Sugar: The whites conundrum

While sugar is trading back near the lows of April, the whites market has been relatively more constructive than the raws. This is despite the fact that the global sugar surplus this season is largely driven by the whites market. So why the disconnect? India is one of the key reasons

No. 5 whites structure at odds with fundamentals... or is it?

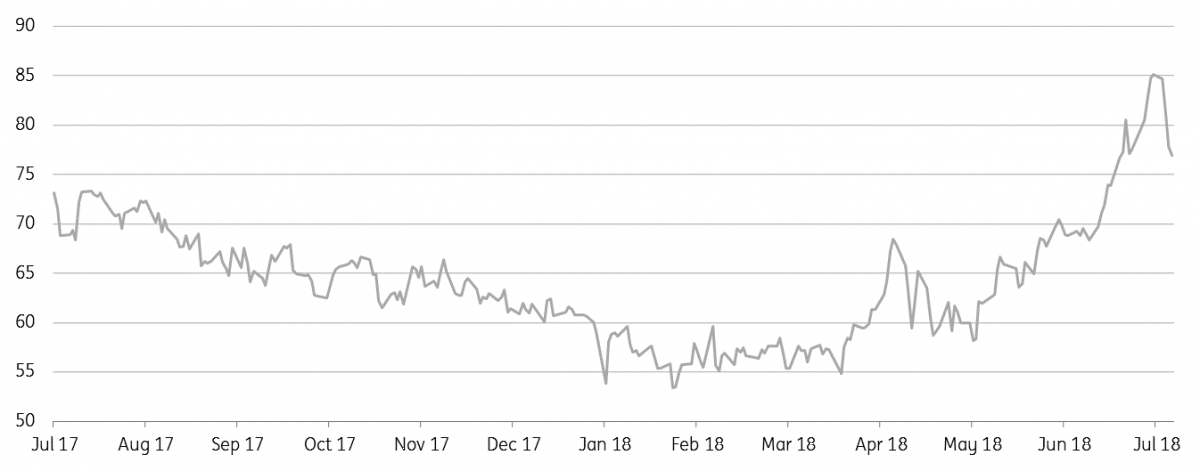

The white sugar market was meant to be bearish. We are nearly through the first season of the lifting in EU sugar production quotas, which has seen the EU become a significant whites exporter once again. India has seen an extraordinary recovery in output. In fact, production increased by an estimated 11.7mt year on year to a record 32mt in the 17/18 season. This leaves a domestic surplus of around 7mt, which is predominantly low-quality whites. Despite this additional supply, we have seen the no. 5 whites curve strengthen. This week, the August/October spread expired at $14.80/t premium, whilst the October/December spread is trading at a premium of $1.80/t (although has been as high as $3.70/t this week), up from an $8/t discount in mid-May. Looking at the whites relative to the raws, the October whites premium has traded as high as $85/t, up from around $60/t seen in May. This price action appears to be in conflict with fairly bearish fundamentals. However, there is more at play here.

October whites premium hits US$85/t

Oct/Dec whites spread trades to a premium (US$/t)

When will India's surplus hit the world market?

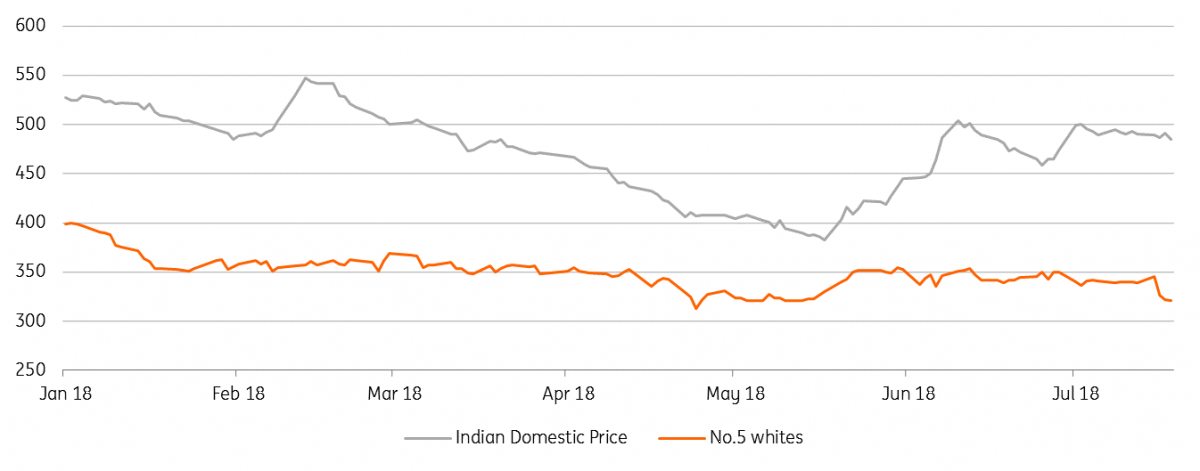

In India, the government has tried to shift its estimated surplus of 7mt onto the world market by removing export duties, mandating exports, and providing a subsidy to mills. These measures have not had the desired impact, with limited exports. In order to try support domestic prices, the government decided to create a 3mt buffer stock, but by doing this, sizeable exports from India now look even less likely. So whilst India has a large whites surplus, it is not available to the world market at current prices.

This, however, is not sustainable, particularly given the fact that India is set to see an even larger crop in the upcoming 2018/19 season. The Indian Sugar Mills Association (ISMA) currently estimates that next season, sugar output could hit a record 35mt, assuming a normal monsoon over the summer, which would leave a domestic surplus of 9mt over the course of the season. As a result, it’s not so much a question of 'if' India exports to the world market, but more a question of 'when'. The pressure of a large 2018/19 crop we believe will weigh on domestic prices, opening up the export parity. However, government intervention will play a role here.

Indian domestic market premium over world market widens (US$/t)

The EU market

It certainly has been a buyers’ market when looking at the EU. Monthly average prices reported by the European Commission fell to €362/t at the end of April, which is 26% lower than where they started the 2017/18 season. Spot prices are reportedly even lower. This is not too much of a surprise, with a significant increase in area and stronger than average yields seeing production reach 21.1mt, up 25% YoY. However despite this weakness, EU sugar exports onto the world market have slowed down as the season has progressed. This has been on the back of EU producers' reluctance to sell at low flat price levels onto the world market. Provisional data from the European Commission shows that the pace of exports from the EU has slowed. In 4Q17, exports averaged almost 340kt a month, this then fell to almost 290kt in 1Q18, and is on course to drop to an average of around 240kt in 2Q18. This trend in exports is at odds with what we saw over the previous two seasons, where exports usually peak over 2Q and 3Q.

Looking ahead to 2018/19, whilst EU production is expected to fall to 20.1mt, it will still be a sizeable crop. Therefore ahead of the harvest, we could see EU producers keen to shift old crop sugars, which could put some renewed pressure on the whites premium and spreads. The recent August expiry does suggest this, with the largest volume of EU sugar delivered into the tape since the lifting of EU production quotas, although the strong August/October spread at expiry would have also played a key role in this.

What signal is the whites premium sending to refiners? And where will it go next?

The whites premium has recently been sending a clear signal to standalone refiners: increase throughput rates. These refiners are not too concerned about the flat price, it is the whites premium which is important to them. The October whites premium peaked recently at $85/t, although since then has fallen back towards $77/t, while if we consider the carry in the market, and look at the diagonal whites premium (No.5 Mar-19/No.11- Oct-18), refiners are able to achieve around $80/t. We do not expect the strength in the whites premium to last. The EU is set to see another sizeable crop next season, and we expect India to become a significant exporter of low-quality whites over 2018/19, with an increasing domestic surplus set to weigh on the local market.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

CommoditiesDownload

Download article