Strong TLTRO-III borrowing suggests banks have confidence meeting lending benchmark

German, Italian and French banks increased their TLTRO drawings in March and country data suggests most banks have qualified for the favourable TLTRO-rate from June 2020 to June 2021

The €331bn March drawing is the second-biggest of the seven TLTRO-III allotment so far

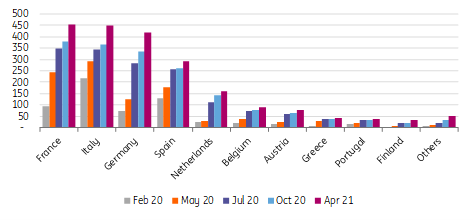

The European Central Bank published updated data today in which banks have utilised its €2,107bn longer-term refinancing operations (LTRO), part of its efforts to help banks deal with problems brought about by the pandemic. In particular, banks in Germany increased their borrowing in the TLTRO-III tranche 7 as German LTRO usage jumped by €80bn from February until 2 April. Italian banks have hiked their TLTRO borrowing by €74bn, French by €57bn, Spanish by €29bn and Dutch by €20bn since February 2021.

The increase in LTRO drawings since 26 February to 2 April

In total, the ECB allotted €330.5bn funding for banks in the seventh tranche of its TLTRO-III operation in March 2021. 425 banks took part with the average allocation at €780m per bank. The size of the total TLTRO-III operation now runs at €2,080bn. The €330.5bn in drawings now positions the March tranche as the second largest in the TLTRO-III operation following the 4th one that amounted to €1,308bn in June 2020.

Bank drawings from the ECB’s longer-term refinancing operations

The large allotment suggests confidence meeting the 2021 TLTRO lending benchmark

The average drawing was the third largest within the 7 tranches allocated to date potentially pointing towards a higher participation of smaller and medium sized banks in addition to larger banks’ drawings being limited by the already high usage of the programme. Additionally, banks that drew funds from tranche 7 could include:

- those which expect strong lending development this year

- banks that met the “special reference period” lending benchmark that ended in March and now have certainty about the TLTRO rate applying to them, and

- those planning to benefit from the -50bp rate in the special interest rate period and then pay back early.

The ECB’s TLTRO-III funding programme allotment by tranche

Belgian, Italian and Spanish banks have drawn the most, compared to their allowance

The 7th tranche is the last tranche of the “older part” of the TLTRO-III, i.e. allowing access to all existing lending benchmark periods based on which the interest rates are set. The first voluntary repayment date for this tranche is in March 2022.

After this 7th tranche, French banks remain the largest users of the ECB’s LTRO operations with the total drawings increasing to €455bn at the beginning of April. The Italians come in second with €448bn, followed by the Germans at €420bn, the Spanish at €290bn and the Dutch at €162bn.

The share of the TLTRO-III take up relative to the borrowing allowance is now higher than it was in October

We particularly consider banks in Belgium, Italy and Spain to have already utilised a relatively high share of their TLTRO-III borrowing allowance. Banks in countries such as Germany and France may have further room to increase their drawings in the following three tranches subject to their lending performance. The Dutch names are positioned somewhere in the middle here.

What is noteworthy is that for all countries, the share of the TLTRO-III take up relative to the borrowing allowance is now higher than it was in October, prior to the ECB raising the cap to 55%. We consider this to mean that banks have not just increased their TLTRO drawings with the higher cap, but they have also taken action to account for the positive lending performance and access to the attractive interest rates.

Estimated TLTRO drawings vs the indicative 55% lending cap

Favourable TLTRO-rate probably secured for most banks until June 2021

The TLTRO-III facility has a base rate equal to the deposit facility rate (-50bp), with an optional -100bp rate from June 2020 to June 2022. The optional rate is dependent on banks growing their lending to businesses and households (excluding mortgages).

The so-called “special reference period” ran from March 2020 to March 2021. If banks managed to meet their lending benchmark in this period (set at 0% for most banks, dependent on past lending performance), they qualified for the -100bp rate from June 2020 to June 2021.

The “additional special reference period” runs from October 2020 to December 2021.

Meeting the lending benchmark qualifies for the -100bp rate from June 2021 to June 2022.

Bank lending data for March was published last week and show that at the country level, the TLTRO “special reference period” lending benchmark was realised in all major economies. The only countries where the March 2021 TLTRO-qualifying loan portfolio was smaller in March 2021 than a year ago, were Lithuania, Luxembourg and Slovenia. Indeed in these countries, TLTRO-takeup is relatively low.

To be sure, benchmark realisation at the country level is no guarantee that all domestic banks will have met their target. After all, the ECB calculates benchmark performance per bank, and not per country. In some countries, including Germany, Netherlands and Austria, lending accelerated markedly in March. It cannot be excluded that this acceleration is related to banks making an effort to clear the TLTRO benchmark hurdle. In any case, based on country data, we expect the majority of banks to have qualified for the favourable TLTRO rate in the June ’20 – June ’21 period.

The jury is still out on whether an extension into June 2022 is feasible

To extend the favourable TLTRO rate until June ’22, TLTRO-eligible bank lending is benchmarked between October ’20 and December ’21. This is called the “additional special reference period”.

We are now six months into this period, and the chart below shows the interim performance. Interestingly, some countries suffer from past performance. Spanish banks, in particular, lent substantial amounts to businesses in the first months of the pandemic, in spring 2020. But Spanish net bank lending growth subsequently stagnated from June 2020 onwards. As a result, Spanish banks’ performance on the “additional special reference period” is meagre so far, with net bank lending growth at 0%. Countries where the pandemic bank lending response was slower, such as Italy, perform better. The effort made by German, Dutch and Austrian banks shows up in March.

We are not even halfway through the “additional special reference period”, and realising a rate of -100bp in June 2021 -June 2022 is still very uncertain with nine months left in the benchmark period. Once vaccination allows a gradual reopening of the economy, business demand for bank loans may pick up again. The strong take-up in the 7th tranche suggests that banks, in general, are confident that they will realise their TLTRO benchmark lending this year.

Cumulative TLTRO-eligible bank net lending growth since October '20, %

March marked the end of the so-called “special reference period”, and country data suggests most banks have met their lending benchmark, qualifying them for the favourable -100bp TLTRO rate in the June 2020-June 2021 period. The strong drawings in the 7th TLTRO auction by the German, Italian and French banks in particular indeed suggest confidence on their part in meeting this lending benchmark, but also the benchmark of the “additional special reference period” running until December this year. Spanish lending to businesses has been stagnant since Summer 2020, suggesting they have the biggest challenge meeting the latter benchmark as economies are slowly reopening.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article