Stronger supply of sustainable aviation fuels crucial to securing uptake

Blending sustainable aviation fuels (SAFs) needs to grow massively to meet ambitions for 2030 and beyond. Demand is there, but supply is limiting uptake. Ramping up capacity investments is critical to meet the aspired goals. Airlines (purchase grants) and suppliers (production, delivery) have a joint role here, but more policy support will help

This article has been updated following the EU parliamentary adoption of amended blend fuel mandates last month.

Ambitions and goal-setting for using sustainable aviation fuel (SAF) by authorities and governments, as well as airlines and corporates, have gained traction over the last two years. This created the conditions for the take-off of SAFs from the demand side. But what is the current state of play in supply? What are the critical factors and what is expected in terms of growth?

Global jet fuel demand expected to recover and continue to increase

The global consumption of conventional jet fuel by commercial airlines totalled 360 billion litres in 2019, according to the trade association IATA. Consumption dropped following the Covid-19 pandemic, but airline activity is expected to recover and fuel burn is bound to exceed pre-pandemic consumption levels again by 2025. Over the following decades, an average annual global growth of passenger aviation (RPK) of around 3-3.5% is estimated. Operational efficiency measures (such as in taxiing, flight and arrival optimalisation) and aircraft replacements are likely to offset a significant part of the additional fuel consumption, but not all. So annual jet fuel consumption is expected to continue increasing. Given the lack of mature and commercially viable low-carbon technologies, this means aviation will rely heavily on SAFs to pave the way for decarbonisation over the next two decades.

SAF production and delivery on the brink of acceleration

SAF production capacity per year in billion litres based on publicly-announced intentions

SAF production to reach 1% of jet fuel consumption in 2023 and almost 3% in 2026

The usage of SAFs has been under discussion for quite a while, but on a global scale production hasn’t made a large difference yet. That’s about to change, though. If all publicly-announced initiatives to start and expand production by the summer of 2022 come to fruition, available global SAF capacity will increase fivefold in 2023 and continue to rise in the years after. Production capacity could reach a 1% share of global consumption in 2023, more than 2% in 2025 and nearly 3% by 2026.

SAF supply is the critical factor to reach the targets

Despite the higher costs of SAF, supply is currently still the most critical factor to secure further uptake. The investment case requires long-term cooperation and commitment between airlines, manufacturers (like Neste, Gevo and World Energy) and distributors (like SKY-NRG – which also develops production partnerships – and World fuel services). Planning and development of production facilities can easily take several years before delivery starts off. This means 2030 targets are already around the corner.

Much more production is required to reach ambitious targets for 2030

Development global SAF capacity based on publicly-announced intentions and future blend ambitions

Not on track yet – blending goals require much more SAF-production locations

Although SAF production is about to accelerate, 2030 targets from IATA (6%) and the corporate initiatives Clean skies for tomorrow and One world group (10%) require more progress, especially when taking into account the expansion risks, such as project delays. The industry targets require strong growth, but they still fall short of what IEA deems necessary for a global net-zero scenario pathway. This implies we’re just at the start of the required surge and we face a long haul to push growth. Market analysts estimate that ultimately 5,000-7,000 SAF facilities may be required to achieve the global SAF blending goals of the aviation industry by 2050 (ATAG/ICF).

Global challenge is also a regional challenge – locations availability at airports is key

There’s also a regional puzzle of supply and demand as airlines are dependent on available SAFs at local airports. This means supply networks will need to be unrolled and developed. Currently, SAF supply in the US is concentrated in San Francisco and Los Angeles, and in Europe it is mostly at Amsterdam-Schiphol, London Heathrow, as well as Scandinavian airports, whereas supply at the Asian hubs Singapore and Hong Kong is expected shortly. Local production and diversification are obviously crucial to fueling airline aircraft with more SAF and avoiding long lead times.

Europe and US take the lead in SAF production capacity, Asia follows

SAF capacity per year in billion litres per region based on publicly-announced intentions

The US is taking the lead in developing SAF production capacity

European market players seemed to be most ambitious in developing SAFs, but the US now leads the way thanks to efforts made by the Biden administration in the US. America has adopted a different approach to Europe’s demand targeting by subsidising $1.25-1.75 per gallon of bioSAF ($0.33-0.46 per litre) and stimulating supply. Production capacity in the US is expected to surpass Europe’s potential in 2023 or 2024. Examples of recent agreements include Aemetis's delivery to eight members of the One World group at San Francisco Airport. The Asian-Pacific region falls behind despite air travel in Asia expanding at the highest pace over the last decade, and it will continue to do so post-pandemic.

SAFs gain from scaling, but will continue to trade at a premium

SAFs production entails significantly higher costs than conventional jet fuel. Based on WEF figures and a fixed production cost of $600 per MT (which is relatively low but still provides a relevant comparison), we have detailed the relative cost ranges for the four distinguished eligible SAF production pathways over time. As a result of economies of scale, production costs are expected to come down significantly in the following decades. But they are unlikely to drop below conventional jet fuel before 2050. This means SAFs will keep trading at a premium, leading to higher fuel costs for flights fueled by SAF blends, as well as higher ticket prices.

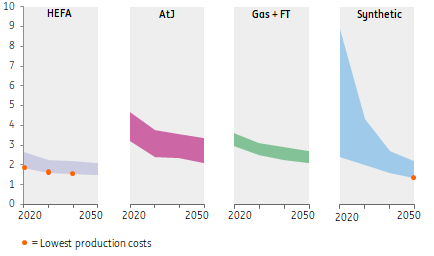

HEFA is the cheapest production option, but ultimately synthetic SAF is expected to be most competitive

Development of production costs per SAF route (upper and lower boundary) as multiple of jet fuel

HEFA is most competitive, but ultimately synthetic SAF is expected to be the most cost-efficient

The HEFA production route which has bio-oils and recycled fats as feedstocks (bioSAF) is the most mature and most competitive, with an estimated price range of 1.8-2.7 the cost of conventional jet fuel. The other biogenetic pathways are still significantly more costly at this point. Synthetic SAF currently has the largest cost range, depending on the production costs of hydrogen and the origin of carbon (waste sources, direct carbon capture). With the expected global surge in green energy supply, the costs are expected to drop below the bioSAF in the long run.

Most cost efficient HEFA is dominant, but other SAFs are increasingly needed as well to supply sufficient SAF

Forecasted SAF capacity per year in billion litres per technology based on publicly-announced intentions

HEFA dominates, while the development of other SAF pathways is also needed to meet future demand

HEFA is the cheapest pathway for SAF and is also expected to represent the vast majority of global production this decade. Availability of feedstocks enables HEFA production to expand towards 2030, but expanding bioSAF will increasingly need to be accommodated by alternative feedstocks like cellulosic (paper) and municipal waste (MSW). For the US, feedstock from fats and oils (HEFA) won’t be enough to meet SAF demand. Other production methods are technically feasible but more expensive. Nevertheless, feedstock availability, increasingly stringent requirements, as well as regional differences leave little choice. Development and upscaling of Alcohol to Jet (AtJ), Gassification+FT as well as synthetic SAF are also required to meet future demand.

Using SAF will eventually push up airline ticket prices

The fuel cost for airlines usually varies between 15-30% of operating costs. Assuming a 25% fuel cost share, an average SAF blend of 10% in 2030 would push total operational costs up by 2.5-5%. For a ticket from London to New York, this initially means an increase of some €15-25. After 2030, the step up in blending rates will push fuel costs up further, despite the expected price decrease. In the low margins airline industry, this will quickly be reflected in higher ticket prices.

Increased climate awareness leads to scrutiny of SAF feedstocks

With respect to decarbonisation efforts, corporate sustainability actions are increasingly under scrutiny. The Science Based Target Initiative (SBTI) approach is also increasingly used as a reference. This may not only lead to a shift away from carbon offsets but also encourage the shift to more advanced SAF feedstocks. Sustainability-linked loans with SAF targets have also been introduced. Palm oil blends are already controversial because of deforestation, but the use of (by)products of food crops like corn for SAF (alcohol to jet fuel) will have adverse effects on food or feed supply chains and this might also push up food prices. In the EU, there’s a push for the use of advanced feedstocks and the European Commission also considers a cap on waste oil feedstocks and focuses on more advanced waste and residual sources. But limited availability also leads to tensions. In the US, corn is still seen as an important source for bioSAF going forward.

CO2 reduction potential ranges of the SAF pathways

Large contribution from synthetic SAF needed to maximise decarbonisation

The aviation sector is expected to require hundreds of billions of litres of SAF in 2050. At the same time, demand for biofuels and bio feedstocks from sectors including road transport, shipping and the chemical industry is also increasing. On a global level, an estimated 41-55% of SAF could potentially be provided from biogenic origin. In Europe, bio feedstock supply for SAF is expected to lack ambitions from 2035 onward. This means the remainder should eventually be provided by synthetic fuels. Synthetic SAFs also have the highest potential for decarbonisation when using (almost) 100% green electricity. However, producing synthetic SAFs is energy-intensive and requires more electricity than it contains. It requires large areas of land or sea to produce and intensified competition with other sectors is expected. Consequently, synthetic SAF will depend on the availability of sufficient green energy to convert into the required green hydrogen.

Synthetic SAF is expected to be the accelerator from 2030 onward

In Europe, several low-volume production facilities for synthetic SAFs (including in the Netherlands and Sweden) are planned to come online between 2025 and 2030. The EU already includes a sub-mandate for synthetic SAFs as part of general targets, which starts at 0.7% of total fuel consumption in 2030, increasing to 28% in 2050. In the US, the introduced production subsidies currently only apply to bioSAFs.

Generally, the rise of synthetic SAF requires a significant reduction in the three cost drivers: green energy, electrolyser technology and direct air capture – and this takes time. Once the global availability of green energy has expanded significantly and the production of synthetic SAF can be scaled, the production costs of synthetic SAF are expected to come down. Eventually (in 2050) synthetic SAF is also expected to be the cheapest option.

Some regions have a competitive edge in producing synthetic SAFs

The success of SAFs also has a regional element to it, as previously explained. Countries with an abundance of solar energy and space such as Australia, and Saharan countries, as well as European countries like Spain, could benefit from a competitive advantage as locations for the future production of synthetic SAF as low renewable energy costs are a critical pillar of the business case.

Corporate cooperation required to accelerate SAF supply, more policy support would help

SAFs have higher production costs and trade at a premium. Imposing mandatory global blending rates enforced by ICAO would probably be most effective to ramp up supply, although that's not easy to achieve. From a market perspective, subsidies for scaling up production, such as in the US, could improve the business case and push up investments in global supply in the short run. Pricing emissions on a global scale can generally be an efficient measure to structurally improve the market position of SAFs, especially if revenues are (partially) redistributed for decarbonisation. ICAO's CORSIA programme takes a start by increasing obligations for carbon offsets, but only from 2027 and it’s not yet clear how this will eventually play out for the SAF market. In Europe, continental flights are already subject to the European emission trading scheme (ETS), but due to free allowances the impact is currently still limited. Thus, policy changes to support and speed up SAF supply are possible.

Demand for SAFs is already there, but supply needs to catch up with the blend ambitions in the coming years. Viable alternative technologies in commercial aviation are still a long way off and SAFs, therefore, have a critical role in emission reductions. Manufacturers, distributors, airlines and corporate users are challenged to team up to develop and secure even more SAF supplies and more policy support can be helpful.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

11 May 2023

Sustainable aviation fuels play a critical role in future air travel This bundle contains 2 Articles