Sugar: Tighter times ahead

It’s Sugar Week in Brazil, and players are eager to know when the expected supply deficit for 2019/20 will start to be reflected in prices. We might have to wait a bit longer; the market needs to drawdown large stocks, and the threat of significant Indian exports is keeping people nervous

The shift back to deficit

The global sugar market is set to return to a deficit of around 5mt in the 2019/20 season having spent the last two seasons in surplus. The change has been driven by lower YoY output from the likes of India, Thailand, the EU and Central-South Brazil. Declines in India, Thailand and the EU has been driven by a combination of poor weather and lower planted area. While in CS Brazil the reduction is driven by the fact that mills in the region continue to favour ethanol production over sugar.

Given the deficit outlook for this season, one would expect that to be broadly constructive for prices. However, looking at price levels and the fact that speculators continue to hold a sizeable net short position in No.11 sugar all show that this is clearly not the case. So why the disconnect between tightening fundamentals and prices?

There are two key factors which are keeping the lid on sugar prices

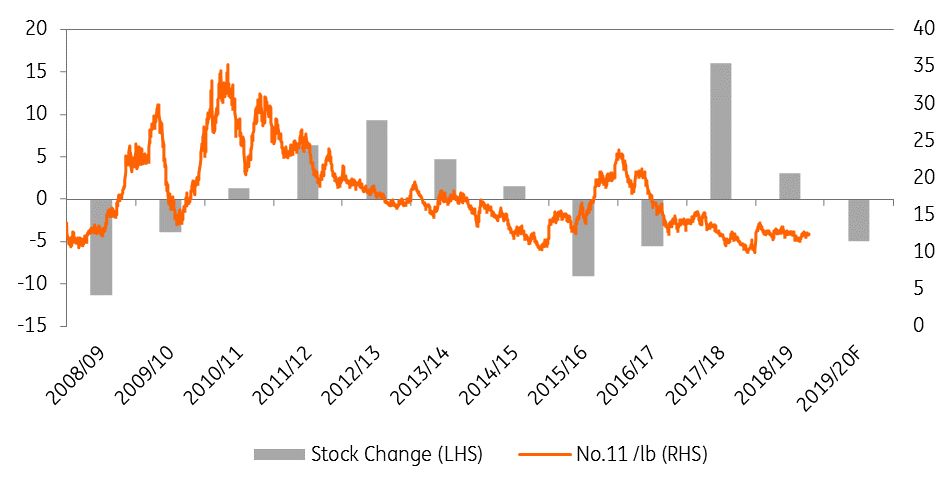

There are two key factors which are keeping the lid on sugar prices. Firstly, we have come out of a two-year surplus period, where we saw a significant buildup in stocks, and so we would need to see a drawdown in these stock levels before one can get overly bullish about the market.

Secondly, India is key for market sentiment. While India is set to see a smaller crop this year, they are still expected to have a surplus, and so adding to the already high stock levels in the country. These stocks will remain a risk to the world market, and so prices are unlikely to move significantly above export parity levels, unless the world market needs this sugar. For the moment, it seems, it doesn't.

Saying that, we do hold a mildly constructive view on the market, and are forecasting that No.11 will average USc13.30/lb over the course of 2020, as we move deeper into deficit. Obviously, key to this assumption is that we do not see any upside surprises to production, or India increasing subsidies to shift domestic sugar to world markets more quickly.

Global sugar stock change (m mtrv) vs. No.11 sugar price

Brazil: Maximising the ethanol mix

The peak of the harvest in CS Brazil is now behind us, and it won’t be long until we see mills starting to wind down for the season. The 2019/20 season has once again seen the Brazilian industry maximising the ethanol mix, given the more attractive returns on offer. The cumulative cane crush through until mid-October stands at 510.3mt, up 5% YoY. However, if we look at cumulative sugar production over the same period, it stands at 23.7mt, up just 1% YoY. The key behind this difference is the mix, with 64.69% of cane going towards ethanol production, compared to 63.89% at the same stage last year. Industry body, UNICA, expects that sugar production this season will total 25.5mt, which would be 1mt lower than the levels produced last season.

At least for now, it makes little sense for sugar prices to trade above ethanol levels given that it would send the signal to producers to adjust their mix accordingly, and produce more sugar. Although saying that, given we are moving closer towards the end of crushing season, there would be limited impact to the mix for the remainder of this season. Where it could have an impact is on the 2020/21 harvest.

Brazilian ethanol demand is performing strongly

In a surplus market, the ethanol parity level should generally offer a ceiling for world market prices, whilst in a deficit market with low stocks, the ethanol parity level should be a floor for sugar prices. Currently ethanol parity is around USc13.80/lb.

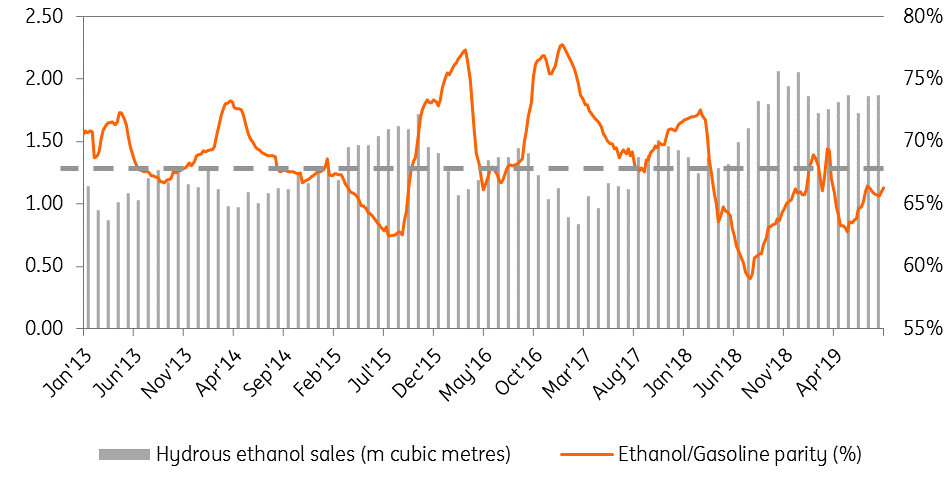

Brazilian ethanol demand is performing strongly, according to consumption numbers reported by ANP, cumulative hydrous ethanol consumption over the first eight months of 2019 totalled 14.49b litres, up 26% YoY. The growth in demand looks even more impressive when compared to 2017 when demand for the same period totalled 8.56b litres. This amazing growth in demand is driven by the fact that, from a price point of view, it makes sense for motorists in Brazil to fill up with hydrous ethanol rather than gasoline. A general rule of thumb is that if the ethanol/gasoline price parity is 70% or below it is advantageous to switch to ethanol- with ethanol having around 70% of the efficiency of gasoline. At the moment hydrous ethanol prices are 66% of gasoline prices, while over 2017 this parity averaged 71%.

Brazil hydrous ethanol sales & parity

India: The export threat

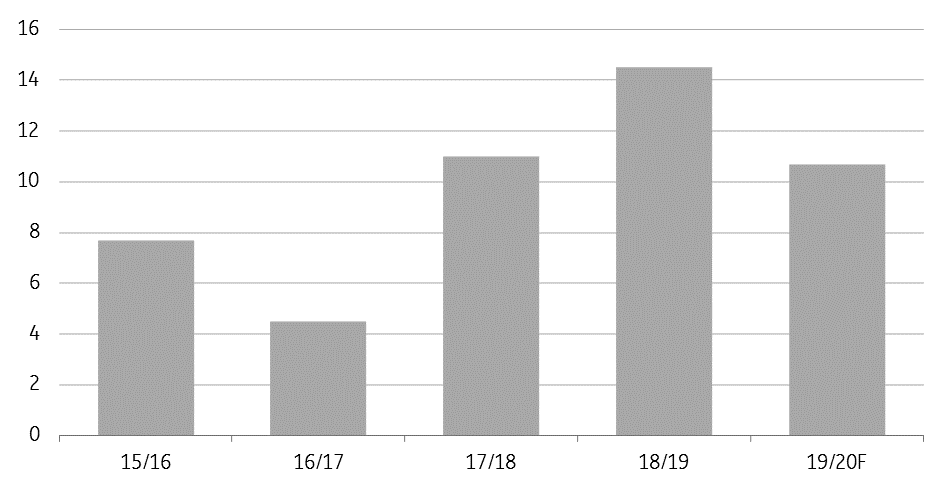

India remains a key driver for the market, and over the past two years it has become even more important, taking the number one spot for the largest sugar producer, moving ahead of Brazil. India is estimated to have produced a record 33mt in the 2018/19 season, which saw domestic stocks growing for yet another season, and ending the marketing year at around 14.5mt- equivalent to 55% of annual consumption. The government provided export subsidies to export 5mt of sugar over the season. Volumes, though, have fallen short, coming in below 4mt.

Indian export levels should provide a cap on the market for the time being

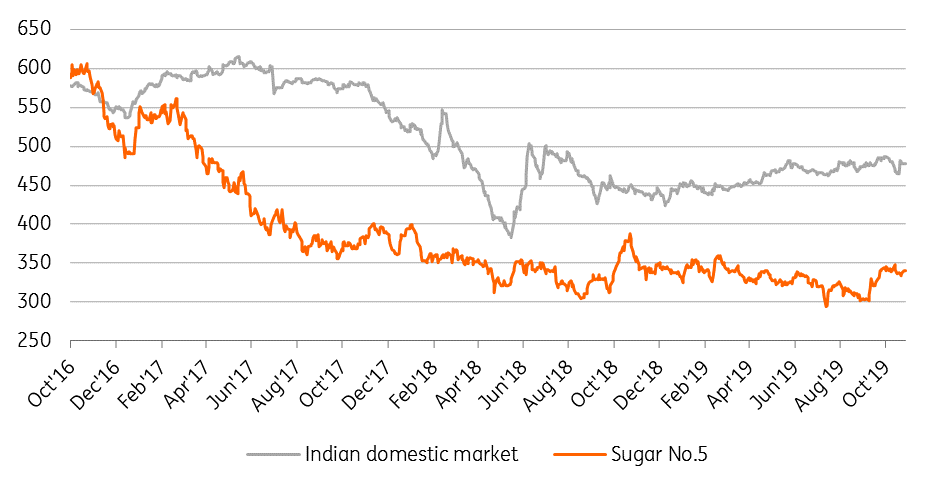

For the current 2019/20 marketing year output is expected to fall, with previously poor rainfall and low reservoir levels in Maharashtra impacting plantings. As a result, output is expected to total 28.2mt this season. Unfortunately for the bulls, this is still in excess of domestic consumption of around 26mt. So in the absence of exports, India would see another season of stock building. Aware of this, the government has provided another financial package to the domestic sugar industry, in the form of export subsidies, which work out to about US$150/t for 6mt of exports. Indian export levels should provide a cap on the market for the time being, at least until we get to a stage where the market needs this Indian sugar. Taking into consideration the export subsidy, and factoring in transportation and fobbing costs, export parity is in the region of US$20/t above current No.5 white sugar levels.

Sugar No.5 vs. Indian domestic price (US$/t)

Indian sugar ending stocks (m tonnes)

EU: Another tight season

The outlook for the EU market is more constructive, with the EU balance sheet set to tighten even further this season, which should continue to see prices strengthening. The European Commission estimates that planted beet area this season decreased by 5.5%. Sugar yields are expected to increase from 10.9 t/ha to 11.4t/ha YoY, although this is still significantly lower than the 12.7t/ha seen in the 2017/18 season. This should see sugar production for the 19/20 season total around 17.5mt, down from 17.6mt last season. We highlight further downside risks to this number though, with the Commission revising EU beet yields down even further to 71.3t/ha just this month. That has widened the gap to the 5 year average of 75.1t/ha.

This will leave ending stocks for the 19/20 tight at around 1mt, which should continue to support EU sugar prices. As a result of a tightening balance sheet, we are likely to see a fall in sugar exports once again this season - at the moment the European Commission is estimating exports for the season at 1.4mt - taking us back towards pre-2017 sugar reform export levels, and down from 1.6mt in 18/19 and significantly lower than the 3.35mt exported in 17/18.

We are likely to see imports also picking up to ensure adequate supply in the region. As usual these imports will be limited to only preferential sugar imports, and so reflecting flows under a number of TRQs, along with EBA/EPA imports from ACP countries. For the moment, the Commission is forecasting that imports in the marketing year will total 2mt, up from 1.85mt last season, but still below pre sugar reform levels of around 2.5mt.

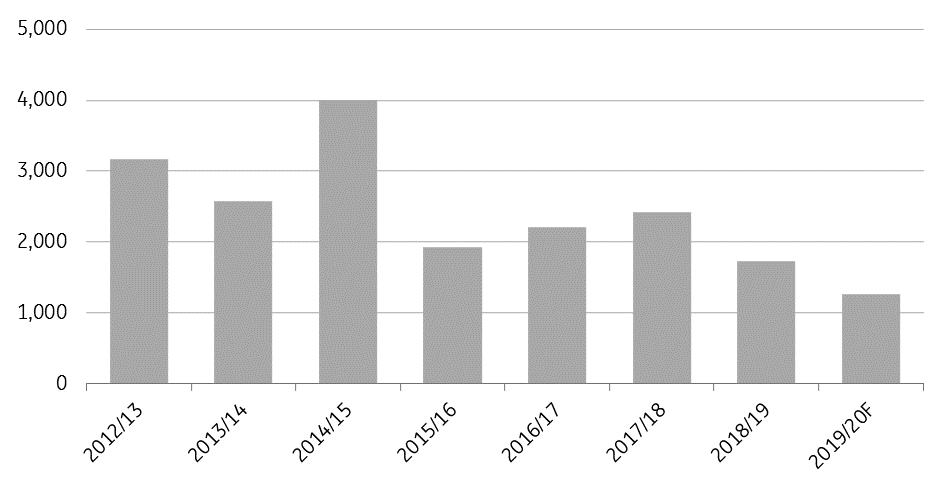

EU sugar ending stocks

China: Demand pickup in 2020?

Finally on the demand side, a key market to look at is China. Over the last couple of years, Chinese import demand has disappointed, with the government imposing prohibitively high imports on out-of-quota sugar imports. Historically the import duty on these imports was 50%; however, this was hiked to 95% in 2017 and has been gradually reduced since then to 85% currently. This higher duty is set to expire in May 2020, which would see the duty revert back to 50%. Unsurprisingly the domestic sugar industry is lobbying the government hard to keep in place these higher duties.

Therefore, the outlook for Chinese import demand moving into 2020 will largely depend on how successful the industry is. Another year of reduced imports will tighten the domestic balance sheet only further, which would only increase the attractiveness to smuggle sugar into the country; the level of this smuggling is significant, within the region of 2mt of white sugar smuggled in previous years.

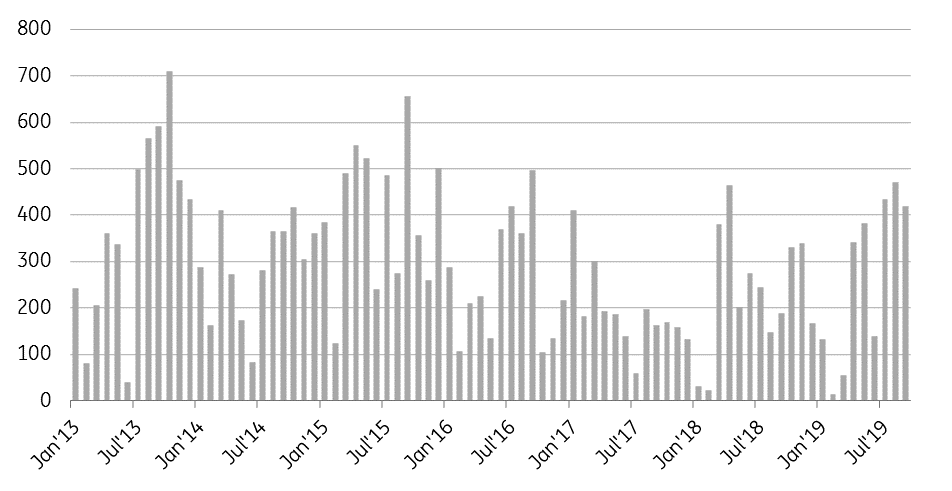

Monthly Chinese sugar imports (k tonnes)

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more