Bank Outlook 2023: it has been a strong year for Turkish banks. Will the momentum continue?

Leading Turkish banks have delivered stellar earnings growth this year. With such a high comparative base, beating or matching these levels will be more difficult in 2023. We are also mindful of the growing degree of regulation of the sector in 2022, which may continue to increase further next year, restricting future earnings growth

Strong earnings growth for Turkish banks in 2022

While the year is not over yet, the country's top banks, and the Turkish banking sector overall, are set to achieve strong earnings growth in 2022. According to Banking Regulation and Supervision Agency (BDDK) data, during the first eight months of the year, the system-wide earnings growth was 420% year-on-year. We have observed a similar picture for the top Turkish banks as they have been reporting their third-quarter 2022 numbers. We expect that this cumulative earnings momentum will be sustained for the remainder of this year. Such earnings growth is powered by strong Turkish lira loan growth momentum (+58% year-to-end August), higher net interest margins (net interest income after provisions were up 230% YoY during the first eight months of the year) and supplemented by healthy growth in fees and commissions (up 81% YoY during the first eight months of the year). In effect, the Turkish banking sector has benefited from the more contained funding costs relative to the loan rates and securities income (in particular, from the CPI linkers).

Asset quality holding up for now

The Turkish banking sector has maintained a modest level of non-performing loans of 2.38% as of end-August 2022, according to the BDDK calculations. This represents a reduction relative to 3.15% at YE21 and 4.08% at YE20. We note that these headline numbers are somewhat lower than for the leading private commercial banks, which reported higher non-performing loans (NPL) ratio levels on the order of 3.0-3.5% for 2Q/3Q 2022. We also note that the Turkish banking sector is fairly well-provisioned relative to these NPL levels (at 83.3% according to BDDK as of end-August 2022). Given the current relatively low headline NPL ratio, we fear that the risks are to the upside in the coming year. Among the individual sectors, at the system-wide level, construction, utilities (electricity, gas and water resources, as defined by the regulator), retail and hotels represent the highest NPL ratio levels. Among borrower categories, small and medium-sized enterprise (SME) NPL ratio levels are higher versus those of larger commercial borrowers and consumer loans.

Capital buffers still healthy for top banks

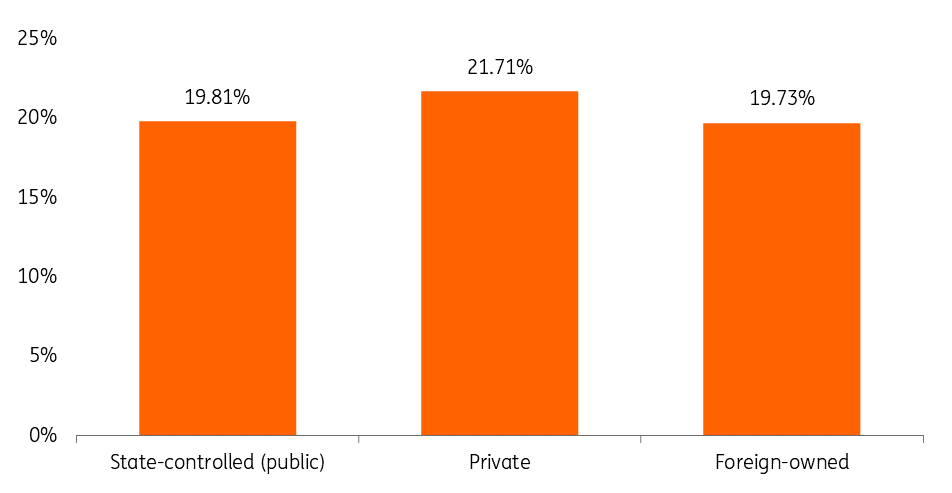

Despite the sharp devaluation of the Turkish lira year-to-date in 2022, the strong growth in earnings allowed the Turkish bank sector to preserve its capital adequacy ratio (CAR) at a high level, well above the regulatory requirements. We hasten to add that the headline numbers continue to benefit from the continued regulatory forbearance when calculating the ratio. Specifically, the Turkish sector CAR was 18.69% according to the BDDK as of the end of August 2022, up slightly from 18.39% at YE21 but down from 20.38% at the end of March. CAR levels are even higher among the country’s private banks as can be seen from the chart below. On balance, we believe that top Turkish banks will have adequate capital buffers entering 2023.

Turkish Bank Sector CAR (March 2022)

FX maturities should not pose near-term risks, but foreign borrowing is shrinking

We note that the top Turkish banks we follow currently have suggicient FX liquidity buffers relative to the respective near and medium-term foreign currency maturities. We also have observed a lack of Turkish bank Eurobond issuance this year, in spite of some of the maturities and repayments taking place. As a result, the curves of the Turkish Eurobonds have been shrinking. We may observe the same phenomenon with the FX syndicated loans which may not be rolled over to the full extent during the next six to 12 months.

Earnings outlook less certain for 2023

Against such a strong current backdrop, matching or exceeding earnings next year will pose a greater challenge, in particular, if the earnings momentum becomes diluted by the regulatory measures. However, we would not expect an imminent earnings implosion either as some of the drivers underpinning the growth in 2022 will still be present next year, at least, at the beginning of it. We also hope that the government oversight of the sector will be balanced with the commercial interests of the banking sector.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

1 November 2022

Banks Outlook: The major challenges and opportunities for 2023 This bundle contains 8 Articles