Supply chains strains continue to hold back US output

Industrial output is rising, but supply chain strains mean that manufacturers are struggling to keep pace with orders. In an environment of robust consumer demand this is leading to more and more shortages and the risk of higher and higher prices

Output rises, but it should have been better

US manufacturing output increased 0.9% in May versus the 0.8% consensus, but there were some hefty downward revisions with April now reported as having seen output grow 0.1% versus the 0.5% rate initially reported.

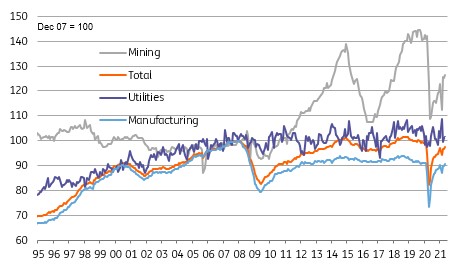

US industrial output levels December 2007 = 100

The details indicate manufacturing rose 0.9% month-on-month as autos rebounded 6.7% MoM from a period of weakness while utilities rose 0.2% and mining posted a 1.2% increase. This leaves manufacturing output 0.7% down on the pre-pandemic peak, having fallen 19.8% peak to trough from January to April last year. This is an encouraging story with all the lost output set to be fully recovered within the next couple of months. Nonetheless, the long term structural headwinds are underlined by the fact that output peaked in December 2007 – fast approaching 14 years ago.

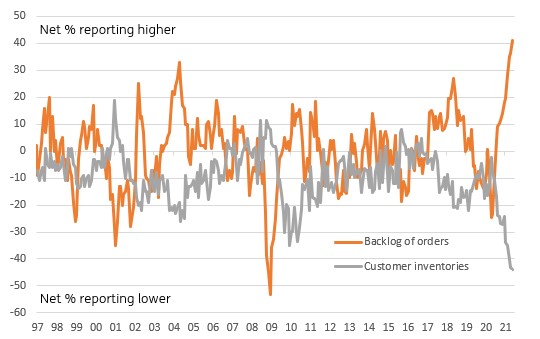

That said we remain upbeat on growth and job prospects for the sector this year since the Institute for Supply Management has reported that new orders continue to grow strongly, but supply chain issues appear to be holding back production. This is resulting in a record for order backlogs so there is plenty of opportunity for output growth and job creation.

ISM backlog of orders hits new highs while customer inventories are at record lows

Supply chain strains imply more inflation risks

Our bigger concern in the near-term is that the supply chain strains continue far longer. Manufacturers already suspect that their customers may be becoming more desperate with inventories at record lows, as indicated by the ISM time series in the chart above. In an environment of robust consumer demand ongoing shortages mean that prices can rise even more rapidly.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article