FX

Strong G10 FX seasonal trends in April

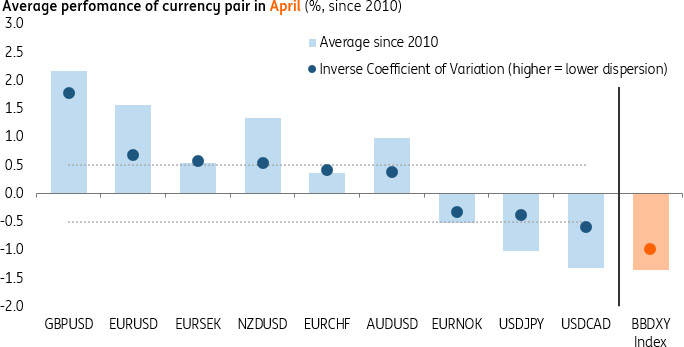

G10 currency pairs have historically exhibited strong seasonal patterns in April; here's a look at some key trends

Key pairs to watch

- At the top of the list is GBP/USD - which has posted a positive move in April every year for the last eight years. The average performance since 2010 has been +2.20%, while over the past five years the average has been +2.35%. We think the cards are aligned for GBP/USD to post a similar bullish move this month - not least as cyclical economic factors also favour a move higher in the pair (see our note GBP remains the comeback kid of FX markets). We target GBP/USD moving to 1.45 in 2Q18.

- Across the other currency pairs, EUR/CHF has shown seasonal tendencies in the last five years (posting an average +2.15% move higher). Equally, we note EUR/USD has moved higher every April in the last five years (posting an average move of +0.90%). This suggests greater risks that EUR/USD moves up to 1.25 in the coming months.

- More broadly, we note that April is typically a bad month for the US dollar. The Bloomberg Dollar Index (BBDXY Index) has posted a negative move every April in the last seven years - with an average move of -1.60%. With weak USD expectations embedded in markets, one could see this coming April also being strongly negative for the US dollar. As we have previously argued, US protectionist measures implicitly signal the administration's desire for a weaker USD – and such expectations are likely to be entrenched in FX markets until credibly broken (see our note Trade Wars: Episode 1 - The Presidential Menace).

G10 FX April Seasonality Trends

Technical footnote

Inverse Coefficient of Variation should be interpreted as a measure of significance.

A higher value indicates lower dispersion in the monthly performance of the currency pair across the sample period and therefore suggests greater conviction in the mean value.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article