, to be adopted within six months of the Omnibus package's entry into force.

CSDDD: A change in the due diligence focus

For the Corporate Sustainability Due Diligence Directive (CSDDD), the Commission proposes aligning its implementation scope with that of the CSRD, also significantly reducing the final number of corporates required to disclose. The other major change in the proposal concerns the definition of business partners only as direct suppliers. This marks a change in the core ambition of the Directive by stepping away from requesting full value chain transparency and instead focusing on direct partners. The Commission proposes to keep the disclosure requirements for the full value chain only in cases where plausible adverse impact risks are identified.

While financial institutions don’t have to disclose their downstream value chain under the CSDDD, the Omnibus proposal remains relevant for the sector. This is because it recommends removing the option to extend the Directive to financial services, thereby ensuring that the sector will remain outside the Directive's scope—removing its inclusion as a potential future possibility.

The Commission also proposes the creation of “reality checks” on a bi-annual basis to ensure the dialogue between the regulator and entities in scope. In addition to that, the monitoring interval would be extended from an annual basis to a five-year basis. The Commission would also like to remove the minimum fine cap in case of infringements as well as the possibility to enforce a national civil liability clause.

EU Taxonomy: An optional disclosure

The draft Taxonomy proposal includes an even more significant cut in the enforcement scope. In the current policy, entities falling under the SFDR and the CSRD have to disclose their Taxonomy eligibility and alignment. The Commission proposes to take an extra step, besides the CSRD scope alignment, by implementing an opt-in clause allowing entities with over 1000 employees but a net turnover below €450m to disclose under the Taxonomy. This implies that all entities with a net turnover of less than €450m will be exempted from the Taxonomy disclosures, even if they have over 1000 employees.

Additionally, the executive arm of the Union proposes a materiality threshold set at 10% of the denominator KPI, allowing entities in scope of the Directive to focus their reporting effort on the largest chunk of their activity.

Surprisingly, while the Green Asset Ratio (GAR) was heavily criticised for its current structural asymmetry, the current draft only focuses on excluding entities outside the Directive's scope from its calculation. In addition to that, it proposes delaying the inclusion of trading books, fees, and Commission KPIs in the denominator until 2027. The draft document does specify that further work on the GAR would be proposed through a Delegated Act, without specifying any further details or timeline.

Proposed changes in a nutshell

Corporate Sustainability Reporting Directive (CSRD):

- Reduction of the final scope by 80%. Scope lowered to entities with at least 1000 employees and either a turnover above €50m or a balance sheet above €25m.

- For non-EU entities, group level disclosures required once €450m is generated in the EU, the branch level is in scope when €50m is generated.

- All entities out of scope would have the option to disclose through a proportionate standard for voluntary use.

- Extension of the value chain cap up to entities with 1000 employees.

- Removal of sector-specific standards and removal of the possibility to go from limited to reasonable assurance.

- Changes to the ESRS proposed through a Delegated Act to be adopted in the six months after the enforcement of the Omnibus proposal.

Corporate Sustainability Due Diligence Directive (CSDDD):

- Alignment of the scope to the CSRD.

- Removal of the option to extend the scope to financial entities.

- Definition of business partners only as direct suppliers with the full value chain disclosure only required in the event of plausible adverse impacts.

- Implementation of bi-annual reality checks with the regulator.

- Extension of the monitoring interval from one to five years.

- Removal of the minimum fine cap and the national civil liability clause in case of infringements.

European Taxonomy draft:

- Scope reduced more than for the other Directives through an opt-in option for enterprises with over 1000 employees and a net turnover below €450m.

- All entities outside the opt-in scope or not wishing to disclose their Taxonomy alignment would be out of scope.

- Inclusion of a minimum threshold for disclosures at 10% of the denominator KPI.

- Postponement of the inclusion of the trading portfolio, fees and commission KPIs in the GAR to 2027.

Variable impact for the banking sector

Now that the proposed changes have been laid bare, let’s look at the impact this could have on the banking sector. We identify three channels through which these changes would affect the European financial sector.

1. Smaller banks falling out of scope

Starting with the change in the Directives’ scope, the European Commission suggests reducing the number of entities required to disclose under the different sustainability Directives by 80%. As this number includes both corporate and financial institutions, we deemed it necessary to draw a more precise picture of the change for the banking sector specifically. Therefore, we built a sample of 140 banks from 15 European jurisdictions. This includes both significant institutions directly under the European Central Bank's supervision as well as less significant ones regulated by the National Central Banks. Germany and Italy are the most represented countries in our sample, with 22 and 14 institutions, respectively, followed by France and Austria.

Number of banks included in the sample by country

Based on the average number of employees of these institutions, we were able to estimate the number of entities currently in scope of the Directive as well as the number that could fall out of it following the Commission’s proposal.

The graph below shows an estimation of each country’s share of banks that would fall out of scope of the CSRD when applying the Commission’s proposal. While the Norwegian sample shows the highest share of entities not required to disclose under the current CSRD, Finnish banks would see the highest share of institutions not in scope following the Commission’s proposal. Overall, the highest impact would be for Nordic countries (except Sweden) with over 50% of banks sampled falling out of scope of the CSRD when using the Commission’s proposed threshold. Those would be followed by Belgium, the Netherlands and Germany, in which about 30% of the sample would be out of scope, a 15 to 35 percentage points (pp) change to the current levels.

On average, the proposed threshold change would imply a 16pp increase in the share of institutions not in scope of the reporting directive at 24.8%. In nominal terms, it means an increase to 36 institutions from the current 12.

Estimated share of banks out of scope from the CSRD, pre and post Omnibus proposal

The national differences highlighted here partly stem from the constitution of the banking sector in each jurisdiction. Countries with a large number of small national banks will automatically show a higher share of entities out of scope. Additionally, our sample does not include the entire European Banking sector. Therefore, while the graph gives an idea of such change to the directive, it should also be taken with a pinch of salt.

Despite not giving an exact representation of the banking sector, the results derived from this sample indicate that the proposed change in scope would lift the reporting burden for about 17% of our sample, which is currently in scope of the policy but could fall out of it. However, for the rest of the institutions, this is not necessarily good news. This brings us to the second impact: the reduction of available data.

2. Lower data availability

As mentioned earlier here, banks inherently rely on client data for their own disclosures. The current CSRD plans a gradual increase of the Directive’s scope. This automatically implies a gradual improvement in data availability. Indeed, the more corporates in scope of the Directive, the more data collected and available for banks to use for their own sustainability disclosures. With the drastic reduction in entities required to disclose under both the CSRD and Taxonomy, the banking sector is unlikely to experience improved access to critical data.

To address this challenge, financial institutions have two solutions: first, they can develop bilateral agreements with their clients to gather and share the necessary data points. However, considering both the one-off cost of implementing the required systems and the longer-term maintenance costs, it is difficult to imagine the benefit this would represent for corporates out of scope. In addition to that, corporates falling under the value chain cap are in no way obliged to gather and share such data with their credit institution.

Secondly, financial institutions could make use of more proxies to compensate for the lack of data from their clients. While this solution would offer the benefit of limiting costs, the current state of the Directive limits the use of such proxies. To be a realistic option, the regulator should review and loosen those limits to allow a broader use of these methods. Additionally, relying on proxies could raise questions about the reliability of the data, as it would not accurately reflect the true state of banks' books.

In light of the two current options, one thing remains certain: with the Commission’s Omnibus proposal, the European banking sector would not see its data collection costs decline in the coming years.

3. Legislative uncertainty

The design and implementation of both the CSRD and the European Taxonomy imply significant costs for the European banking sector. This includes one-off costs to set up the systems necessary for the disclosures as well as data gathering expenses, workforce development and time. While those costs are non-negligible, they were known to the sector. The initiation of the Omnibus package brought the sector back to the early 2020 situation, where the only certainty is that the sustainability reporting requirements will change over the coming months or years. However, both the timeline and actual changes remain unclear.

The cost of legislative uncertainty is especially important for the set of smaller credit institutions that might fall out of the scope of the Directives. Indeed, these entities face two choices: either continue investing in the development of systems to gather the necessary data and potentially face sunken costs if and when falling out of scope. Alternatively, they could prematurely decide to halt all efforts to align with the European Directives but potentially face fines if that is not the case.

In addition to this, estimating the time that the Omnibus finalisation will require remains an arduous task. The last time the EU made use of the Omnibus package (successfully) was on the topic of agricultural provisions back in 2016. In that case, the legislative process took nearly two years to conclude. Therefore, despite the Council’s willingness to “fast-track” the discussions on the topic, it remains difficult to truthfully estimate a timeline.

The next step

While the Commission promised that the Omnibus proposal would reduce the reporting burden for corporates by 25%, the three impacts highlighted here paint a slightly different picture for the European banking sector.

The scope reduction will allow part of the European banking sector to stop (or never start) reporting under the CSRD and the EU Taxonomy. Nonetheless, it also implies that a significant share of banks’ clients won’t either. The cost reduction associated with some banks falling out of scope is, in our view, not equivalent to the data accessibility gains that would occur upon the full implementation of the current CSRD scope.

By drastically reducing the scope of the reporting directives, the Commission is taking away banks’ plans to rely on their clients’ available data. The enforcement of the Commission’s proposal would have a mixed impact on the banking sector. Institutions falling out of scope would benefit from the reduced requirements, while those remaining within scope could face rising reporting costs over time, driven by challenges in tethering data.

In addition to this, parts of the Commission’s plan are less clear. These include the proposed changes to the ESRS, such as a reduction in the number of required data points and clarification of the materiality assessment. However, no further details have currently been provided as these changes would only take place after the Omnibus has come into force. Therefore, it is difficult to concretely estimate the gains these would represent for the banking sector.

The situation is similar when it comes to the GAR. The Commission’s text mentions further improvement to the ratio, without giving additional information on the direction of the said rework. What is known, however, is that while the GAR was initially designed to give investors an overview of banks' sustainability in one ratio, the Commission’s proposal would significantly change that. By slashing the scope of entities included in the calculation, the GAR will be reflecting only a small part of a bank’s portfolio. And this, of course, only for institutions still required to disclose under the EU Taxonomy at all.

The GAR is not the only part of the sustainability reporting Directives that would see its essence or final objective change with the Omnibus. Indeed, the executive arm of the EU is also changing direction when it comes to value chain transparency within the CSDDD.

While the proposal only represents the Commission’s view, the general scope reduction signals the EU’s strategic shift away from its comprehensive and rigorous reporting standards. The question remains: will this change in focus slow the EU’s path towards a sustainable transition, or are sustainability disclosures not actually necessary to make that transformation?

In the meantime, several steps remain before the finalisation of the sustainability Omnibus. Indeed, the package will go through the ordinary legislative procedure, which implies that the current proposal needs to be reviewed by both the Parliament and the Council before the start of the trilogue negotiations. Once those negotiations are complete, the package will still have to be voted on by the Parliament, after which it will enter into force. In short, this is only the start of the discussions.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article