The growing demand - and need - for more US sustainable finance

Sustainable finance has morphed from being a quirky Europhile-type obsession to an obvious discussion point on the agenda of virtually any major financing decision. It has successfully found a firm foothold in the United States in recent years. But how much of a big deal is it in America?

A new tone on the environment from the US administration

Tackling environmental issues is an important part of Joe Biden's Covid stimulus plan. When you look at the sections on climate change, he wants to spend a trillion dollars over an 8-year period on sustainability projects and public-private partnerships are key to this. It's expected that the private sector embraces the initiatives which include renewable energy, electric vehicles and wider decarbonisation of the economy. The other half of the aggregate $2tn plan is also full of socially responsible elements too.

A key positive here is that US policy on sustainability is now coming from the top

A key positive here is that US policy on sustainability is now coming from the top. It may need more stick (carbon taxes) than carrot (grants and partnerships) for it to prove really effective at long term de-carbonisation, but there is a clear swing of the policy pendulum relative to the previous administration, one that is positioning itself to embrace the need for action on climate change.

A positive underpinning factor is that Corporate America had been embracing many of these ideals through their funding programs; more of a bottom-up approach to sustainable thinking. The Biden plan in that respect cheerleads the existing ambition for Corporate America to do more. And there is room to go further still.

How the US stacks up in the sustainable finance space

Long gone are the days where discussions on sustainable finance were sidelined as a parallel but mostly academic endeavour. US corporates, and indeed the wider issuer base, have increasingly endorsed the advantages that come from engagement with socially constructive projects, even where the politics have at times moved strongly in the opposite direction. Participants will be that bit more receptive still as the wider policy pendulum swings back towards growing projects that are applicable for sustainable financing.

Remember, the size of the global bond market (brown and green) is $128tn. The area of sustainable finance is small in proportion, with cumulative issuance to date of $1.6tn globally, equating to 1.25% of the global bond market capitalisation. That said, it's growing rapidly.

| $1.6tn |

Size of global bond market in green, social and sustainability1.25% of the global bond market |

Of the global bond market (for all bonds, deep green to dark brown), 26% originated in the US, and issuance profiles are broadly reflective of this.

As for sustainable finance, we find that US-based issuers of all guises have accounted for some 19% of global issuance in green, social and sustainability bonds in recent years. So, the US representation is slightly below what is typical in brown bonds, but not by much.

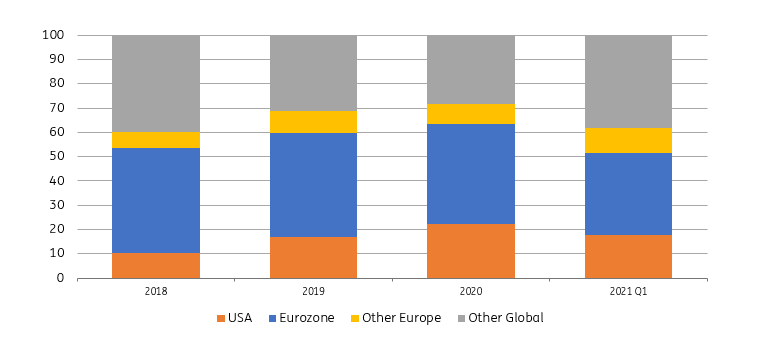

Global issuance in sustainable finance ($bn)

The overall proportion of US sustainable financing in fact fell to 15% for 2020, but partly on account of outsized Covid-inspired social bond issuance by non-US entities. But the absolute volumes rose, to $110bn (which includes loans of some $32bn).

| 15% |

Sustainable finance bond issuance by US domiciled entitlesAs % of global total (2020) |

For the first quarter of 2021, bond issues from US entities ran at $34bn. That's not far off half the total amount we saw in 2020, so the pace has quickened. That said, the US proportion of global issuance in sustainable finance has slipped to 11%. It's too early to read too much into this, apart from noting that issuance in this space remains very much on the up.

And when we narrow it down to corporates?

So far we've looked at bond issuance from all entitles. So what happens when we narrow it down to corporates?

The global corporate bond market capitalisation is $41tn, of which some 27% is in US corporate debt, and this is reflective of issuance proportions. And corporate issuance in sustainable finance is running at about 1.8% of global market capitalisation, globally.

Corporate issuance in sustainable finance as proportion (100%)

Digging a bit deeper into pure corporates (excluding financials), some 22% of wider sustainable finance issuance coming from US-domiciled corporates. That is up from 17% in 2019.

| 22% |

Sustainable finance bond issuance by US corporatesAs % of global total (2020) |

The proportion of US corporate issuance as a proportion of global is back down to 18% for Q1 2021, but the absolute amount of US corporate issuance in the first quarter is already running at half the total issuance seen in 2020 as a whole.

Adding loans to the narrative

The numbers for US corporates get even more interesting when we include loans. In 2020 there was $21bn of sustainable finance corporate loans. In just the first quarter of this year that is already running at $16bn, and the proportion of US corporate loans versus global ones in this space has shot up to 23% (from 16% in 2020). That's a significant build in sustainability-linked loans which is underpinning this growth.

| 23% |

Sustainable finance corporate loansAs % of global (Q1 2021) |

In terms of global size, by way of guidance, the amount done in corporate sustainable finance-orientated loans has been running ahead of bonds, at $168bn in loans for 2020 compared with $114bn for bonds.

So, this market is not all about bonds, there's an important dimension coming from loans. Total cumulative borrowing all things considered is running at $2.5tn (compared with $1.6tn for bonds).

| $2.5tn |

Cumulative global loans for sustainable finance purposes |

How Municipalities and the Treasury stack up

Compared with the global market capitalisation of government and semi-government bonds at $87tn, the green, social and sustainability size is small, representing just 0.6%. But, the official sector is becoming a bigger player, and especially in the past couple of years.

The green, social and sustainability size is small

The US has not been a significant player there though, accounting for just 8% of wider sustainable finance issuance across all public issuers globally. The proportion is higher if we focus on Green issuance. In this space, the US accounted for 16% of issuance when compared with global public sector green bond issuance.

The dominant reason for the lower showing of the US in the overall numbers is the under-representation in social bond issuance. The US has issued bonds that could have been eligible and earmarked as social bonds, as the Treasury must finance Covid-impacted projects. Europe has been dominant here in marking out bonds specifically directed at such projects.

There's a similar theme in the supranational space. Here there has been an explosion in social bonds issuance. Partly Covid-induced, this has exploded to $55bn for 2020 from just $1bn in 2019. Such issuance has been euro dominated. Of the $55bn done, only $5bn was denominated in US dollars, and of this just $2bn originated in the US.

The big picture

The first quarter of 2021 has been busy and the US is keeping pace. Big USD issuance shows there is room for much more

Looking at the all-in summary numbers, there was $757bn of sustainable finance issuance in 2020 (bonds and loans). Of this, US-domiciled entitles issued $110bn. That equates to a 15% proportion for the US.

Global USD-denominated issuance from all entities globally was practically double this, at $212bn. In Q1 2021, the proportion of USD-denominated issuance rose further to 32% (from 28% in 2020). There is clearly demand for USD denominated bonds with a sustainable finance twist.

US issuance in Q1 2021 is impressive, at $55bn. That, in just one quarter, is half what was seen over 2020 as a whole. However, that is just keeping pace with what is happening elsewhere, as the proportion of US borrowing in sustainable finance remains at 15% (bonds and loans).

Bottom line, while about a third of overall sustainable finance issues is denominated in US dollars, issuance from US-domiciled entities is running at under a fifth (of global issuance). So, it's good that the pace is being kept up, but the rise in USD issuance shows there is a solid market out there for more.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

19 April 2021

What a wonderful world This bundle contains 6 Articles